Chapter 6 - Business Costs & Revenue

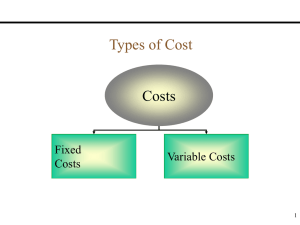

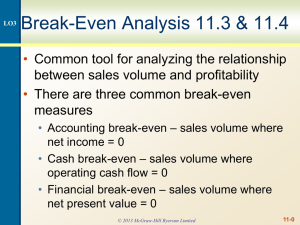

advertisement

Chapter 6 – Business Costs & Revenue Syllabus Unit – Business Finance and Accounting You will learn …… Why businesses need to know the costs of running their activities and the revenue gained by selling their products The different types of costs involved in running a business How break-even analysis helps managers make decisions The purpose of budgets and financial forecasts Business Costs Why do we need to know business costs? ◦ Comparing Costs & Revenue ◦ Determining Profit/Loss ◦ Comparing locations of a possible new site ◦ Price Determination Business Costs List 10 costs that would be involved in opening and running a new factory making sport shoes Business Costs Fixed Costs (FC) ◦ Do not vary with output in the shortterm ◦ Paid regardless of output ◦ “Overhead Costs” Business Costs Variable Costs (VC) ◦ Vary with output ◦ Costs directly associated with output ◦ “Direct Costs Business Costs Total Costs (TC) ◦ Fixed Costs + Variable Costs Break-Even The Break-even point (BEP) is the point at which cost or expenses and revenue are equal: there is no net loss or gain Break-even charts show; ◦ Costs ◦ Revenue Price x Quantity (P x Q) ◦ Level of sales to breakeven Break-even Break-Even Charts Break-even Charts Namib Tyres Ltd produce motorcycle tyres. The following information about the business has been obtained ◦ ◦ ◦ ◦ Fixed Costs are $30,000 per year Variable Costs are $5 per unit Each tyre is sold for $10 Maximum output is 10,000 tyres per year Break-even Charts Advantages ◦ Identify break-even point of production ◦ Calculate maximum profit ◦ Expected profit/loss at different levels of output ◦ Impacts on BEP with various business decisions ◦ Helps in decision-making ◦ Margin of Safety Break-even Charts Disadvantages ◦ Assumes all goods produced are sold ◦ Fixed costs constant only if scale of production doesn’t change ◦ Ignores other aspects of the business which need to be analysed ◦ Straight lines not realistic Break-Even Equation Breakeven Equation Total Fixed Costs Contribution Per Unit Contribution ◦ Selling Price – Variable Cost Break-Even Equation A fast food restaurant sells meals for $6 each. The variable costs of preparing and serving each meal are $2. The monthly fixed costs amount to $3600 a) How many meals must be sold each month for the restaurant to break-even? b) If the restaurant sold 1500 meals in one month, what was the profit made in that month? c) If the cost of the food ingredients rose by $1 per meal, What would be the new break-even level of production? More Business Costs Direct Costs ◦ Directly identified with each unit of production ◦ Vary with the level of output More Business Costs Indirect Costs ◦ Not identified with each unit of production ◦ Associated with performing a range of tasks or producing a range of products ◦ Overheads More Business Costs Marginal Costs ◦ Additional costs for producing one more unit of product ◦ Extra variable costs will be needed for that one extra unit More Business Costs Average Cost Per Unit Total Costs Output Economies of Scale Purchasing Economies ◦ Bulk-buying discounts Economies of Scale Marketing Economies ◦ Transport ◦ Advertising Economies of Scale Financial Economies ◦ Lower interest rates Economies of Scale Managerial Economies ◦ Specialists in all departments Economies of Scale Technical Economies ◦ Specialisation ◦ Latest equipment Diseconomies of Scale Poor Communication Diseconomies of Scale Slower Decision-Making Diseconomies of Scale Low Moral Budgets & Forecasts Budgets ◦ Plans for the future containing numerical or financial targets Forecasts ◦ Are predictions of the future Reasons why businesses fail Do not consider future at all and make no plans Unprepared for unforeseen events Budgets & Forecasts Managers try to predict/forecast ◦ Sales / Customer Demand ◦ Exchange rates of the currency ◦ Wage rises Budgets & Forecasts A managers biggest problem is ……. uncertainty about the future Forecasting Methods Trend ◦ An underlying movement or direction of data overtime ◦ This can be extended into the future Forecasting Methods Line of Best Fit ◦ Figures plotted on graph (scatter diagram) ◦ Line extended into the future Forecasting Methods Panel Consensus ◦ A panel of experts are asked for their opinions ◦ Most likely to be on future sales Forecasting Methods Market Research Surveys ◦ Useful in forecasting sales that are yet to be launched onto the market ◦ No previous data exists Budgets Plans for the future containing numerical and financial targets Budgets Businesses plan months/years ahead Plan ahead for future reactions Future targets in numerical/financial terms Budgets Budgets are set for; ◦ ◦ ◦ ◦ ◦ ◦ Revenues Costs Production Levels Raw Material Requirements Labour Hours Needed Cash Flow Master budget is derived from these smaller budgets Budget and Forecasts Budgets Advantages ◦ ◦ ◦ ◦ ◦ ◦ Departmental Target Setting Gives focus Motivates Variance Analysis Worker, Supervisor & Manager involvement Helps to control the business Budgets Reviewing past activities Budgeting useful for: Comparing actual with budgeted figures Controlling current business activity – Keeping to Targets Planning for the Future Setting Goals to be achieved