March 22 Cost approach

advertisement

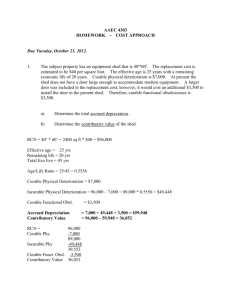

Percent Change in Iowa Land Values by Crop Reporting District from Sept. 2010 to March 2011 (RLI) 30% 25% 20% 15% 10% 5% 0% C EC NC NE NW SC SE SW WC State Basic idea is that an informed buyer won’t pay more than the cost of constructing an equal, substitute property minus the depreciation and assuming no delay. Market data is used to value the components of the subject property including the land. Even though both the cost and sales comparison approaches use market data DO NOT mix the two; the cost approach uses a different methodology. Most applicable when: Improvements are new and are highest and best use Subject property has characteristics typical in the area Subject property is a special use property Enough data to value the property components but limited data to value the whole property Least applicable when: No vacant land sales available Construction costs are hard to measure Depreciation is hard to measure Improvements are very old Steps: Develop a land value opinion; vacant land in highest and best use valued as highest and best use regardless of present use. Use similar highest and best use Estimate reproduction or replacement costs for improvements. Estimate amount of depreciation Subtract the depreciation from the cost estimate Total the land and building components New cost of improvements $300,000 Depreciation -175,000 Depreciated value of improvements $125,000 Value of the land $600,000 Value from Cost Approach $725,000 Land value is the value for vacant land Unimproved is land without building or structures Urban usually means land without a house/structure even if there are roads, sewer, etc. Rural unimproved doesn’t mean there aren’t fences, tile, ponds, etc. Just that there are no buildings or structures. Why? Subject property has 160 acres of pasture with fences and stock pond Three other sales are located for $2800 an acre all with similar fencing and water The indicated value of $2800 would include the fence and water If an appraiser valued the land at $2800 and then added the value of the fence and water they’d be overstating If the request was for an appraisal that valued them separately then the other 3 sales would have to be allocated between the land and site improvements The Cost approach inventories the land for the subject property into various classes Cropland, tillable pasture, permanent pasture, woodland, farmstead roads, ditches, etc. Vacant sales are used to estimate the values for the various classes of land on the subject property Values are applied to the subject WITHOUT making the plus or minus adjustments used in the Sales comparison approach (except be sure you still make the time adjustments) Tillable ground: 90 + CSR 85 – 90 CSR Cropland A Cropland B 50 acres of Cropland A 75 acres of Cropland B Total tillable 15 acres of pasture 5 acres of farmstead 2 acres of roads/ditches Total non-tillable 22 acres TOTAL 147 acres $8,000/ac 7,500 $400,000 562,000 $962,000 $1,050 $8,000 $ 15,750 $ 40,000 0 $ 55,750 0 $2,534 $1,017,750 $6,923 Value of the land determined first Cost for the building; Reproduction; cost to construct an exact replica of the existing building Replacement; cost to construct a building with the utility equivalent to the one being appraised; using modern material, current standards, design, layout, etc. Using either method use the date of the appraisal and with current prices Local builders Market abstraction; based on sale of a new building after the land is subtracted; works best with houses, not so good with rural property Cost services; this is a group that summarizes costs for the appraiser; they provide manuals and other information to use in making the appraisal Depreciation is the difference between the cost to reproduce or replace property and its contributory value as of the date of the appraisal Three types of depreciation to consider: Physical deterioration; Functional obsolescence Defects in design; material, design, otherwise obsolete by current standards Sometimes this could be cured External obsolescence; effect on value from outside property itself; traffic, odor, hazards, etc Corn used to be harvested on the ear and stored in ‘cribs’. Today most of the cribs have been abandoned. This is an example of A modern hog confinement needs greater ventilation of the waste pits. This is an example of: Functional depreciation Asphalt singles on the garage are starting to leak. This is an example of: Functional depreciation Physical depreciation A ethanol plant is located across the road. The resulting dust, traffic, etc. would cause: External obsolescence What is an economic term for this? Two kinds of physical depreciation to remember: Curable; this is when the deterioration is economically feasible to cure and they generally are taken care of; deferred maintenance; be sure to include all costs! Physical incurable; this is when the deterioration either can’t be corrected or it would cost more to correct than its contributory value to the property Short lived; roof, furnace, etc. that would be replaced some time but not at the time of the appraisal Long lived; basically the ones that will last the life of the improvement; foundation, etc. Economic age-life method: Depreciation = Effective age/economic life * replacement cost Actual age is when it was built but there could have been extensive remodeling that would change the effective age; the effective age is based on condition and utility of the structure; there are judgments that has to be made Economic life is the time where the improvements contribute to the property value; they can be extended Remaining economic life is time left where the improvements continue to contribute to the property value Econ. life = effective age + remaining econ. life Effective age = Econ. Life - remaining econ. life Remaining econ. life = Econ. life - effective age A major problem with this approach is that it groups the types of depreciation together. Reproduction cost Effective age Economic life Remaining econ. life Ratio for cost Total Depreciation $100,000 10 yrs 50 yrs 40 yrs. 20% $20,000 Depreciated value of improv. $80,000 Land value $250,000 Value indicated by cost approach $330,000 The appraiser can recognize the curable items of physical deterioration and functional obsolescence by estimating the cost to ‘cure’ them. This amount is then subtracted from the replacement costs. The appraiser has to recognize the impact this adjustment might have on the effective age and economic life Reproduction cost Minus curable items Effective age 9 yrs Economic life 50 yrs Remaining econ. life 41 yrs. Ratio for cost (9/50) 18% RC minus the curable Other depreciation 17,460 Total Depreciation (+ $3,000) Depreciated value of improv. Land value Value indicated by cost approach (rounded $100,000 $3,000 $97,000 $20,460 $79,540 $250,000 $329,500 Market abstraction First step is to estimate the depreciation from a sale Second step is to apply this estimate to the subject building This works for properties either with similar problems as the subject with respect to curable and incurable or for properties without physical curable or incurable short live items The appraiser is trying to estimate the annual percentage depreciation from the sale and apply it to the subject Sales price $400,000 Land value $100,000 Contributory value of improve. $300,000 Reproduction cost new (RCN) $500,000 Accrued Depreciation ($500,000 - $300,000) $200,000 Overall percentage ($200/$500) 40% Effective age 10 Annual percent depreciation 4%/yr. Reproduction cost $600,000 Effective age 15 years Total depreciation percentage 60% Total depreciation ($600,000 * 60%) $360,000 Contributory value of improvements $240,000 Land value $150,000 Value estimated by cost approach $390,000 The market abstraction approach can also be modified to consider the curable depreciable items Similar process Sales price $1,700,000 Land value $100,000 Contributory value of improve. $1,600,000 Reproduction cost new (RCN) $2,875,000 Accrued Depreciation (RCN – contrib. value) $1,275,000 Physically curable 200,000 Long lived depreciation 1,075,000 Long lived costs (RCN – curable) $2,675,000 Long lived dep. ($1,075/$2,675) Effective age Annual percent depreciation 40% 20 2%/yr. Remember that the whole purpose of this is to come up with an estimated value for the property. We want to correlate the values indicated from the different approaches we used and to come up with a single value. “Reconciliation is the method of bringing together all of the data and analyses into one final estimate of value.” The reliability of the data is crucial, garbage in, garbage out A wide spread in the estimates from the different approaches indicates a strong possibility there were mathematical and/or technical errors made. In theory, all of the approaches should lead to the same estimate. But, for this you need; The markets to function perfectly The appraiser to function perfectly That’s not likely to happen The market is the market and sometimes things don’t happen the way you’d expect. I think this is especially true with land and land values It is important to strive for perfection but don’t let that get in the way of being honest; don’t manipulate data beyond its limits; one paired sale isn’t the same as multiple and so on At the end, don’t forget to ask yourself, if the property is really worth the value stated!