Financial Aid and Scholarships

advertisement

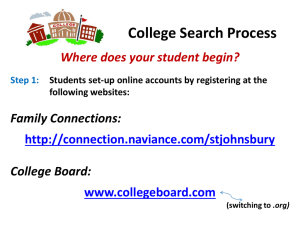

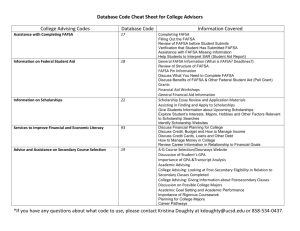

Financial Aid and Scholarships FAFSA The FAFSA stands for Free Application for Federal Student Aid. This application should be filed by any student seeking aid or scholarships. Most colleges require students submit a FAFSA although some schools also require a CCS Profile and Institutional Forms Check the College Application Read the application for the college you are applying to determine which forms are required. File the FAFSA, CCS Profile, and any unique forms required by the college you are applying to. Contact the financial aid office at the college if you have questions. All colleges ask that you file the FAFSA (Free Application for Federal Student Aid). The FAFSA can be worked online, but not filed before January 1. It should be filed as soon as possible thereafter. The FAFSA is for federal programs and goes to a processing center in Kentucky. At the center your family’s financial situation is analyzed by computer, and you will be sent a statement of your eligibility for Federal grants and loans, such as Pell Grants, Stafford Loans, Perkins Loans, and the Federal Work-Study program. To fill it out, you and your parents need to have collected all of the same information that you will use to file your income tax forms—W-2 from employers, bank statements of interest earned, mortgage interest paid, etc. If an accountant helps you with your taxes, he or she might also help with the FAFSA. The FAFSA is available online at http://www.fafsa.ed.gov/index.htm Be sure to select the correct school year before filing out the FAFSA. Here are the basic facts about financial aid. Most colleges have thousands of dollars earmarked to aid families who need help paying for the tuition and other expenses of that college. In addition, both the federal government and state governments have funds available for that purpose. Banks are willing to lend money for educational expenses, and there are many organizations which provide scholarship money to encourage people to attend college. In addition to the FAFSA, some colleges ask that you use the CCS PROFILE. The CCS PROFILE is available in early fall online at https://profileonline.collegeboard.com/index.jsp CCS Profile When you have settled on your list of colleges, you then look at the CCS PROFILE website to see which colleges require this form. The cost of the CCS PROFILE is significant, so it is important that you go through this process correctly and give CSS an accurate list of colleges. Both the FAFSA and PROFILE will analyze your family’s assets and calculate the size of your Family Contribution to the cost of your first year in college. The next part of the process happens in the financial aid offices of the colleges which accept you for admission as a student. Each office will put together a financial aid package in which they will do what they can to meet the need of your family (which is the difference between the college’s total expenses and your Family Contribution). This package will probably consist partly of grant money, given to you either by the college or federal or state government, loan money from a wide array of loan programs, and work-study money, which will come from a job at the college, for which you will receive a wage per hour of work. When you receive these various offers of financial aid, you will then compare them, and they will become part of your final decision as to which college you will attend. There can be great variety in the different financial aid packages and also in the abilities of the colleges to meet your total need. If the college can only meet 75% of your need, they would then expect you to find another source of the remaining 25% of your need—such as a bank loan or a mortgage refinancing. It is acceptable to call the financial aid offices of colleges to discuss their offers. If your first choice school is just beyond your reach, you might solicit their help as to how to make it possible for you to attend that college. There is some flexibility in the process, but it requires tact and honesty on your part in trying to work with the financial aid personnel. Remember, this is a four year process, and, if things don’t go well the first year, that does not bode well for the next three. Parents should attend the Senior Parent Financial Aid Night in January at Saint Francis High School. Check the school calendar for the date. There are many private sources of scholarship money to which you may also apply. If you are going to pursue these, there is a thorough handbook on financial aid called PAYING LESS FOR COLLEGE, published by Peterson’s, which you can buy in many paperback bookstores. Check the Financial Aid link on the Saint Francis Guidance and Counseling website. Keep in mind that most of the big scholarships require about as much work to apply as any of your college applications. You will be writing essays, getting recommendations, sending transcripts, and so on. Check the Scholarship Notebook in the Counseling Center for information on scholarships. Check it often as it is constantly updated. There are small local scholarships as well, through many of the organizations in our local areas, such as churches, Rotary, Lions, professional organizations, Boy Scouts. Even if you feel your family may not qualify for financial aid, there are many scholarships available. At no other time has so much information been available to you, so take advantage of your resources. The following scholarship searches are available on the Internet: www.fastweb.com www.collegeboard.com Instructions on how to present special circumstances in an application for financial aid are available in the Counseling Center. As a general rule, contact the financial aid office of each college you are applying to discuss special circumstances. As you can see, getting sufficient financial aid to help you attend college is quite possible, but the process takes your active participation. Our office can be a resource to help you, but we cannot do it for you. This part of college admission takes real effort and communication between you and your parents