Chapter 13

advertisement

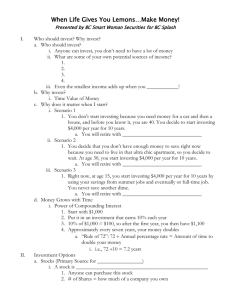

The Investment Decision Chapter 12 Planning Your Financial Future, 4e by: Boone, Kurtz & Hearth Why Invest? Some people have specific reasons for investing Supplement current income Reduce current and future tax liability Send children to college Retire comfortably For fun 2 Why Invest? We’re living longer—thus, we’ll have a longer period of retirement Personal incomes are not rising rapidly Experts expect personal incomes to keep pace with inflation To raise your standard of living, you’ll need to earn more than inflation The labor market is changing People are changing jobs many times during their life and spend some time unemployed Saving/investing can help you weather the storm Self-directed retirement plans are now the norm Individual is responsible for most, if not all, investment decisions 3 The Steps in the Investment Process Know your goals Your present situation will impact those goals If one goal is a secure retirement and your employer does not offer a retirement savings plan, you’ll have to do this on your own If you already own your own home, saving for a down payment wouldn’t be a goal—maybe you’d be focused on paying down your mortgage 4 Assessing Risk and Return How long do you plan to invest (your expected holding period)? Over longer time periods you can afford more risk What level of your goals? expected return is required to meet Higher expected returns mean taking higher risks How much risk are you comfortable with? If you panic at every daily fluctuation, you should stick with lower risk investments Personal characteristics, such as age and income, influence risk tolerance 5 Selecting the Right Investment Examine your investment goals, time horizon, risk tolerance, desired return, etc., and choose your investments Stocks – represent ownership in a company Share in the company’s profits May receive cash dividends May receive capital appreciation (main reason people invest in stocks) No maturity date 6 Selecting the Right Investment Bonds – represents a promissory note issued by a corporation/entity promising to pay interest and principal Bonds don’t have to pay interest, but if they have a coupon rate they should Bonds usually have a maturity date (up to 30 years or so) Receive benefits through interest income Main reason people invest in bonds May experience price appreciation 7 Selecting the Right Investment Money market instrument – a lending investment that matures within one year Examples include Treasury bills Bank savings accounts Typically pay low interest rates but are very low risk Two aspects to investment selection, or asset allocation Strategic Decisions concerning the general mix of investments (i.e., 50% stocks, 30% bonds, 20% money market) Tactical Selecting specific investments that are best for you (i.e., choosing an index mutual fund for the stock portion of your investments) 8 Managing Your Investments Buy and hold philosophy A passive approach wherein you purchase a set of investments and do not manipulate the investments Make changes only if and when your goals or personal situation changes Active philosophy Actively watch the performance of your investments, buying/selling as you see fit 9 Understanding Risk and Return By investing, you EXPECT to earn some rate of return, but it always has some degree of risk because it is an EXPECTATION Sources of Investment Returns Income Dividends (stocks) Interest (bonds) Capital appreciation (price of investment increases) 10 Understanding Risk and Return Compare the income vs. price change portion of various investments over a recent 10-year period Average Annual Return Income Portion Price Change Portion Stocks 10.6% Little Most Bonds 6.6% Most Little 4% All None Investment Money market 11 Measuring Investment Returns Total Return Return you earned on the amount you invested over a certain time period (usually one year, but not necessarily) Includes both income and price changes 12 Measuring Investment Returns Example: You bought 1,000 shares of stock one year ago at a price of $50. You sold it for $55 because you felt the future uncertainly was too great. During that time you received dividends of $1 per share. Calculate your total return from your investment. Total Return = (Selling Price + Dividends – Purchase Price) Purchase Price Total Return = ($55 + $1 – $50) $50 = 12% 13 Calculating Average Returns Annual Return EOY Value of $1,000 (cumulative) Year A B A B 1 15% 45% $1,150 1,450 2 15% 0% 1,322.50 1,450 3 15% 0% 1,520.88 1,450 Average (Arithmetic) 15% 15% Average (Compound) 15% 13.18% Can overstate the actual return to investor. Clearly A is the better investment. Measures actual change in wealth. 14 What is Investment Risk? Risk is the uncertainty that an investment’s actual return will not be what you expected it to be There’s an upside and a downside Types of investment risk Default risk Credit risk Tax risk Purchasing power risk Interest rate risk Market risk Event risk 15 Figure 12.4: Annual Returns on Stocks and Treasury Bills: 1979–2003 Stocks have more market risk than T-bills. Source: Based on data from Morningstar, Inc., and the Federal Reserve Board. 16 Are Risk and Holding Period Related? The longer your holding period, the more risk you should consider taking Between 1926 and 2003, stocks had returns < 0% for 22 of the 78 years But when looking at a longer 10-year holding period, there were only negative returns for 4 of the 68 rolling 10-year periods 17 Figure 12.5: Stock, Bond, and Treasury Bill Average Returns T-bills have only slightly outperformed inflation. Source: Based on data from Morningstar, Inc., and the Federal Reserve Board. 18 Figure 12.6: Investment Growth over a 25-Year Period: 1979–2003 Source: Based on data from Morningstar, Inc., and the Federal Reserve Board. 19 Comparing Stocks, Bonds and T-Bills Stability of principal Value of investment will never fall below what you originally invested T-bills are the winner Current income Historically bonds have paid more income than stocks or t-bills Stability of Bonds are the winner—you know how much income you are promised each year Growth of income income Stocks are the winner because dividends tend to grow over time, while bond income remains fixed 20 Some Lessons for New Investors To earn high returns, you have to be willing to take high risks Diversification is helpful Can help reduce risk without decreasing return a great deal (due to comovement) Past performance is not a guarantee of performance Financial markets are fairly efficient future Fair, orderly, and very competitive (lots of buyers and sellers) No “easy money” 21 Some Lessons for New Investors Avoiding common investment mistakes Chasing returns Investing your money based on how well an investment performed last period Fad investing Investing in something simply because others are doing so Buying right after a major price increase or selling right after a major price decline Hanging onto a loser Investing with no plan Trusting the self-proclaimed gurus Fearing the wrong risks Being unwilling to take risks—especially if you have a long-term investment horizon 22 Sources of Investment Information Problem isn’t that there is too little information, but too much Periodicals and newspapers Newspapers, local & business-oriented Investor’s Business Daily The Wall Street Journal Barron’s Periodicals Time U.S. News & World Report Business Week Forbes Kiplinger’s Personal Finance Money 23 Sources of Investment Information Investment advisory services Moody’s and Standard & Poor’s Value Line Morningstar Brokerage firms Investment newsletters Computerized sources of information investment 24 Web Links Good source for basics http://moneycentral.msn.com/investor/home.asp http://www.quicken.com/ http://www.kiplinger.com/ http://www.morningstar.com/ http://www.vanguard.com/ http://www.nyse.com/ http://www.nasdaq.com/ 25