Retail (2.6%) PowerPoint Presentation PowerPoint Presentation

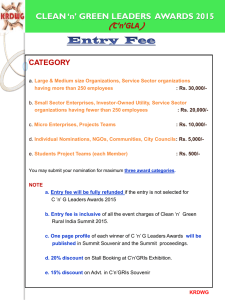

advertisement

for the period ended 31 August 2013 Proceedings • Introduction • Highlights Sandile Nomvete • Strategy • Unitholder profile • Financial review • Capital management Bronwyn Corbett • Consolidated property portfolio • Capex • Prospects Sandile Nomvete 2 Introduction Introduction to Delta • Black managed property loan stock company • Successfully raised R1.7 billion in equity post listing • Defensive portfolio at an average value of R98.8 million • Ratio of government to non-government (GLA) = 56:44 • Total investment portfolio of R4.8 billion (49 properties) • Market capitalisation of R3.0 billion • Constituent of the FTSE-JSE SA listed property index (J253) • Achieved a Level 2 BEE property charter rating 4 Highlights Highlights for the period under review • Distribution achieved of 32.51 cents per linked unit, ahead of forecast • In line to meet year end distribution • Portfolio occupancy of 94.7% • Attractive forward funding rates of 7.7% • Leases renewed for 39 533 m² (R244.7 million) • Yield enhancing acquisitions R2.7 billion (average yield of 9.7%) 6 Strategy Strategy Short-term: • Achieved interim distribution • Sweated current portfolio (lease renewals and uplift on vacancies) • Transfer of all new acquisitions • Bulked up asset management team • Included 3 further property managers • Maintained A/B grade fund – new acquisitions • On track to achieve distribution growth and February 2014 distribution 8 Strategy | continued Medium-term: • Grew portfolio to R4.8 billion: › Yield enhancing assets › Increased SARS portfolio • Diversification of portfolio: (60/40 government/ non government) › New acquisitions › Parastatal › Industrial 9 Organogram CEO Sandile Nomvete (Exec Dep. & Prop Dev. Prog) CFO / COO Bronwyn Corbett (CA (SA)) Asset Management Legal Taryn Harris Finance (BA Hons, LLB) Senior AM Otis Tshabalala Andre Janari Senior Ops AM Trevor Matthews Group Financial Manager Greg Booyens (CA (SA)) Ops AM Sandra Mqina Ojong Nso Godfrey Ndlovu Finance and Compliance Manager Stefan Smit Bookkeeper Rochelle Mumbengegwi (Bcom Acc) (CA (SA)) 10 Unitholder profile As at 31 August 2013 Units held Holding Coronation Fund Managers 88 389 171 24.62% Stanlib Asset Management 74 875 588 20.85% Public Investment Corporation 57 496 972 16.01% Directors, Management and Founders 39 925 588 11.12% Momentum 16 058 889 4.47% 276 746 208 77.07% Other 82 337 407 22.93% Total 359 083 615 100.00% Subtotal 11 Financial review Financial highlights • Converted to a REIT • GCR Credit Rating achieved › Raised R190 million 6 month commercial paper › Long-term: BBB+ › Short-term: A2 • Introduced Standard Bank as debt funders • Reduced cost of funding to 7.50% • Achieved 5 year fixed funding at 7.87% 13 Financial overview 31 August 2013 Distribution per linked unit 32.51 Cost to income ratio 23.40% Gearing level 41.10% Weighted average interest rate (at 31 August 2013) Fixed vs. floating 7.50% 62 : 38 Average debt fixed period (years) 3.50 Net asset value per linked unit (excl deferred tax) 7.99 Average rental/m² 82.04 Average escalation 8.34% 14 Distributable income statement R’000 Net property income 31 August 2013 167 734 Rental income 218 950 Property operating expenses (51 216) Administration expenses (15 813) Net finance costs (34 024) Sundry income Retained profit not distributed Distributable income for the period Number of linked units in issue Distribution per linked unit (cents) Cost to income % * Includes property management fees historically excluded 17 (1 176) 116 738 359 083 615 32.51 23.40%* 15 Segmental analysis Revenue Distributable earnings 149 062 119 135 58 335 39 115 Industrial 6 064 5 056 Retail 5 489 4 428 218 950 167 734 R’000 Office government Office other Total property portfolio Other income 17 Administration and corporate costs (15 813) Net finance charges (34 024) Retained distributable earnings Total distributable earnings (1 176) 218 950 116 738 16 Net property income analysis GEOGRAPHICAL 2.0% SEGMENTAL 0.6% 6.7% 2.6% 3.0% 6.8% 45.0% 23.3% 7.4% 71.1% 8.0% 23.5% Gauteng (45.0%) Limpopo (8.0%) Northern Cape (6.8%) Free State (2.0%) KwaZulu Natal (23.5%) Eastern Cape (7.4%) Western Cape (6.7%) North West (0.6%) Office: government (71.1%) Office: other (23.3%) Industrial (3.0%) Retail (2.6%) 17 Capital management Group debt structure Maturity date Debt facility maturity profile Interest rate August 18 7.09% July 18 7.09% May 18 7.22% May 18 7.87% November 17 7.88% # May 16 7.00% May 16 7.04% May 16 7.55% May 16 7.01% November 15 7.74% November 15 7.18% January 14 7.55% 0 # Fixed rate expires Feb 2016 50 100 150 Variable rate debt 200 250 300 Fixed rate debt 350 400 R million 19 Consolidated property portfolio Delta at a glance Market capitalisation No of properties Valuation of portfolio Average value per property Gross lettable area Sectoral profile: GLA Tenant profile: GLA Occupancy rate Weighted average rent Weighted average escalation Loan to value Funding costs * OG – Office government At listing 31 August 2013 R1.35 billion 20 R2.10 billion R105 million 203 261 m² Office: 94% Retail: 6% Industrial: 0% *OG: 72% Non Gov 22% Retail: 6% Industrial: 0% 95.6% R 96.04 8.41% 40.0% 70% hedged / fixed Ave all in rate 7.90% R3.0 billion 49 R4.80 billion R98.8 million 477 680 m² Office: 81% Retail: 7% Industrial: 12% *OG: 56% Non Gov 25% Retail: 7% Industrial: 12% 94.7% R 82.04 8.34% 41.0% 62% hedged / fixed Ave all in rate 7.50% 21 Consolidated property portfolio analysis SECTORAL PROFILE: GLA GEOGRAPHIC PROFILE: GLA BUILDING GRADE: GLA 7.0% 24.9% 11.9% 6.0% 28.8% 11.1% 5.0% 3.4% 1.7% 0.6% 7.3% 15.3% 73.6% 47.5% 55.9% Office: government (55.9%) Office: other (24.9%) Retail (11.9%) Industrial (7.3%) SECTORAL PROFILE: RENTAL Gauteng (47.5%) Western Cape (7.0%) Eastern Cape (5.0%) Free State (1.7%) GEOGRAPHIC PROFILE: RENTAL 7.5% 25.6% 6.3% 24.1% A (73.6%) B (11.1%) 64.6% 7.3% 6.6% 6.7% 10.9% 82.4% 45.8% Gauteng (45.8%) Northern Cape (7.5%) Eastern Cape (6.6%) Free State (1.7%) C (15.3%) BUILDING GRADE: RENTAL 6.5% 1.7% 0.5% 3.5% Office: government (64.6%) Office: other (25.6%) Retail (6.3%) Industrial (3.5%) KwaZulu Natal (28.8%) Northern Cape (6.0%) Limpopo (3.4%) North West (0.6%) KwaZulu Natal (24.1%) Western Cape (7.3%) Limpopo (6.5%) North West (0.5%) A (82.4%) B (6.7%) C (10.9%) 22 Acquisitions No of properties Valuation of portfolio Average value per property Gross lettable area Sectoral profile: GLA Tenant profile: GLA Occupancy rate Weighted average rent Weighted average escalation % tenants single tenanted % tenants < 5 Lease expiry > 28/02/2018 Lease renewals SARS Randburg SARS Bellville Presidia *SAPS OG – Office government Acquisitions: 31 August 2013 29 R2.7 billion R93.8 million 271 447 m² Office: 72% Retail: 7% Industrial: 21% *OG: 47% Non Gov 25% Retail: 7% Industrial: 21% 96.6% R78.20 8.7% 45.5% 52% 93% 5 years 5 years 5 years23 Acquisitions GEOGRAPHICAL SPLIT (GLA) 5.2% LEASE EXPIRY PROFILE 1.0% 6.7% 2.6% 3.0% 57.0% 8.5% 23.3% 71.1% 21.6% Gauteng (57.0%) Western Cape (8.5%) Limpopo (5.2%) KwaZulu Natal (21.6%) Northern Cape (6.7%) Free State (1.0%) Office: government (71.1%) Office: other (23.3%) Industrial (3.0%) Retail (2.6%) 24 Leasing • Portfolio vacancy at 31 August 2013: 5.3% (GLA) • Bad debts of 0% at half year • GLA renewed: 39 533 m² • Lease expiry (GLA) >28/02/2018: 79% • Lease expiry (rental) > 28/02/2018: 81% • Average rate/ m² achieved: R82.04 • Average rental escalation achieved: 8.34% New leases SARS Springs NPA Tivoli Term GLA Historic rate/m² New rate/m² 3 years 1 992m2 R63.92 R69.00 9 years 11 months 10 552m2 R108.00 R112.00 5 years 2 075m2 R80.23 R86.65 25 Consolidated property portfolio analysis LEASE EXPIRY PROFILE: GLA (percentage) Incremental GLA Cumulative GLA 100.0% 100% 79.2% 80% 100% 80% 60% 60% 40% 40% 15.4% 20% 19.6% 20.7% 20.8% 20% 10.6% 5.3% 5.3% 4.8% 0% Vacant 4.2% 1.1% 0.1% 28 Feb 14 28 Feb 15 29 Feb 16 28 Feb 17 28 Feb 18 Incremental GLA 0% Beyond 2018 Cumulative GLA 26 Consolidated property portfolio analysis LEASE EXPIRY PROFILE: RENTAL (percentage) Incremental rental income Cumulative GLA 100.0% 100% 81.5% 80% 100% 80% 60% 60% 40% 40% 16.8% 20% 18.4% 18.5% 1.60% 0.10% 10.3% 5.9% 4.40% 6.50% 0% 28 Feb 14 28 Feb 15 20% 29 Feb 16 Incremental rental income 28 Feb 17 0% 28 Feb 18 Beyond 2018 Cumulative rental income 27 Consolidated property portfolio analysis WEIGHTED AVERAGE RENTAL ESCALATION (percentage) Rental escalation 10% 9% 8.3% 8% 7% 6% 5% 8.4% 8.2% 7.8% 8.6% Office: government Office: other Retail Industrial Sectoral Average 28 Consolidated property portfolio analysis WEIGHTED AVERAGE RENTAL (R/m²) Rental 100 82.04 80 60 40 20 0 97.38 82.74 67.94 22.64 Office: government Office: other Retail Industrial Sectoral Overall 29 Capex Capex projects underway SARS KIMBERLEY: Waterproofing project Salient features • • • • Roof before Building area: 2 950 m² Location: Kimberley Anchor tenant: SARS Current gross rental/m²: R111.33 Renovation • Capex cost: R1.2 million • Completion date: August 2013 • Lease term: 5 years – 30 June 2015 after 31 Capex projects underway NPA: office refurbishment: R33.5 million Salient features • • • • • Building area: 10 5525 m² Location: Cape Town Anchor tenant: NPA Current gross rental/m²: R134.57 (incl parking) Lease term: 9 years, 11 months – expiry 31 March 2023 • Building will be Grade A after refurbishment SARS Randburg: extra parking: R11.5 million Salient features • • • • • • • Building area: 8 496 m² Location: Randburg Anchor tenant: SARS Current gross rental/m²: R79.58 Present parking: + 237 bays, to add 167 bays Parking ratio will increase to 4 bays/100m² Lease expiry: 28 February 2017 WB Centre: waterproofing project and office refurbishment: R3.8 million Salient features • Building area: 7 425 m² • Location: Kimberley • Anchor tenant: Woolies (1 738 m²) Jetmart (1 500 m²) • Current gross rental/m²: R76.31 Tivoli Building: office refurbishment: R3.0 million Salient features • • • • • • Building area: 2 075 m² Location: Klerksdorp Anchor tenant: DPW (DHA) Current gross rental/m²: R86.55 New gross rental/m²: R93.48 (incl parking) Lease expiry: 30 September 2018 32 Prospects Prospects • Distribution growth • Availability of yield enhancing, quality assets • Value creation in existing assets • Constituent of the FTSE-JSE SA listed property index • REIT approval • Liquidity of the fund • Attractive funding rates from DCM programme • Capitalise on BEE status (lease renewals) 34 Q&A