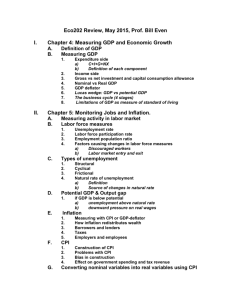

Review outline

advertisement

Eco202 Review for First Midterm Exam March 2015, Prof. Bill Even 1) Chapter 4: Measuring GDP and Economic Growth a) Definition of GDP b) Measuring GDP c) Expenditure side i) C+I+G+NX ii) Definition of each component iii) Inventory changes and timing of production versus sales d) Income side e) Gross vs net investment and capital consumption allowance f) Nominal vs Real GDP g) GDP deflator h) Lucas wedge: GDP vs potential GDP i) The business cycle (4 stages) j) Limitations of GDP as measure of standard of living 2) Chapter 5: Monitoring Jobs and Inflation. a) Measuring activity in labor market i) Labor force measures ii) Unemployment rate iii) Labor force participation rate iv) Employment population ratio v) Factors causing changes in labor force measures vi) Discouraged workers vii) Labor market entry and exit b) Types of unemployment i) Structural ii) Cyclical iii) Frictional c) Natural rate of unemployment i) Definition ii) Source of changes in natural rate d) Potential GDP & Output gap i) if GDP is below potential (1) unemployment above natural rate (2) downward pressure on real wages e) Inflation i) Measuring with CPI or GDP-deflator ii) How inflation redistributes wealth. (1) Borrowers and lenders f) iii) iv) CPI i) ii) iii) iv) v) vi) Taxes Employers and employees Construction of CPI Problems with CPI Bias in construction Effect of CPI on growth in government spending and tax revenue Converting nominal variables into real variables using CPI Using CPI to determine value of dollar at different points in time (e.g. $1 in 2000 has same purchasing power as $x in 2010) vii) Chained CPI versus conventional CPI. 3) Ch.6: Economic Growth a) Mathematics of growth rates b) Calculating annualized rate of growth c) Rule of 70 d) Sources of economic growth in classical model e) Labor market i) Factors affecting labor supply ii) Factors affecting labor demand iii) Aggregate production function f) Factors shifting production function g) Using classical model to examine how various factors affect i) Real wages, employment ii) Productivity iii) Potential GDP 4) Chapter 7: Savings and Investment a) Gross Investment, Net Investment and Depreciation b) Wealth and Saving c) sthe permanent income hypothesis. i) effect of permanent versus temporary changes in income ii) effect of expectations about future income iii) effect of unexpected changes in current wealth iv) effect of current or future expected tax changes d) Source of funds for investment i) I = S + (T-Tr-G) + (M-X) e) Loanable funds market i) Supply of loans (Savings) ii) Demand for loans (Investment) iii) Equilibrium interest rate f) Nominal vs real interest rate g) Factors shifting supply or demand for loans and effect on interest rates, saving and investment. i) permanent income hypothesis and implications for savings ii) determinants of investment h) The role of government budget deficits/surpluses in loanable funds market. i) effect of budget deficits on investment, saving, and interest rates ii) Ricardo-Barro effects. i) The Global loan market i) Link between net exports and position as net borrower or lender. (1) Net exports>0 net lender (2) Net exports<0net borrower ii) What factors can cause a country to be a net borrower? (1) savings rates in home and foreign country (2) investment demand in home and foreign country (3) government budget deficits/surpluses in home and foreign country