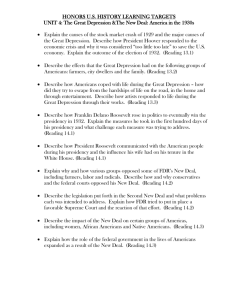

The 1930's WORKING!

advertisement

Economic Troubles on the Horizon • As the 1920’s went on, serious problems threatened economic prosperity • Some Americans became very wealthy and some could hardly earn a wage • Farmers grew more crops than they could sell • Consumers and farmers were going into debt… quickly! Industries in Trouble • During the 1920’s key basic industries, railroads, textiles, and steel, had barely made a profit – Railroads lost business due to other new forms of transportation – Mining and lumbering, had expanded during WWI, and were no longer in high demand • Coal fell victim new forms of energy such as hydroelectric power, fuel oil, and natural gas Farms Need a Lift • Farmers suffered the most during the 1920’s – During WWI, demand for crops went up so farmers borrowed money so they could plant more crops, buy more land and farm equipment – WWI ended, and the demand went down 40% and farmers were left with an abundance of crops they couldn’t sell and a ton of debt they couldn’t pay – Annual farm income went down from $10 billion to $4 billion in one year! Farms Need a Lift Many farmers lost their farms when the bank came and took them because they couldn’t pay their loans • In turn, many rural banks ended up failing and were on the verge of closing – Often auctioned off farming equipment and anything to try to recoup their loss of money • Congress tried to help when they passed the McNary-Haugen bill which called for federal pricesupport for certain products – The government would buy surplus crops at a guaranteed price and sell them on world Market… Coolidge vetoed it twice! • Consumers Have Less Money To Spend • As farmers’ incomes fell they bought fewer goods and services and consumers in general were not buying as much because: – Rising prices – Stagnate Wages – Unbalanced distribution of income • More than 70% of the nations family earned less than $2,500 per year – Overbuying on credit in the preceding years • Many Americans appeared to be prosperous but they were actually living beyond their means and using credit for everything! Dreams of Riches in The Stock Market • The stock market was the name of the game in the 1920’s, those who could afford to invest in the stock market did –> See HW for more info! – The Dow Jones Industrial Average was/is what determined the Stock Market’s health • The Dow is a measure based on the stock prices of 30 representative large firms trading on the New York Stock Exchange • If the Dow is doing well, the stock market is doing well! • In the 20’s the Dow hit 381 points which was 300 points more than a year earlier Dreams of Riches in The Stock Market People took advantage of the “bull market” (a period of rising stock prices) and rushed to buy stocks and bonds but… – People were engaging in speculation – they bought stocks and bonds on the chance of a quick profit, while ignoring risks – Many were buying on margin- paying a small percentage of a stock’s price as a down payment and borrowing the rest • With easy money available to investors it boosted the market upwards – But this didn’t reflect a companies true worth! • The Stock Market Crashes! • In early September of 1929, stock prices peaked and then fell and people stared to get iffy about their investments – On October 24, the market took a plunge and investors unloaded their shares • On October 29th- now known as Black Tuesdaythe bottom fell out of the market (suddenly lost value) – People tried to sell their shares before they lost even more value roughly 16.4 million shares were dumped that day! – People were stuck with HUGE debt! The Stock Market Crashes! In order to pay off their debts from buying on margin people used what little savings they had and those that played the market with their savings, lost it all! • By mid-November, investors had lost about $30 billion! Roughly what the U.S. had spent on W.W.I • The stock market crash signaled the beginning of the Great Depression – The period from 1929 to 1940 in which the economy plummeted and unemployment skyrocketed. • Bank and Business Failures! • After the crash, many people panicked and withdrew their money from banks… – Some couldn’t get it because the bank had invested it in the stock market – 1929, 600 banks closed – 1933, 11,000 of the 25,000 banks in the U.S had failed – Government didn’t protect or insure bank accounts, so millions of people lost their savings! Bank and Business Failures • The depression was felt nation wide – Between 1929 and 1932, the Gross National Product (GNP) – the nation’s total output of goods and services- was cut nearly in half. From $104 Billion to $59 billion – Millions of workers lost their jobs, companies didn’t have money to pay people, no one had money to buy goods • 1.6 million in 1929 to 13 million in 1933! • One out of four workers was out of a job • If you did keep your job you got a pay cut and reduced hours Worldwide Shock Waves Much of Europe was suffering during the 1920’s due to WWI, but the Great Depression made things worse in Europe – Now America was very limited to what it could import from Europe (hurt Europe’s economy) – America couldn’t continue giving Germany money for the Dawes Plan • Congress passed the Hawley-Smoot Tariff Act – Highest protective tariff in U.S. history which was supposed to protect American businesses – Actually hurt the U.S. because now businesses couldn’t export to Europe • Worldwide Shock Waves Most common set of factors that caused the Great Depression: 1. Tariffs and war debt policies that cut down the foreign market for American goods 2. A crisis in the farm sector 3. the availability of easy credit 4. an unequal distribution of income • These factors led to falling demand for consumer goods • The federal government contributed to the crisis by keeping interest rates low thus allowing people to borrow more than they should of • • The Depression in the Cities Cities across the nation, people lost their jobs, were evicted from their homes, and ended up in the streets – Many were forced to live in parks or sewer pipes and wrap themselves in newspapers (soon called Hoover Blankets), some made shacks out of scrap metal or wooden crates – Shantytowns- little towns consisting of shackssprang up all over – The poor dug through trash cans for food, or begged – Soup kitchens and bread lines became a common sight The Depression in the Cities The Depression in Rural Areas • The depression was somewhat better in rural areas – Most farmers could grow food for their families – Due to falling prices for food and rising debt some farmers lost their land and farms and there were many foreclosures- the process by which a mortgage holder (bank) takes back the property if an occupant has not made payment – Many farmers turned to tenant farming to scrape by! The Dust Bowl Effects on the American Family The Depression strengthened family ties, but also increased family tensions • Some men abandoned their families, discouraged by their inability to provide for them some became “hoboes” – Some would take to the streets every day to try and find work • Women also faced greater pressures to provide for themselves & their families – Canned food and sewed cloths – Ones who kept their jobs became the targets of resentment from men • Effects on the American Family • Children also suffered during the GD – Serious health conditions resulting from malnutrition… rickets – Falling tax revenues caused schools to shorten the school day or even close – Some teenage boys became “Wild Boys” • Teenage boys who hopped aboard freight trains to travel the country in search of work • From all kinds of families, poor farmers, miners, wealthy parents who lost their money • Soon became known as “Hoover Tourists” Social and Psychological Effects Many people became demoralized by the hard times that they lost the will to survive – Suicides & admissions to mental hospitals increased dramatically.. 30% more! • During the GD many people showed kindness to strangers who were suffering – People gave food, clothing and sometimes a place to stay – Since there was no direct relief- cash payments or food provided by the government- a lot of charity services sprang up or the cities offered small amounts of compensation •