Treating Customers Fairly

advertisement

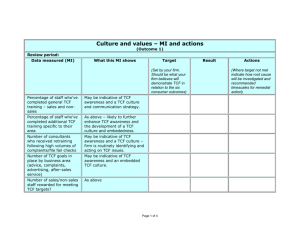

Financial Services Board Treating Customers Fairly: Some TCF considerations for the short-term insurance industry Presentation for the Insurance Conference Sun City June 2012 By: Leanne Jackson Head: Treating Customers Fairly Financial Services Board 1 Treating Customers Fairly Background • The FSB piloted a TCF self-assessment tool in late 2011. • The exercise helped identify future TCF focus areas, for both industry and the FSB. • A detailed feedback report was published in December 2011. • 22 short-term insurers and 5 underwriting managers participated. Some particular considerations for the short-term insurance industry can be drawn from the pilot feedback report (and other feedback) – with good practices noted too, although not verified. 2 Treating Customers Fairly An informal, implicit approach to TCF – strategic and governance implications not fully considered • In this regard, there is no notable difference between short-term insurance and other financial sectors • Limited board and management appreciation of strategic implications - TCF seen almost entirely as a customer service matter • Unclear executive ownership and inconsistent application across groups – ownership often allocated to compliance, risk or other support functions • Assumption that TCF is implicit in culture, with a “wait and see” attitude to structured implementation • Market conduct related risks not clearly identified – seen purely as part of operational risk (often compliance / regulatory risk) Outcome 1: Customers are confident that they are dealing with firms where 3 fair treatment of customers is central to the firm culture. Treating Customers Fairly Short-term insurance seen as inherently “low risk” for retail customers • • • • • • Strong view that there is low / no risk of products being wrongly targeted Product value proposition seen as simple and self-evident Product designed to fit distribution model, rather than the other way around Stated focus on “value for money” as an aim, but not clear how this is tested other than by price competition – with risk of inadequate focus on other features Limited focus on TCF for bundled, loyalty and “add-on” services – including but not limited to consumer credit insurance products Confusion re responsibility for product targeting in binder models: • insurers: “we only underwrite, we don’t design the product” • underwriting managers: “we use the insurer’s licence but we design our own products for our target market” Outcome 2: Products and services marketed and sold in the retail market are designed to meet the needs of identified customer groups and are 4 targeted accordingly. Treating Customers Fairly Emphasis on up front, technically accurate information • As for other sectors, there is limited customer testing of product information material – and a strong legal and technical emphasis • The complexity of some short-term concepts is under-estimated • Call centre models sometimes rely on customer’s assurance that they have understood • Inconsistent use of renewal communications to highlight changes, risks of inaction, available options • Generally, much greater emphasis on up front information than post sale or ongoing information Outcome 3: Customers are given clear information and are kept appropriately informed before, during and after the time of contracting. 5 Treating Customers Fairly Different challenges for direct and intermediated distribution models • No-advice models assume that products are simple, do not require advice but customers will ask for advice if they need it (“but very few ask for it”) – more emphasis on ensuring advice is not provided than on checking whether it should be • For intermediated models, strong reliance on FAIS compliance – but widely divergent approaches to ensuring product knowledge of independent intermediaries, and to whose responsibility this is • In binder models, confusion as to who “owns” the intermediary relationship – complex value chain creates risk of customer not understanding who is responsible for advice vs product performance • For intermediated models, almost no view of complaints as a potential mis-selling indicator – some insurers stated that they do not get any advice related complaints, as these are “fielded” by the intermediary • Product comparison services present both potential TCF risks and benefits Outcome 4: Where customers receive advice, the advice is suitable and6 takes account of their circumstances. Treating Customers Fairly Customer satisfaction and retention as TCF proxies • Strong emphasis on customer satisfaction as a TCF indicator – and a marketing tool • Some confusion that this Outcome only relates to investment products • Limited or inconsistent insight into customer experience through outsourced service providers – SLA’s used as the main control • More emphasis needed on proactively alerting customers to risks of inaction – often seen as only the adviser’s job Outcome 5: Customers are provided with products that perform as firms have led them to expect, and the associated service is both of an acceptable 7 standard and what they have been led to expect. Treating Customers Fairly Claims as the short-term insurance “shop window” • Short-term insurance, by its nature, has a more advanced focus on quality of claims handling than other sectors – both by intermediaries and product suppliers • However, focus still tends to be on speed and efficiency rather than quality of outcome • As for other sectors, complaints – and redress – are approached reactively and typically only for those who complain • TCF controls in relation to product switching (replacements) are minimal Outcome 6: Customers do not face unreasonable post-sale barriers to change a product, switch provider, submit a claim or make a complaint. 8 Treating Customers Fairly Other general considerations Short-term insurers, intermediaries and service providers should also take note of the general, overarching TCF considerations flagged in the self-assessment feedback report. In particular: • The “hard” requirements of the TCF culture framework • The need for TCF management information that measures, records and responds to outcomes – i.e. over and above profitability, process efficiency and productivity measures • The need to allocate TCF responsibility appropriately throughout the product life cycle and product value chain • The need to identify TCF risks and develop controls that are appropriate to your particular business model and strategy. 9 Treating Customers Fairly Thank you 10