PACIFIC MANAGEMENT TA - Pacific Financial Technical Assistance

advertisement

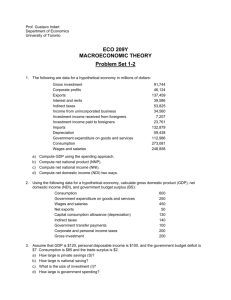

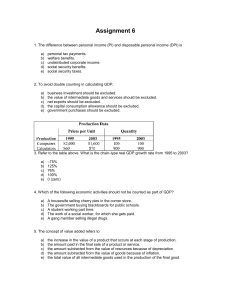

FISCAL MANAGEMENT MODEL Savenaca Narube Team Leader PEM TA Aims and purposes of the FMM Aim To assist the Ministries of Finance maintain fiscal stability Purposes Predict long term implications of fiscal policies on the budget; Explore the mix of policies that will provide the desired impact on the budget; Explain the likely effects of policy decisions; and Policy and budgeting tool. Preliminaries Not an economic model: e.g. GDP and inflation are projected outside the model. It’s a budget projection model—simple, spreadsheet based Projection period: 10/15 years Projections Three years ahead: MTBF Beyond three years: Simple assumptions Examples of long run assumptions Economic Real GDP--long run growth rate Nominal GDP--Inflate real GDP by inflation CPI—1o year average Tax revenues Growth rate or % of nominal GDP/trend Departure tax—visitor arrivals Examples of long run assumptions Expenditure Wages and salaries—Fully or partly indexed to CPI Maintenance—Indexed to CPI Contingency —% of current expenditure Purchase of goods and service—Indexed to CPI Subsidies and transfers—Fixed (Policy) Capital expenditure—Fixed (Baseline) Structure of the FMM ASSUMPTION TAB OUTPUT TAB FINANCIAL TEMPLATE DEBT & NEW LOAN TAB WHAT IF TAB Examples of scenario scanning Change in assumptions Change in the rate of growth of real GDP Change in the CPI growth rate Change in policy Change in the rate of consumption tax Change in the rate of indexation of wages and salaries Drawdown of a new loan in a certain future year Outputs Tracks key fiscal indicators over the long term Compares the baseline and the impact of policy option Generate budget graphs/tables Other issues Updating—automatically linked to MTBF and debt statistics Degree of consolidation to suit countries Sustainability Manual PEM TA support Easy to use DEMONSTRATION