第 十 章 催证、 审证和改证

advertisement

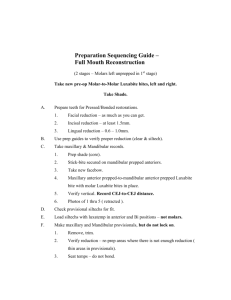

第 十 章 催证 Pressing opening L/C 主讲人:李胤达 教学目标: 1.要求掌握催开信用证的信函写作技巧 . 2.要求掌握催开信用证的信函格式内容. 重点和难点: 1.相关专业词汇 2.相关核心句型 3.相关内容结构 教学方法: 1.课堂详解 2.教学互动 3.实际操作 课时安排: 45分钟 一、导课 (5分钟) 在信用证方式下,买方按约定的时间开 证,是卖方履行合同的前提条件。 在正常情况下,买方信用证最少应在货 物装运期前15天(有时规定30天)开到卖方 手中。但在实际业务中,买方往往拖延开证. 因此,卖方在以下几种情况下,应及时 催促买方开证: ( 正 常 ) 1、按合同规定,买方应在我方装运期前一定 期限内(15天或30天)开证,我方应预计装 运时间并通知买方,同时催促其如期开证。 ( 提 前 ) 2、如果我方因提前备妥货且船期允许,能提 前装运时,可与对方商量,要求其提前开证. ( 滞 后 ) 3、如果在规定的开证期限内,买方一直未开 立信用证,卖方应该去函买方催促开证。 4、开证期限未到,但发现客户资信不佳, 或市场情况有变,则应催促对方尽早开证。 二、正文讲解: (30分钟) Pressing opening L/ C 课 文 Dear Sirs, With reference to Order NO.393 for which we have arranged the production .The goods have been ready for quite some time but until now we have not received the covering L/C. In spite of our repeated requests, however no indication implied you paid close attention to the matter. Please open the credit by cable without delay .Otherwise, any losses caused by delay of shipment will be for your account .If 课 文 your L/C fails to reach us by the end of July, we will be forced to cancel your order. We have to draw your attention that you make sure that the stipulations of L/C are in exact accordance with the terms in our Sales Contract when you apply for opening the L/C in order to avoid subsequent amendments. Your quick reply will be appreciated. Sincerely yours, Key expressions: 1. with reference to 2. arranged the production (重点和难点) 兹、关于、提及 安排生产 3. the goods have been ready for quite some time 货物备妥多时 4. repeated requests 5. no indication implied 6. paid close attention to 再三催促 、一再要求 无迹象显示 高度关注、密切关注 Key expressions: (重点和难点) 7. any losses caused by delay of shipment 任何 因延迟装运所造成的损失 8. for one`s account 9. fails to do sth 10. cancel = withdraw 11. in exact accordance with 由某人(方)承担 不能做到、没有做到 取消 与……完全一致 12. avoid subsequent amendment 以免不必要的改证 译 文 敬启者, 兹393号定单项下的货物,我方早已安排产 且备妥多时,但至今未收到相关信用证。 尽管我方已再三催促,但无迹象显示贵方对 此事予以密切关注。请立即用电报开立信用证, 否则,任何因延迟装运所造成的损失,都由贵方 承担。若贵方信用证不能在七月底前到达,我方 将不得已取消贵方定单。 现提请贵方注意,当您开信用证时,务必确 保与合同条款完全一致,以免不必要的改证。 谨 此, Key sentences: (重点和难点) 1. The goods have been ready for quite some time but until now we have not receiving the L/C. 2. In spite of our repeated requests, however no indication implied you paid close attention to the matter. 3. Any losses caused by delay of shipment will be for your account. Key sentences: (重点和难点) 4 . We have to draw your attention that you make sure that the stipulations of L/C are in exact accordance with the terms in our Sales Contract when you apply for opening the L/C in order to avoid subsequent amendments. 课堂小结: 在理解课文的基础上,对信函的内容 和结构进行归纳总结。 三、课堂小结:(3分钟) (重点和难点) 1. 关键词汇和用语 12个 (Key expressions) 2. 核心例句 4个 (Key sentences) 3. 本章主要内容和结构 3. 本章主要内容和结构 (重点和难点) 第一段:指明具体合同项下的货物已备妥, 但仍未收到信证。 第二段:强调经再三催促,至今信用证仍未 见开到,( 发出警告)若信用证不能在某月某 日前开到卖方,则交易取消。 第三段:顺便提请买方注意,所开信用证必 须与合同保持一致,以避免改证。 四、练习: (7分钟) 对123号合同下的货物已备妥多时,但相关 信用证仍未开到。作为卖方,你现写信催促买 方尽快开立信用证;同时,提请买方注意,所 开立信用证必须与合同严格保持一致,以避免 改证。 提示:可参照课堂小结中的信函结构书写。 Thank You 4、although it is not the deadline, but if we find that the customer’s credit is not fine or the market condition is changing, we also may urge the buyer into opening the L/C. “Sales Contract No.123 Goods are ready. Please rush to open the relevant L/C”。 Chinese Back Examining the L/C: After receiving the buyer’s L/C, the seller should examine and verify it in contrast with the contract according to the UCP. The basic principle of L/C examining is that the content of L/C must be consistent with the contract. But in practice many foreign L/C are not totally in accordance with contracts. Reasons are various. For example, some countries and areas always have special regulations in practice, some foreign customers are not familiar with our policies, some foreign customers or opening banks make mistakes, or some foreign customers deliberately add some unreasonable clauses in the L/C, and so on. So we must seriously examine and verify those foreign L/C. Chinese Back Main content of bank’s verification : (1)Verify the L/C on politics and policy ; (2)Verify the L/C on liability; (3)Verify the L/C on authenticity ; (4)Verify the L/C on the words that guarantee payment and restricted clause; Chinese Back