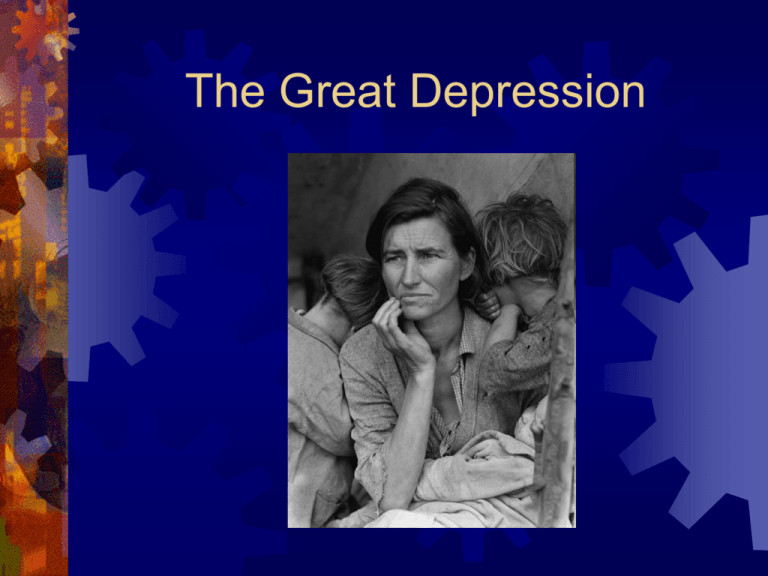

The Great Depression

advertisement

The Great Depression General Causes of the Great Depression Global Depression European World War I debts went unpaid Consumer debt Credit Lack of government regulation Stock market crash/ over-speculation/ margin buying “Less” Income Spending Employment Cycle Business failures Unemployment Good Good Times! 1920’s Public Perception: Economy would continue to grow No fear of unemployment Low taxation Credit Faith in the stable economy In having a job In a growing economy Made people feel safe borrowing BUT PEOPLE BORROWED TOO MUCH Uh Oh… Easy credit means loans to people who might not be qualified, or able, to pay loans back. Little regulation by the government to make sure loans are only made to those who would be able to pay them back. The Consumer Used credit (borrowed money) Did not have the money to pay it back People wanted to buy things Banks wanted to lend (make money on loans) Government wanted credit to continue Consumer spending = strong economy People were in debt Eventually this debt had to be paid-off, then the “less” cycle began. The Stock Market Bull Market – upward trend in stock prices 1920’s was a continuous bull market Bear Market – downward trend in stock prices The Great Depression marked the beginning of a severe Bear Market Stock Speculation Speculating “playing” the market. Buying and selling for quick profit. Buy to create demand Demand means price goes up Sell stock at high price (but the stock was not TRULY worth that high price) Problem? Over Speculation As long as demand continued there was no problem with speculation – UNTIL DEMAND ENDED. Once demand calmed, overinflated stocks dropped significantly in value. People owned stock, but no one wanted to buy it. When demand for a stock falls, what happens to the price? Margin Buying Purchasing stocks with borrowed money Believing one could take a loan, invest it, and make back the loans money plus profit. The Stock Market Crash Black Thursday October 24, 1929 Nervous investors begin to sell their stocks No buyers Stocks fall in value Black Tuesday October 29, 1929 16 Million shares of stock are dumped by investors. Prices of stocks plunge. Margin Buyers found themselves in severe debt. Herbert Hoover “We have passed the worst and… shall rapidly recover.” Business leaders, public officials claimed: Only a minor setback Banking Crisis The Run on the Banks Borrowers defaulted on loans Banks lost money Went out of business Public saw the writing on the wall Individuals wanted to get their money out of the banks before their bank closed for good! The Banking Crisis 1930-1932 5,000+ banks fail Collapse Left of 1 large New York Bank 400,000 depositors without their savings. The Run on the Banks People ran to banks to withdraw money. Money leaving the banks meant banks had no money to invest, or make loans with. Therefore, banks had no means of making money. Banks were forced to close. Business Failures Less consumer spending Less consumption of products Less profit/money for businesses. Business Response: Trimmed inventories Scaled back production Laid off employees Business Failures 1930: 26,000 Businesses went bankrupt 1931: 28,000 Factories and mines were empty. GNP – Gross National Product Total value of goods and services produced in a given year 1929 $103 Billion 1933 $56 Billion Unemployment 1932 (for – 23.6% Unemployment every 100 people, 23 were jobless) Global Depression Massive war debts of Europeans went unpaid. Foreign consumers were unable to purchase U.S. goods Factories that sold to foreign countries were forced to shutdown. Income Gap Growing income gap Rich getting richer, poor getting more poor. Farmers; Laborers Unable to repay loans Farmers; Laborers Not getting a high enough wage to meet the increasing cost of living. Credit Some Americans used credit as a means to bridge the income gap, or maintain themselves with the rising cost of living. Many consumers found themselves unable to pay off their debts. The (Good) Business Cycle People spend Spending creates demand Businesses have to hire more workers to meet demand More people spend. Demand creates jobs The (Bad) Business Cycle People do not spend No demand Businesses have to lay-off workers because there is no demand Less people spend Less people have jobs Review Buying on Margin Bull Market Bear Market Black Thursday Black Tuesday Explain how the Banking Crisis contributed to the Great Depression. Explain how business failures contributed to the Great Depression General Causes of the Great Depression Essay Question State the 3 general causes of the Great Depression, provide an EXAMPLE of each, how each contributed to the greatest economic slowdown in American history.