The Israeli Economy - Ministry of Finance

advertisement

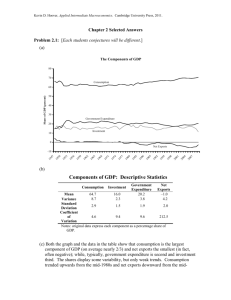

The Israeli Economy January 2012 Ministry of Finance Main Economic Indicators Main Economic Indicators Strong and sustainable GDP growth Labor market Moderate levels of inflation Eight years of consecutive surplus in the current account GDP Growth Percentage Per Annum 9.0% 7.0% 5.7% 5.0% 5.0% 5.4% 4.9% 4.8% 4.8% 4.2% 3.2% 3.0% 1.6% 1.0% -1.0% *Budget Estimate was 4.0% Source: Central Bureau of Statistics, Ministry of finance 0.8% Unemployment and Participation Rates Unemployment rate (left axis) 12% 60% Participation rate (right axis) 10.8% 10.3% 10.3% 10% 9.3% 8.9% 8% 8.7% 59% 58% 9.0% 57.3% 57% 8.4% 56% 7.6% 7.3% 55% 6.6% 6.1% 6.0% 6% 5.5% 5.6% 54% 53% 11 Q 20 1 11 Q 20 2 11 Q 3 52% 20 19 99 20 00 20 01 20 02 20 03 20 04 20 05 20 06 20 07 20 08 20 09 20 10 4% Source: CBS Inflation is Under Control Central Bank’s Key Interest Rate Year-End Inflation Rate 10 10 8 8 6.5 6 4 3.4 0 1.4 2.2 4 1.2 0 Today = 2.75% -0.1 -2 6 3.9 2.7 2.4 2 3.8 2 -1.9 Source: Bank of Israel 6 1/ 11 1/ 10 1/ 09 1/ 08 1/ 07 1/ 06 1/ 05 1/ 03 -4 1/ 04 0 Balance of Payments - The Current Account US$ Billions & As Percent of GDP 10.0 10% 8.0 8% Percent of GDP 6.0 6% 3.5% 5.2% 4.0 4% 3.0% 3.4% 2% 2.0 1.2% 0.0 -0.7% -2.0 \ 1.6% 2.4% 0.4% 1.1% 0% -1.0% -0.6% -2% -4.0 -4% -6.0 -6% 2000 2001 2002 2003 2004 Source: CBS. * First three quarters annualized 2005 2006 2007 2008 2009 2010 2011* Fiscal Policy The New Fiscal Rule Expenditure growth is derived from two elements: Distance from debt target Permanent long term growth Average Growth Rate of 10 Years 60% *Debt/GDP ratio =Expenditure growth rate No change in the deficit ceiling 2009 2010 2011 2012 2013 2014 onwards 6.0% 5.5% 3.0% 2.0% One always functions as the effective limitation 1.5% 1.0% General Government Expenditure As a percentage of the GDP 60 55 50.8 50 50.1 47.3 45.3 45 44.7 43.0 43.0 42.6 42.3 2008 2009 2010 2011 43.6 40 35 30 2007 2006 2005 2004 2003 2002 Source: CBS, The Ministry of Finance en m a Fr rk an Fi ce nl Sw and ed Be en lg i A um us t Ic ri a el P an N ortu d U eth ga ni ted erla l Ki nds ng do m Ita G ly re Sl ece ov H enia un G gar er y m a N ny or w ay Sp O EC P ain D ola - T nd ot al Cz C ec an * h a N Rep da ew u Ze blic al an d U I ni sr te ae Lu d St l xe ate m s bo Es urg to Sl ni a ov J ak ap Re an pu b Tu lic A rkey u Sw stra it z lia er la n K d or ea D General Government Expenditure As a percentage of the GDP, International comparison 2010 65 60 55 50 59 57 55 53 53 53 52 51 51 51 50 50 50 50 45 40 35 * Weighted average; Source: OECD 48 46 46 45 45 44 44 43 43 43 43 41 40 40 37 36 34 31 30 25 Tax Burden of the General Government 2009 % of GDP Source: OECD, Ministry of Finance Public Debt As a percentage of the GDP 110% 100% 99.2% 96.6% 97.4% 93.8% 90% 84.3% 77.8% 80% 77.1% 79.3% 76.3% 74.0% 70% 60% 2011* 2010 2009 2008 2007 2006 2005 2004 Source: The Ministry of Finance 2003 2002 *Estimated Figures for 2011 Ja p Gr a n ee ce Ita Ic ly el Po and rtu Be gal lgi OE Ir um CD ela n -T d o Un Fr tal i te anc d St e Ge ate rm s Hu any ng Un a C i te a ry d nad Ki ng a d Au o m str i Ne Is a r the ae rla l nd Sp s a Po in la Fi nd n De lan nm d No ark rw Sw ay ed Sl ov Sl o en a v Cz k R eni ec ep a h R ub e li Sw pub c Ne it ze lic w rla Ze nd ala n Lu Ko d xe re m a b Au ourg str a Es lia to nia Public Debt Increase Between the years 2007-2010 As a Percentage of the GDP , International comparison 200 180 2010 2007 160 140 120 100 Source: OECD Outlook 90, Israel 2010 - MOF Maastricht: 60% Debt 80 60 40 20 0 Central Government's Budget Deficit As a Percentage of the GDP, actual and according to the scheme 7 Budget law Actual 6.0 6 5.5 5.2 5.2 5 4 3.9 Latest Forecast 4.0 3.5 3.5 3.7 3.4 3.0 3.0 3.0 2.9 3 2.2 1.8 2 3.4 3.3 2.0 1.6 1.5 1.0 0.9 1 0.0 0 *2014 *2013 2012 2011 2010 * According to the Deficit Reduction and Budgetary Expenditure Limitation law 1992 Source: CBS, the Ministry of Finance 2009 2008** 2007 2006 2005 2004 2003 2002 ** Fiscal rule limitation was 3% in 2008 Key Economic Policies Fiscal Responsibility – According to the Fiscal Rule Encouraging Growth by: Structural Reforms - Advancing Competitiveness Active Labor Market Policies Reducing Bureaucracy Automatic Stabilizers Committee for Social and Economic Reform (Trachtenberg Committee) Tax policy Cost of living and competitive markets Priority changes within the expenditure limitation Housing and real-estate market Tax policy Legislation has been completed Cancelling the direct tax reduction scheme (Individual and Corporate) Raising maximum marginal tax from 44% to 48% Lowering income tax for incomes between 8-14 thousand NIS a month (from 23% to 21%) Raising corporate tax from 23% to 25% Raising capital gains tax from 20% to 25% VAT will remain 16% Reducing duty free cigarette allowance Introducing Tax allowance for fathers Cancelling the rise in fuel taxes Increasing negative income tax for women