shale gas resource plays

advertisement

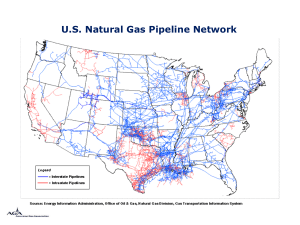

IV Congreso Anual Conjunto de Asociaciones del Sector Energético y XII Congreso Anual de la AMEE Acapulco 2012 IS THERE A PEAK GAS AHEAD? …and what would be its impact? Jean-Marie BOURDAIRE jmbourdaire@sfr.fr ACAPULCO May 25, 2012 OUTLINE • A/ World generalities on reserves • B/ The rise of shale gas in the US • C/ US shale gas: future perspectives • D/ And what about elsewhere? • E/ Annex: Gas resources plays A/ GENERALITIES ON RESERVES AND PEAK THE 2005 NATURAL GAS VISION World production peaks at 130 Tcf/y in 2030 WORLD GAS RESERVES (TCM) 16,2 14,7 9,9 7,4 4,5 North America S-C America Europe OCDE Eurasia (FSU) 58,6 Middle-East Africa Asia-Pacific 75,8 Total reserves: 187 Tcm or 6.6 Pcf NATGAS RESERVES: ~200 TCM EVOLUTION OF GAS PROVEN RESERVES (TCM) 200 AsiaPacific 180 160 Africa 140 MiddleEast 120 100 Eurasia (FSU) 80 Western Europe 60 40 S&C America 20 0 1980 1985 1990 1995 2000 2005 2010 North America THE 2012 LAHERRERE’S VISION Ultimate reserves: 13 Pcf = 10.4 Pcf conventional + 2.6 Pcf unconventional World production peaks at nearly 150 Tcf/y If unconventional gas is > 2.6 Pcf, the peak is not changed but the decline is slower B/ THE RISE OF SHALE GAS IN THE UNITED STATES MAIN SHALE GAS DEPOSITS THE US SHALE GAS EARLY DAYS • 1970-2000: Unconventional gas (on average 70% tight gas, 20% CBM and 10% gas shale up to 2008) has grown slowly from less than 1 Tcf/y in 1970 to ~5 Tcf/y in 2000 • 2000-2008: Unconventional gas was foreseen to reach a 9 Tcf/y plateau in 2010-25, but the fall of conventional gas was such that much increased LNG imports were to be needed • 2008: Oil, natgas prices, and the US rig count, collapse. To maintain their production, operators deploy new technologies, which are at the origin of the shale boom Because of their belief that LNG imports were set to grow, many operators have developed LNG terminals now idle THE PRE-2008 VISION NORTH AMERICA NATURAL GAS Productions and 23-year shifted conventional gas discoveries 30 25 Smoothed discoveries over 7 years Tight gas, shale gas, and CBM Marketed gas production Marketed less unconventional Tcf per year. 20 Unconventional gas AEO-2005 15 US unconventional gas was forecast to plateau at 9 Tcf/y 10 5 Jean Laherrere 2005 0 1900 1910 1920 1930 1940 1950 1960 1970 1980 1990 2000 2010 2020 2030 AEO FORECASTS: 2000-2008 Year after year, production forecasts get more pessimistic USthe DOMESTIC PRODUCTION (TCF) 30 25 AEO 2000 20 AEO 2001 AEO 2002 15 AEO 2003 AEO 2004 10 AEO 2005 AEO 2006 5 AEO 2007 AEO 2008 0 2000 2005 2010 2015 2020 2025 2008: THE TURNING POINT Shale gas contribution overtakes the decline of conventional WET US GAS - SUCCESSIVE EIA FORECASTS (BCF/D) gas 60 YEAR 2006 YEAR 2007 58 YEAR 2008 YEAR 2009 YEAR 2010 56 54 52 50 48 46 Jan-07 Mar-07 May-07 July-07 Sep-07 Nov-07 Jan-08 Mar-08 May-08 July-08 Sep-08 Nov-08 Jan-09 Mar-09 May-09 AEO SHOW A BREAK IN 2008… Shale US gasUNCONVENTIONAL production jumps above the former 9 Tcf/y GAS PRODUCTION (TCF)forecast 15 12 2009 & 2010 are in discontinuity with the 9 Tcf/y plateau foreseen before (2000-08) AEO 2000 AEO 2001 9 AEO 2002 AEO 2003 AEO 2004 6 AEO 2005 AEO 2006 AEO 2007 3 AEO 2008 AEO 2009 AEO 2010 0 2000 2005 2010 2015 2020 2025 2008: THE RIG COLLAPSE… NATURAL GAS RIGS NUMBER VERSUS HH PRICE 25 The rig count closely follows the price trend Gas rig count divided by 100 Henry hub price in $/MBtu 20 Spot WTI price in $/MBtu 15 10 5 0 J-00 J-01 J-02 J-03 J-04 J-05 J-06 J-07 J-08 J-09 J-10 J-11 J-12 …BUT PRODUCTION GROWS US NATURAL GAS MARKETED PRODUCTION (BCF/D) 70 Impressive growth up 65 to 2012 60 55 50 45 40 J-80 J-82 J-84 J-86 J-88 J-90 J-92 J-94 J-96 J-98 J-00 J-02 J-04 J-06 J-08 J-10 J-12 C/ FUTURE PERSPECTIVES FOR THE US SHALE GAS THE VOICE AGAINST SHALE GAS Contrary to the major limitations that Arthur Berman sees… • High costs, poor economics and destruction of capital, • Infrastructure limitations (pipelines and NGL-stripping plants), • Physical fundamentals (small core areas, fast decline rates), • Average break-even prices higher than current prices, …One may be optimistic about the future of shale gas • Shale gas development is not like a Ponzi scheme… • …and US gas majors are not behaving like Madoff. • Some operators may fool some analysts for a while but… • …the entire industry cannot be wrong for ever TRUE SHALE GAS REALITIES • Shale gas is the last unconventional gas in development, and still is at the beginning of its learning curve. • The pace of technological improvement will continue • Expected ultimate reserves critically depend on the type of decline (exponential or hyperbolic) • High costs plays: Liquids (oil or NGL) are essential for the economics • Core areas with good IP are small (a few %), but overall reserves may be very large • Good operators will manage environmental concerns • Infrastructure (NGL plants and pipelines) is critical US PRODUCTION GROWTH Shale gas dominates the natural gas growth WHAT CHESAPEAKE SAYS WHAT THE US DOE-EIA SAYS: US dry natural gas production forecast in the AEO-2012: Growing from 5 Tcf in 2010 to 14 Tcf in 2035! D/ AND WHAT ABOUT ELSEWHERE IN THE WORLD? UNCONVENTIONAL TRANSPORT OF METHANE IN CHINA (1997) CANADA SHALE RESOURCES With resources of 1100 Tcf, 200-300 Tcf may be recoverable A total of 1100 TCF of which ~50% in the Horn River Basin AND WHAT ABOUT THE WORLD? First feedbacks are good for Argentina, possibly good for China (?), uncertain for Europe and Ukraine 6600 Tcf or 6.6 Pcf of which 2-3 recoverable? CONCLUSION: WHAT FUTURE? • In North America: Exports of a few % of production as LNG will sustain a balanced price level (5-6 $/kcf) which, in turn, will allow production to grow evenly. • In Europe: Unconventional gas prospects are remote: not only spot LNG imports push prices down but the EU E&P legislation needs to be deeply redrafted • In Asia-Pacific: Neither China unconventional (still far away), nor Australian CBM-to-LNG (a few Bcf/d) will be game changers and decouple LNG from oil soon. E/ ANNEX: GAS RESOURCES PLAYS CBM RESOURCE PLAYS Recoverable: 600-700 Tcf? 140–1,040 1,680 500 - 700 15-50 100 390-425 22-44 100 750 800 - 1,100 30280 30 335-450 60 220 - 350 5-10 75 CBG resource in-place (Tcf) Other countries with significant exploration activity 0.5 29 CBM RESOURCE PLAYS Production Summary • USA - production commenced in San Juan Basin in 1953. CBM production in 2007: 4.8 Bcf/d (9% of total US dry gas) • Canada – since 2002: 208 Mcf/d in 2007. Could exceed 1.4 Bcf/d by 2015. Average new well on stream at 100 Mcf/d. • Australia – since 1996; 215 Mcf/d in 2006; Queensland produced 272 Mcf/d in 2007; planning up to 6 LNG schemes near port of Gladstone. • Minor production or approaching commercial production: UK; China; India; Kazakhstan; Russia (Kuznetsk Basin). • 13 coal-producing countries have CBM projects. 30 CBM (BCF/D) Pierre Mauriaud, ASPO 9 Bruxelles TIGHT SANDS RESOURCE PLAYS Recoverable: ~1350 Tcf? 560 6,800 75 Tight sand gas resource in-place (Tcf) Other countries / areas with known tight sand exploration activity 0.5 32 TIGHT SANDS RESOURCE PLAYS Basin-Centered Gas Gas dissolved in abnormally-pressured low-permeability aquifers in the central (generally deeper) part of basins • over-pressured in subsiding basins • under-pressured in uplifted and eroded basins. Also known as “deep gas” and “tight sand gas” but these are not necessarily restricted to continuous accumulations (and BCG is not always deep). Examples: San Juan Basin & Greater Green River basins (USA); Western Canada Sedimentary Basin (southern deep basin); Northwest Europe Permian Basin; Pannonian Basin; Algerian basins; Oman Basin; Ordos Basin, China. 33 TIGHT SANDS RESOURCE PLAYS Resources of tight Sand Gas / Basin-Centered Gas Enormous in-place resources in USA (all tight sands) • 3,000-5,000 Tcf in the Greater Green River Basin; • 900 Tcf in the Wind River Basin, Wyoming; • Total in-place resource ~ 7,000 Tcf. USA Ultimate Tight Sand Resource Estimate • 380 Tcf: 140 produced, 60 proved, 180 unproved/undiscovered, 200 Tcf produced and proved considered as “conventional” • USA unproved/undiscovered BCG resource estimates from other sources range up to 340 Tcf. No reliable global resource estimate available 34 TIGHT SANDS RESOURCE PLAYS Production of tight Sand Gas / basin-centered gas USA production from all tight sands • Total US production estimated at >6 Tcf (16.5 Bcf/d) in 2007 • 5-6% recovery factor - but much higher from “sweet spots”: - Pinedale: 56% (10-acre spacing); - San Juan Mesaverde: 44% (160-acre spacing); - Uinta Mesaverde (EOG): 37% (10-acre spacing); - Jonah Lance: 30% (40-acre spacing). Canada • Canadian production from tight sands and carbonates: - Alberta: ~3 Bcf/d; - British Columbia: ~1 Bcf/d. 35 TIGHT GAS (BCF/D) Pierre Mauriaud, ASPO 9 Bruxelles SHALE GAS RESOURCE PLAYS Recoverable: > 700 Tcf? AB / BC ~ 1,000 1,900 600 Shale gas resource in-place (Tcf) Other countries / areas with known shale gas exploration activity / potential 37 SHALE GAS RESOURCE PLAYS USA Ultimate Fractured Shale Resource Estimate • ~415 Tcf: 9 produced, 21 proved, 385 unproved/undiscovered (ICF International). 30 Tcf produced + proved is considered “conventional”. • Unproved / undiscovered shale gas recoverable resource estimates from other sources range from 32 Tcf to 125 Tcf but predate recent improvements in recovery and assessment of recent plays such as Haynesville and Marcellus. Global Resource Estimates • No reliable estimate available but considerable potential exists. • Canada (BC; AB; QC; NB; NS) will be next significant player. Estimated 860 Tcf IP in Western Canada (130 Tcf recoverable). 38 SHALE GAS (BCF/D) Source: World gas profiles (2011) Pierre Mauriaud, ASPO 9 Bruxelles WORLD RESOURCES ALL GASSHALE RESOURCE PLAYS 6600Tcf Tcfof of which which 20-30% 20-30% may 6 622 maybeberecoverable recoverable UNCONVENTIONAL GAS RECOVERABLE BY REGIONS RANGE OF UNCONVENTIONAL REGIONAL RECOVERABLE GAS