Yueqin Yang presents

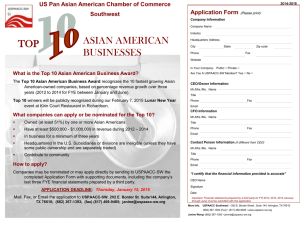

advertisement

Yueqin Yang presents: The Asian Crisis: A Perspective after Ten Years W. Max Corden Department of Economics University of Melbourne The Asian Crisis: a Perspective after Ten Years • Introduction Background Focus on four nations: Thailand, Indonesia, Malaysia, Korea • • • • • • The Boom The Bust and The Trigger Financial Crisis and Exchange Rate Regime Policy Responses Some Special Aspects of the Four Countries Conclusion The Asian Crisis: a Perspective after Ten Years The Asian Crisis: Background The crisis was period of financial crisis in July 1997, and raised fears of a worldwide economic meltdown due to financial contagion. The crisis started in Tailand with the financial collapses of Thai habt. Other Southeast Asian countries were affected. According to the UN, the crisis was “perhaps the most serious financial crisis since the breakdown of the Bretton Woods system in the early 1970s, in terms of both its scope and its effects” The Asian Crisis: a Perspective after Ten Years The Boom Financed by both local savings and by foreign capital inflow Three forms of foreign capital inflow: 1. 2. 3. Foreign direct investment (FDI) Portfolio capital into local stock markets Short-term borrowing The Asian Crisis: a Perspective after Ten Years The Bust and The Trigger •Fundamental Cause Inevitable ending of the investment boom Financial difficulties •Trigger in Thailand: Internal and External factors collapse in exports growth rate increase in current account deficit exchange rate crisis (depreciation of Thai) •Trigger of the other three countries: Thai Baht depreciation The Asian Crisis: a Perspective after Ten Years The Exchange Rate Regime and Crisis The East Asian crisis is often thought of as a currency or exchange rate crisis. •Fixed Exchange-rate System: not perceive hedging governments try to keep the value of their currencies constant against another (usually US dollars) •Floating Exchange Regime: perceive hedging a currency's value is allowed to fluctuate according to the foreign exchange market. The Asian Crisis: a Perspective after Ten Years Currency Mismatch Unhedged Foreign Borrowing • Apply to Indonesia, Thailand and Korea • Balance Sheet Effects Unhedged foreign borrowing (US dollars) A depreciation of the domestic currency Big losses incurred by domestic banks The Asian Crisis: a Perspective after Ten Years Recession • Decline in Investment • Financial crisis due to excessive domestic lending and decline in assets value • Reduction of private consumption • Currency mismatch on Balance Sheet The Asian Crisis: a Perspective after Ten Years The Policy Responses • Moderate the Depreciation • Rescue the Banks • Keynesian Demand Expansion Various increases in public expenditure Public sector infrastructure investment Deliberate reductions in interest rates The Asian Crisis: a Perspective after Ten Years Some Special Aspects of the Four Countries • Thailand: Fixed-but-adjustable Exchange rate Regime(FBAR) • Indonesia: Economic problem interacted with political problem • Korea: Achieve more assistance from IMF and US • Malaysia: Have no currency mismatch problem Government control on short-term capital outflow The Asian Crisis: a Perspective after Ten Years