ACCT 20100 Review Problem

advertisement

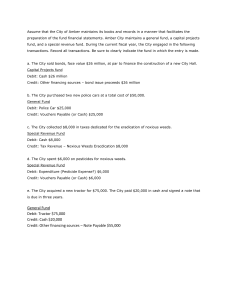

ACCT 20100 Review Problem Review for Exam #1 Fall 2010 Jordan Auditorium Mendoza College of Business September 19, 2010 July 1 Minh invested $12,000 cash in the business. Account Debit Credit July 1 Purchased used truck for $6,000, paying $3,000 cash and the balance on a three year note payable. Account Debit Credit July 3 Purchased cleaning supplies for $1,300 on account. Account Debit Credit July 5 Paid $2,400 cash on one-year insurance policy effective July 1. Account Debit Credit July 12 Billed customers $2,500 for cleaning services earned. Account Debit Credit July 18 Paid $1,000 cash on amount owed on note payable and $800 on amount owed on cleaning supplies. Account Debit Credit July 20 Paid $1,200 cash for employee salaries. Account Debit Credit July 21 Collected $1,400 cash from customers billed on July 12. Account Debit Credit July 25 Billed customers $5,000 for cleaning services earned. Account Debit Credit July 31 Paid gas and oil for month on truck $200. Account Debit Credit July 31 Declared and paid $900 dividend. Account Debit Credit Once Journal Entries are complete, Post these to t-accounts. Prepare UNADJUSTED TRIAL BALANCE from t-account balances Prepare Adjusting Journal Entries (1) Services provided but unbilled and uncollected at July 31 were $1,500. Account Debit Credit (2) Depreciation on equipment for the month was $300. Account Debit Credit (3) One-twelfth of the insurance expired. Account Debit Credit (4) An inventory count shows $400 of cleaning supplies on hand at July 31. Account Debit Credit (5) Accrued but unpaid employee salaries were $600. Account Debit Credit Prepare ADJUSTED TRIAL BALANCE (Post Adjusting Journal Entries to a separate column in the Trial Balance Worksheet) Prepare Financial Statements: 1. Income Statement 2. Statement of Retained Earnings 3. Balance Sheet Prepare Closing Entry Closing Entry Account Debit Credit