Paying with plastic - Ulster Bank MoneySense at Home

advertisement

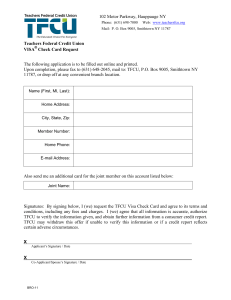

Paying with Plastic Plastic cards may be used as a form of payment but, like cheques, they are not legal tender – shopkeepers do not have to accept them by law. What is money? Money is a recognised method of paying for goods and services. Money comes in different forms. However, not all forms of money are legal tender – a form of money that, by law, must be accepted in payment. What is money? Money overcomes the difficulties of bartering – directly swapping goods and services. Money is: Portable: easy to carry Non-perishable: lasts a long time Scarce in supply: too much = worthless Ways to pay Currency/legal tender: notes and coins Plastic money: credit cards, charge cards, store cards, Visa Debit and ATM cards Bank current accounts: put money in a bank account and use to make payments by cheque, payment card, direct debit, standing order, etc Notes and coins are legal tender Legal tender means that, by law, notes and coins must be accepted in payment for goods or services. Cheques and payment cards are not legal tender and don’t have to be accepted. Payment cards Payment cards let you pay without having notes and coins on your person. Payment cards are only provided if you have a favourable credit score Credit cards: Access, Visa, MasterCard Charge cards: American Express Store cards: Esso, Statoil, M&S ATM and cash cards Visa Debit card Smart card Credit cards Buy now, pay later A type of credit: you are borrowing the money from the card provider You have a credit limit – the most you can spend. You receive a statement each month. Each month you must pay the outstanding balance in part or in full (you must pay a monthly minimum). You pay interest on any outstanding balance. Interest can quickly build up – this can be an expensive way to pay. But if you pay the balance in full each month, you won’t pay any interest – so this can be the cheapest form of credit if you’re disciplined in using it! Charge cards Eg American Express You borrow the money you spend, like a credit card. You receive a statement each month. You must pay the FULL balance. There is an annual membership fee. Store cards Similar to credit cards, but issued by retailers such as department stores and petrol companies You have a credit limit – the most you can spend. The interest rates can be higher than credit cards. You can’t use your store card in any other store – so it can limit you in shopping around for the best value. Visa Debit Given to current account holders You can only spend the money you have in your current account. Swiped or used with chip and PIN: most cards now have an embedded chip The money is taken from your account immediately. Visa Debit cards can be used to pay for goods and services in shops and other retail outlets, online and by phone. ATM Means Automated Teller Machine, often called a ‘hole in the wall’! Available in most towns and many shopping centres and banks 24-hour service Provide many basic services eg Withdraw money Order chequebooks Change PIN View current balance and most recent transactions Top up your mobile phone credit