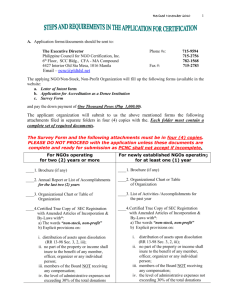

BIR Rules & Regulations Update: Key Changes & Compliance

advertisement

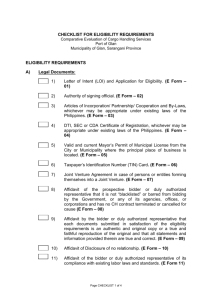

Presented by: CYNTHIA E. OMERES Revenue Officer RR No. 19, Assessment Division 1 Change in Accounting Period (Sec. 46 of NIRC, RR 3-2011 and RR 9-2011) 2 Original Accounting Period (Calendar Year / Fiscal Year) Taxpayer other than INDIVIDUAL Change accounting period to FISCAL YEAR CALENDAR YEAR ANOTHER FISCAL YEAR 1. Letter Request addressed to the RDO / LT Office having jurisdiction over the place of business of the taxpayer; 2. Duly filled-up BIR Form No. 1905; 3. Certified true copy of the SEC approved Amended By-Laws showing the change in accounting period; 4 4. 5. Sworn certification of “ non-forum shopping” stating that such request has not been filed or previously acted upon by the BIR-National Office, signed by the taxpayer or duly authorized representative; and A sworn undertaking by a Responsible Officer of the Taxpayer. (Annex A of RR 3-2011) 5 The request for approval of the change in accounting period should be filed at anytime not less than sixty (60) days prior to the beginning of the proposed new accounting period 6 To the BIR, Revenue District Office or Large Taxpayers Office having jurisdiction over the place of business of the taxpayer 7 Stamping of Income Tax Returns and Attachments (RMO 6-2010, RMO 13-2010 and RMO 13-2011) 8 The ITR shall be stamped “Received” on the space provided for in the three (3) copies of the returns; Any tax return in excess of three (3) shall not be received; 9 The attachments to the ITR shall also be stamped “Received”; The attached Financial Statements shall also be stamped “Received” but only the Audit Certificate, Balance Sheet and Income Statement; 10 In the case of Corporations, and other Juridical persons, an extra two (2) copies of the Audit Certificate, Balance Sheet and Income Statement shall be stamped “Received” for filing with the SEC. 11 VAT Reporting -Standard Format(RMC 17-2011) 12 Add Your Title Requirements of Lessors (RR 12-2011 and RR 15-2011) 14 To Ensure that the person intending to lease their commercial spaces, buildings and establishments is a BIRregistered taxpayer, which should have the following: TIN; BIR Certificate of Registration; and Duly registered receipts and invoices. 15 To submit the following information, under oath, in hard and soft copies: Building / space layout of the entire area being leased with proper unit/space, address or reference; Certified true copy of Contract of Lease per tenant; and The Lessee Information Statement. 16 17 18 Every 31st of January starting the current year (for tenants as of December 31st of the previous year) and 31st of July starting from the current year. 19 Failure to submit; Submitted falsified information; and Knowingly transact with not duly registered taxpayers. A penalty of not less that P 10,000.00 and Imprisonment of not less that one (1) year but not more that ten (10) years 20 Income Tax Returns -New Forms(RMC 57-2011/RR 19-2011) 21 Income tax filing covering and starting with calendar year 2011, which are due for filing on or before April 15, 2012 the following revised forms are to be used: BIR Form 1700 version November 2011 BIR Form 1701 version November 2011 BIR Form 1702 version November 2011 22 All juridical entities following fiscal year of reporting are required to use the new BIR Form 1702 starting with those covered by fiscal year ending January 31, 2012. Disclosures on the Supplemental Information portion of BIR Form 1700 and 1701 will be “OPTIONAL” for calendar year 2011 and will be “MANDATORY” for calendar year 2012. 23 BIR Form 1700 RMC-2011-57-1700 nov 2011.pdf BIR Form 1701 RMC-2011-57-1701 nov 2011.pdf BIR Form 1702 RMC-2011-57-1702 nov 2011.pdf 24 Statement of Management Responsibility (RR 3-2010) 25 1) 2) The Management is responsible for the following: Information and representations contained in the ITR and the attached FS; and All other tax returns filed for the reporting period. 26 1) 2) The Management affirms the following: That attached FS and ITR are in accordance with the books and records; That the ITR has been prepared in accordance with the provisions of the NIRC; 27 3) 4) The Management affirms the following: That any disparity of figures between the ITR and FS has been reported as reconciling items and maintained in the books; and That all applicable tax returns has been filed and the taxes shown thereon has been paid. 28 Taxpayer or Both Spouses, in case of Individual. In case of a Juridical entities: President/Managing Partner Chief Executive Officer or its equivalent Chief Financial Officer or its equivalent In case of a Foreign Corporation, the local manager shall be the signatory. 29 Preparation & Submission of Financial Statements Accompanying The Tax Returns (Sec. 6(H) & Sec. 244 of the NIRC; RR 21-2002; RR 7-2007; RR 8-2007) 30 Shall state the accounts therein in a very descriptive fashion; The account titles must be specific and not control accounts; Must conform to standards promulgated by the FRSC of the Philippines; Must conform to the rules and requirements of regulatory agencies such as the SEC, BSP, IC and etc. 31 a) b) Balance Sheet Income Statement / Profit & Loss Statement I. Sales/Revenues II. Cost of Goods Sold / Cost of Services III. Selling & Administrative Expenses IV. Financial Expenses (if any) V. Other Income VI. Other Expenses Note: Items I, IV, V & VI – should be fully explained in the Notes to the Financial Statements Items II & III – should be supported with schedules 32 c) Statement of Changes in Equity showing either: All changes in equity Changes in equity, other than those arising from transactions with equity holders acting in their capacity as equity holders d) Statement of Cash Flow e) Notes (comprising a summary of significant accounting policies & other explanatory notes) f) Schedules attached to the afore-cited statements 33 Financial Accounting Tax Accounting Reconcile maintain books & records, recording & presentation shall be done in a manner that it will be understood by the examiners/auditors of the BIR To reflect in its books of accounts the adopted/accepted year-end adjusting entries; and Be made available to the investigating officers of the BIR upon audit, the working papers prepared pertinent to the adjustments made. 35 To maintain and preserve copies of the audited and certified Financial Statements for a period of three (3) years from the due date of filing the ITR or the actual filing thereof whichever comes later. 36 Any independent CPAs who, in his capacity as external auditor, willfully falsifies any report or statement, shall be dealt with in accordance with Sec. 257 of the Tax Code, as amended, shall be subject to the applicable penalty provisions of RR 11-2006. 37 The end 38