KMG EP

advertisement

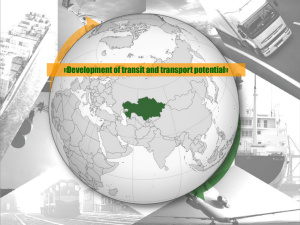

KMG Investor Presentation October 2012 1. KMG Group Overview and Recent Developments KMG (Baa3/BBB-/BBB-) – Government “Arm” in Kazakhstan’s Oil & Gas Industry Representing state interests Diversified asset base Key financials KMG is fully owned by the Government, through JSC SWF “Samruk-Kazyna” Represents interests of the Republic of Kazakhstan in the strategically important oil & gas sector Represents the State in exercising its pre-emptive rights with private industry players in E&P projects Right to acquire 100% of all new onshore and 50% of offshore fields/licenses M&A policy aims to strengthen the State’s role in the oil & gas sector and to consolidate control of the domestic oil products’ market Stakes in almost all significant oil & gas assets in Kazakhstan with P1+P2+P3 reserves of 653.7 (1) mln tonnes of oil and 102.2 bcm of gas Participates directly in equity of 38 oil&gas related companies in Kazakhstan and abroad, while 251 companies make up the group (2). Control over KMG EP (61.36%)(3), the largest public exploration and production company in Central Asia Participation in JVs operating and exploring some of the world’s largest oil fields: NCPC (Kashagan) (c.17%), KPO (Karachaganak) (10%) and TCO (Tengiz field) (20%) Other participations in exploration and production JVs: MMG (50%), KazakhOil Aktobe (50%), KazGerMunai (50%)(4), PKI (33%)(4) Joint or sole control over the largest oil & gas pipeline networks in Kazakhstan (combined length of 19.9 thousand km) Joint or sole control over all three refineries in Kazakhstan and two in Romania (combined capacity of 23.3 mmt/year) Marketing and sales of oil products in Kazakhstan and in Europe 2010 revenue of US$14.24 bn, 2010 EBITDA of US$5.6 bn 2011 revenue of US$17.7 bn, 2011 EBITDA of US$6.8 bn 6M 2012 revenue of US$9.8 bn, 6M 2012 EBITDA of US$3.6 bn Leading vertically integrated company operating in every major segment of the oil & gas industry, including upstream, midstream and downstream (1) Gaffney Cline report (2) Company data (3) As of October 3rd, 2012 (4) Through KMG EP 3 KMG Group Overview and Recent Developments KMG – Recent Developments Funding & Liquidity January 2011 – Samruk-Kazyna (S-K) extends a KZT 23.3bn loan (13 yr, 2% p.a.) to KMG for Beineu – Bozoi – Shymkent project financing July 2011 – KMG successfully acquires a US$ 1bln syndicated loan (5 yr, 3 yr grace, L+2.1%), drawn in 2011 for refinancing purposes June 2012 – KMG finalizes acquisition of a 10% stake in Karachaganak project, 1/2 of which was financed by a US$ 1bln carry loan from consortium members (3 yr, L+3%), the other 1/2 as a capital injection from S-K July 2012 – KMG secures a US$ 986m carry loan for Kashagan B.V. (4 yr, L+3%) 2012 – preparation for a transaction with the National Fund of the Republic of Kazakhstan to bring in a US$ 4bln loan. First drawdown to take place in 2013 (for up to US$ 2.5bln) Second drawdown to take place in 2015 (for up to US$ 1.5bln). Funds are to be utilized for refinancing and investment activities. KMG has arranged credit lines for Atyrau Refinery (US$ 2.94bln) and is in process of arranging credit line for the modernisation of Pavlodar Refinery. Reorganisation Enhancing operational efficiency – Disposal of non-core assets – Corporate centre to optimise costs Consolidating core businesses into five segments across legal entities Upstream: Consolidation of principal E&P assets under KMG EP Oil transportation Refining, Marketing and Retail Gas Transportation Oil &Gas Services Deleveraging and optimising financial structure of Rompetrol 4 KMG Group Overview and Recent Developments Strategic Developments Upstream The key acquisition was a 10% stake in Karachaganak that was concluded in 2011 and was paid in June 2012 (US$ 1bn). NC KMG also acquired MMG Service companies (Aktauoilservice) with a consideration of US$ 334m Commercial development at Kashagan to commence in March 2012 and reach optimum production levels before June 2014 (370 ths. barrels per day) Transportation 2011 - Completion and commissioning of AGP – Turkmen gas transit to China 2011 - CPC Pipeline expansion project capacities to 67mtpa (twofold) by 2015 2012 - Kazakhstan – China pipeline to be increased up to 20 mln. tonnes p.a. through put capacity in near future Downstream 2012 - KMG initiated modernization of its 3 refineries in Kazakhstan, aiming to execute these projects on or before Jan 1, 2016. So that the oil products will meet the Euro 5 fuel standards. 2. Kazakhstan Oil Industry Overview Kazakhstan Oil & Gas Industry Overview – Upstream #15 global and #2 CIS producer #9 globally in terms of 1P reserves Tengiz, Karachaganak and Kashagan to provide 70% of oil and 85% of gas production in Kazakhstan Predominant part of reserves located in Pre-Caspian and Mangyshlak basins – North Eastern side of the Caspian Sea 2011 Global Liquids Production 2011 Global 1P reserves 2011 Production in Kazakhstan Other 11.4% RoW 20.9% US 1.9% Kazakhstan 2.1% OPEC 42.4% Mexico 3.6% PetroChina 6.9% RoW 18.6% Kazakhstan 1.8% OPEC 72.4% Russia 5.3% Canada 4.3% China 5.1% LUKoil 7.4% CNPC 6.9% BG 6.1% US 8.8% Source: Annual BP Statistical Review 6 Kazakhstan Oil Industry Overview Chevron 20.9% Eni 6.1% Russia 12.8% Kazakhstan: 1.8 mmboe/d KMG 25.7% Kazakhstan: 30 bn boe Source: Annual BP Statistical Review Exxon 8.6% Total: 2.1 mmboe/d Source: Wood Mackenzie Kazakhstan Oil & Gas Industry Overview – Midstream and Downstream Transportation Refining & Marketing Kazakhstan is key focal point in the transportation of oil & gas from Central Asia to Europe and China Kazakhstan transportation networks are largely controlled by KMG – Oil pipelines via KTO – transported 66 mln tonnes of crude oil in 2010, 67 mln tonnes in 2011 – Gas pipelines via KTG – transported 102 bln. m cubed of gas in 2010, 111 bln. m cubed of gas in 2011 – A number of major pipelines have recently been completed jointly with CNPC, including Kazakhstan-China Pipeline and Asian Gas Pipeline – Infrastructure investments are key for serving international markets in Asia and Europe – Several areas of growth, including upgrades and new pipelines to Russia and China Caspian Pipeline Consortium (CPC) 2 Uzen-Atyrau-Samara 3 Atasu-Alashankou – In 2010, the refineries produced 17.05 mln tonnes of refined products, while in 2011 this amount reached 17.78 mln tonnes. Slightly higher results are expected by the end of 2012. Russia Oil pipelines 1 Refining / Downstream industry is now primarily in KMG’s control – Refineries with max refining capacity of up to 20 mln tonnes per year: Atyrau: Western region (4.9 mln tonnes per year); Shymkent: Southern region (5.25 mln tonnes per year); Pavlodar: Northern region (5.0 mln tonnes per year) Rompetrol: Romania (5.2 mln tonnes per year) Gas pipelines Russia Samara Pavlodar Astana Pavlodar Refinery 2 1 Atyrau Refinery 1 Central Asia-Center (Kaz) 2 Okarem-Turkmenbashi-Beineu (Kaz) Atasu Cities 1 Atyrau Novorossiisk (Black Sea) Aktau Caspian Sea Source: Company Data 7 Kazakhstan Oil Industry Overview 3 Alashankou 2 Beineu Uzen Shymkent Refinery Uzbekistan Turkmenistan China Almaty Shymkent Kyrgyzstan Refineries 3. Business Overview Group Structure 100% Transport 100% Exploration & Production (1) (2) (3) KMG EP – 61.36%(1) – Kazgermunai - 50% – PKI - 33% – CCEL - 50% TCO - 20% KPO - 10% Kashagan - 16.8% MMG - 50% KazakhOil Aktobe - 50% KazMunaiTeniz - 100% Transportation KazTransOil - 100% – KCP - 50% – Munai Tas - 51% KazTransGas - 100% AGP - 50% KazRosGas - 50% CPC - 20.75%(2) KazMorTransFlot - 100% Kaz Pipeline Ventures - 100% Refining and Sales KMG RM - 100% – Pavlodar - 100%(3) – Atyrau - 99.17% – Shymkent - 49.72% TenizService - 49% KING (R&D) - 83.9% KMG Service - 100% – – KMG-TransCaspian - 100% The Rompetrol Group - 100% Vega – 54.60% Petromidia – 54.60% KPI - 50% As of October 3rd, 2012, as a percentage of ordinary voting shares of KMG EP 19% through the government and 1.75% through Kazakhstan Pipeline Ventures (KPV) The Company owns a 100% interest in Refinery Company RT (which owns all of the assets of the Pavlodar Refinery and a 58% in Pavlodar Refinery JSC, the entity owning the licences to operate the Pavlodar Refinery). The remaining 42% in Pavlodar Refinery JSC is held directly by KMG RM. Refinery Company RT leases 100% of the assets comprising Pavlodar Refinery to Pavlodar Refinery JSC, which then operates the Pavlodar Refinery Source: Company Data 9 Business Overview Others Key Operational Data FY 2011: Average price of $111/bbl which is 40% higher than 2010 Oil production volume slightly decreased due to strikes at the level of KMG EP Oil transportation volume increased due to an increase at the level of Kazakhstan China oil pipeline. Gas transportation volume increased due to commissioning of Kazakhstan – China gas pipeline. Oil processing slightly increased because of implementation of cyclical upgrades. Oil trading as agent lower because due to general market fluctuations Oil production (mln ton) Gas sold (bn m3) 25 3.0 20 15 2.5 9 11 9 2009 13 12 12 9 8 8 9 2010 2011 2012 2013 1.0 Cons. JVs 60 50 20 10 14 13 16 20 15 10 5 9 14 12 13 2010 2011 15 7 51 7 18 18 2012 2013 5 10 5 6 12 16 16 2010 2011 0 0 2009 Cons. JVs Source: Company data 10 Business Overview 2012 2013 2009 Traded As agent 2010 2011 2012 2013 Karachaganak 120 54 52 52 52 8 100 12 2 105 95 105 105 2009 2010 17 109 102 101 2012 2013 90 2009 6 1.6 110 2010 2011 Cons. 20 15 1.5 115 10 Oil traded (mln ton) 1.6 Gas transport (bn m3) 40 30 1.6 125 0 Oil processed (mln ton) 20 2009 Oil transport (mln ton) 10% stake in Karachaganak and Kashagan’s production start in Q4 2012 Oil transport of CPC and gas transport of AsiaGasPipeline increase in 2012 with start of Kashagan Oil processed increases in Rompetrol in 2012 after the modernization Oil traded to increase gradually 25 1.2 TCO 70 Oil production increases at KMG EP after increased Capex, acquisition of a 30 0.5 0.8 0.0 0 Forecast: 25 0.4 1.5 10 5 2.0 JVs 2012 2013 2011 Cons. JVs KMG Upstream Snapshot 2011 Oil Production Volumes(1) 2011 Gas Production Volumes KazGerMunai 7.4% Kazakhoil Aktobe 3.4% MMG 15.9% Other 13,13% KMG EP 43.2% Kazakhoil Aktobe 3,1% MMG 4,7% KMG EP 10,62% TCO 30.2% (1) Proportionate consolidation of JVs Source: Company data 11 Business Overview TCO 55,75% Major Role in Upstream: KMG EP KMG owns 61.36% of KMG EP shares(1) KMG EP is the largest public oil and gas company in Kazakhstan Listed on LSE and KASE The Uzen field is the largest oil field of KMG EP and has been in production since 1965 Production to stay stable due to enhanced recovery techniques Strong free cash flow generation Modernisation programme launched Clear strategy to 2020, focussed on maximising shareholder value by increasing reserves, expanding production and improving profitability KMG EP’s share price evolution (US$) 26 24 Consolidated Reserves* 22 2P, mmbbl 20 18 16 14 12 Jan-11 (1) Apr-11 Jul-11 Oct-11 Jan-12 Apr-12 Jul-12 As at October 3 2012, as a percentage of ordinary voting shares of KMG EP. Source: Company data, Bloomberg 12 Business Overview UMG and EMG, 100% KGM (50%) CCEL (50%) PKI (33%) Total 1,661 80 208 134 2,083 *Reserves of UMG, EMG, KGM and CCEL as at 2011 year end, PKI as at 2010 year end Kashagan - Project Overview Overview Launched in 2000 and is part of the North Caspian Project Consortium (NCPC) – One of the world’s largest oil fields – The parties to the NC PSA estimate that the Kashagan field has 7 to 9 billion bbl of recoverable crude oil – A+B+C1 reserves of crude oil of 131.4 mln tonnes attributable to KMG on a consolidated basis The project development involves building artificial islands in shallow water, with land rigs to drill wells as opposed to conventional platforms – Experimental phase of the project completed, with the construction of five artificial islands in the Caspian Sea and 40 wells, including 32 production wells and 8 injection wells – Production expected to start in March 2013 Final agreement signed in October 2008 with Kazakh authorities implementing operational and governance framework – Replaced single operator with new joint operating entity comprising seven participants – In October 2008, parties agreed to sell approved 8.48% stake to KazMunaiGaz NC for a consideration of US$1.78 billion – Rotating leadership, operatorship to be passed to KazMunayGaz NC on start-up, once development stages are completed (Shell to act as a partner in managing production operations) – According to Amendment №4 of the Project’s development Plan and Budget, which entailed a CAPEX increase of USD 6.9 bln, commercial development to start in March, 2013. Current participation overview (NCPC) Source: Company data 13 Business Overview Karachaganak Project (KPO) Overview Karachaganak is a giant oil and gas condensate field in north west Kazakhstan, discovered in 1979 The Karachaganak Project (KPO) is a Production Sharing Agreement (PSA) originally singed in November 1997 for a term of 40 years between the Republic of Kazakhstan (RoK) and a group of foreign contracting companies: BG Group (32.5%), Agip (32.5% ), Chevron (20%) and Lukoil (15%). Under the terms of the PSA, British Gas and Agip are the sole operators of the project In 2011, the RoK and the contracting companies reached an agreement on the transfer of a 10% share of Karachaganak Project The agreement became effective in June 2012, with KMG acquiring a 10% share of KPO KMG, together with the other PSA participants, will support the 3rd phase of the development of the Karachaganak field Since the beginning of the PSA, the field has produced around 146 billion cubic meters of gas and more than 108 million tons of liquid hydrocarbons The total geological reserves of the Karachaganak field are 1,381 billion cubic meters of gas and 1,241 million tons of liquid hydrocarbons The total recoverable reserves of the Karachaganak field are 929 billion cubic meters of gas and 483 million tons of liquid hydrocarbons Current participation overview (KPO) Source: Company data 14 Business Overview Major Role in Upstream: TCO Overview Established in 1993 to develop the Tengiz field, which is operated by Chevron Crude oil reserves of 245.8 mln tonnes, which are attributable to KMG’s 20% share KMG’s stake is 20% – Veto right over major decisions, chairmanship of the management committee – Dividends from TCO represented approx. 70% of total dividends for KMG over the last three years Export via CPC pipeline and railways Major growth in production since the completion of 2nd generation plant in 2008 TCO is undertaking future generation expansion project in the Tengiz Field after receiving all the necessary approvals by the appropriate regulatory authorities and partners. The project is expected to further increase TCO’s oil field production and plant processing capacity. The cost of the project is expected to be up to US$18bn and is expected to be completed in 2018 Ownership Structure 5% 20% 50% (1) 20% attributable to KMG Source: Company data 15 Business Overview 25% Control Over Midstream: KazTransOil & KazTransGas KTO Oil & Gas Transportation Natural monopoly oil pipeline operator in Kazakhstan 7,498 km of pipelines Operates three transportation companies: KTO, KCP and MunayTas – KTO’s major asset is the Uzen-Atyrau-Samara (connection to Transneft) pipeline – KCP is a joint venture between KTO and CNODC (50/50%) – pipeline to China – MunayTas is a joint venture between KTO and CNPC E&D (51/49%) Following the completion of Kenkiyak-Kumkol Pipeline (1 of the 3 sections of the pipelines to China) in October 2009 KTO is now able to transport crude from western Kazakhstan to China Transported 66.9 mln. tonnes of oil in 2011 KTG Operates the largest gas pipeline network in Kazakhstan through ICA The major asset is the Central Asia-Centre gas pipeline (CAC) from Turkmenistan to Russia Large projects: – Asia Gas Pipeline will increase capacity to 30 bcm per year by the end of 2012 – Improved gas transportation logistics with the completion of first stage of the South West Pipeline (up to 6 bcm p.a.). Second stage expected to complete in 2016, increasing capacity up to 10bcm p.a. Terminals / Infrastructures Shuttle vessels Existing oil pipelines New oil pipeline projects Gas pipelines Refinery Source: EIA 16 Business Overview Consolidated Downstream: KMG Refining and Marketing KMG Refining and Marketing(1) (“KMG RM”) is the 100% owned principal refining and trading company of the KMG group An integrated downstream arm of KMG KMG RM’s strategy: – Increase sales volume to utilise spare capacity of refineries KMG RM’s principal refinery assets: Designed Refining Refinery (1) (2) Capacity (mln tonnes/year) Atyrau (Kazakhstan) 99.17% 4.9 Shymkent (Kazakhstan) 49.72% 5.25 Pavlodar (Kazakhstan) 100.00% 5.0 Petromidia (Romania) 54.60% (2) 4.90 (2) 0.3 Vega (Romania) KMG RM Ownership 54.60% Dedicated investments in gas stations resulted in 2nd largest retail network in Kazakhstan (e.g. 299 stations and c.8% market share) In June 2009, KMG acquired the remaining 25% of Rompetrol, Romania’s 2nd largest oil group In September 2010, KMG’s ownership (which is held through Rompetrol) in Rompetrol Rafinare (owning Petromidia refinery) was reduced to 54% Volumes Produced (ktonne) in 2011 ktonne 5,000 4,500 4,000 3,500 3,000 2,500 2,000 1,500 1,000 500 0 4,471 3,730 4,649 330 Atyrau 17 Business Overview Shymkent Petromidia Vega Pavlodar Product mix of KMG RM Refineries in 2011 Other 20.3% Jet Fuel 0.2% Fuel Oil 32.9% Previously KMG Trade House Via Rompetrol Source: Company data 4,604 Source: Company data Diesel Fuel 32.9% Gasoline 13.7% 4. Financial Summary Financial Summary of Core Assets(1) 100% 100% 100% ownership: Investors’ Change of Control Put if Government ownership drops below 100% National Company KazMunayGas NC KMG EY 2011 Actual, in USD mln Consolidated: Debt Adj EBITDA Cash Leverage Standalone: 15,086 6,788 7,381 2.22x Debt Adj EBITDA Cash Leverage Upstream KMG EP Debt Adj EBITDA Cash Leverage Transport Kashagan 593 2,174 3,561 0.27x Debt Adj EBITDA Cash Leverage KMT 2,221 (10) 118 na Debt Adj EBITDA Cash Leverage KTO 153 (11) -14.06x Debt Adj EBITDA Cash Leverage Downstream KTG 2 462 424 0.00x Note: i-) EBITDA is adjusted based on bond and loan documentation, ii-) Leverage is Gross Leverage, iii-) USD 265m debt resides at other non-mentioned entities 19 Financial Summary 9,774 4,045 1,311 2.42x Debt Adj EBITDA Cash Leverage RM KMG 661 541 592 1.22x Debt Adj EBITDA Cash Leverage Rompetrol 940 496 746 1.90x Debt Adj EBITDA Cash Leverage 477 (41) 199 -11.67x Financial Performance Revenue Adj. EBITDA (US$ mn) (US$ mn) 25,000 10,000 20,000 8,000 15,000 6,000 10,000 5,000 17,703 10,777 4,000 14,220 2,000 5,633 6,788 0 0 2009 2010 2009 2011 2010 Capex Total Debt and Leverage (US$ mn) (US$ mn and Multiple) 16,000 3,000 14,000 12,000 2,500 10,000 2,000 3,222 3,091 2,501 5.0 14,490 15,416 4,000 2,000 2.74x 2.22x 2009 2010 Source: KMG’s audited financials, Company data 20 Financial Summary 2011 2.0 1.0 0 0 4.0 3.0 6,000 500 15,086 3.39x 8,000 1,000 2011 0.0 2009 2010 2011 Debt / adj. EBITDA (x) 3,500 1,500 4,276 Historical and Planned Capex Historical Capex (US$ mln) Capex per segment, $mln Upstream Oil transport Gas transport Downstream NC KMG Other Total FY2009A FY2010A FY2011A (1,647) (198) (179) (371) (14) (92) (2,501) (1,804) (175) (306) (465) (179) (293) (3,222) (1,900) (230) (285) (434) (64) (179) (3,091) 2011 Total Capex Breakdown 2% 6% 2009 project CAPEX/Maintenance CAPEX – 60%/40% 2010 project CAPEX/Maintenance CAPEX – 65%/35% 2011 project CAPEX/Maintenance CAPEX – 68%/32% 14% 62% 9% 7% Source: Company data 21 Financial Summary Upstream Oil transport Gas transport Downstream NC KMG Other KMG Group Debt Breakdown and Financing Policy KMG’s future financial policy Scheduled Debt Maturities (US$ mn) Objectives of financial management: – Monitor leverage and take steps to reduce or term out debt – Maintain optimal working capital position at the subsidiary level – Maintain high level of financial flexibility of KMG group Finance projects without using balance sheet: – Non-recourse project financing – JV partner taking majority of financing burden – Acquisition financing with limited recourse to acquired asset and its dividend flow Debt Breakdown By Currency KZT 18.5% By Interest Rate EUR 1.6% Variable 34% Borrow at the KMG level and use this liquidity as needed by different parts of the group KMG’s financial policy targets – Total Debt / EBITDA < 3.5x USD 79.8% 22 Financial Summary Fixed 66% – Net Debt / Net Capitalisation < 0.5 5. Investment Highlights Investment Highlights 1. Most significant asset of the Government 2. Significant portfolio of large-scale exploration projects onshore and offshore to drive long-term production growth (e.g. Kashagan) 3. Strategic pre-emptive rights High Strategic Importance to the Government 4. Largest oil producer in Central Asia 5. Midstream: control over oil and gas pipeline infrastructure 6. Downstream control: downstream capabilities including three major refineries across Kazakhstan and Rompetrol assets in Europe 24 Investment Highlights Vertically Integrated Group

![[Presentation Title/Subject]](http://s2.studylib.net/store/data/005306011_1-531bebd888094ab5a40895a46edc0595-300x300.png)