Bus 304: Homework #2

advertisement

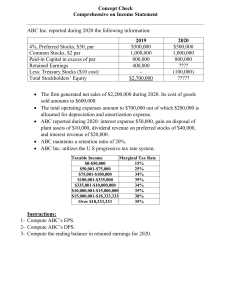

1/2 Bus 304: Homework #2 Due: Friday, September 9. Part I (Use formulas and a calculator) The following table is for Problems 1-3: Probability .10 .25 .20 .15 .30 Stock 1 .24 .16 .10 –.08 –.02 Rate of Return Stock 2 .16 .11 .16 .09 .03 Stock 3 .12 .06 .10 .15 .23 1. Compute the expected rate of return for each of the three stocks. 2. Compute the variance and standard deviation for the three stocks. 3. Compute the population covariance and the correlation coefficient between stocks 1 and 2 and between stocks 1 and 3. The following table is for Problems 4-6: Year 1 2 3 4 5 6 Annual Rates of Return ABC S&P 500 0.07 0.01 – 0.03 – 0.02 0.06 0.06 0.03 – 0.05 0.06 0.05 0.10 0.02 4. Calculate the sample mean returns for ABC and the S&P 500 Index. 5. Calculate the sample covariance between returns for ABC and the S&P 500 Index. 6. Plot a graph showing the annual rates of return on ABC (vertical-axis) against the annual returns of the S&P 500 Index (horizontal-axis). Draw a “line of best fit” through the data points. 2/2 Part II CFA Problems from BKM 9th Ed. (pp. 157-158) Chapter 5: #1, 2, 3, 4, 5, 6, 7 Part III (a) Collect data for the S&P 500 Index and 6 stocks: (1) S&P 500 Index ^GSPC (2) Starbucks SBUX (3) Ford F (4) Nike NKE (5) Apple AAPL (6) Old Dominion Freight Line ODFL (7) A stock of your choosing ??? Download 5 years of monthly price data from Yahoo Finance into your copy of the Excel spreadsheet 304.Stocks (MyNorthwestern). Use monthly adjusted closing prices (Adj Close). Adjusted close means that the price is adjusted for dividends and splits (recall HPR formula). August 1, 2006 – August 1, 2011 (61 prices) (b) Convert the adjusted prices into 60 months of return data. 61 prices will allow us to compute 60 returns. HPR formula for Adj Close: HPR Ending price of a share Beginning price Beginning price (c) Calculate the sample mean and sample variance for each company and the S&P500 index. Use Excel’s statistical functions AVERAGE, VAR.