Billing The Guest Folio

advertisement

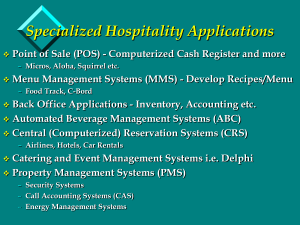

Billing The Guest Folio Chapter 10 WHAT THE CHAPTER IS ALL ABOUT Between check-in and check-out, guests enjoy the services of the hotel. Selling those services is what hotelkeeping is all about. Recording those sales is what this chapter is all about. Sale of Services: Some hotels (budgets) offer room sales only, others have many operating departments ranging from room service, to wedding chapels, to spas. Recording Sales: Unlike other retail merchants, the hotel merchant waits for payment. In the meantime, guest purchases are recorded on a bill, which hotel professionals call a folio. Preparing the Folio: The folio is available on demand to both the guest and the hotel’s management. It is ready even though the exact moment of departure is unknown, even unknown to the guest. Recording (Accounting) for Each Transaction: Understanding accounting rules is not essential to a clear understanding of the other three components of the chapter. ACCOUNTS RECEIVABLE A customer who owes a business for services that have not been paid is known as an account receivable. Types of Accounts Receivable (A/R): 2 Types + City Receivables: Accounts receivable who are not registered + Transient Receivable: Accounts receivable who are currently registered Ledger: Group of folios + City Ledger: A ledger of city receivables + Transient Ledger: A ledger of transient receivables; also called a rooms ledger, a front-desk ledger, a guest ledger Posting: The process of recording a charge or credit on the folio The Folio: The Individual Account Receivable Location and Filing of Folios: + Modern hotels use the computerized folios that property management systems (PMSs) create. Number of Folios: + One folio is the norm for each occupied room. There are exceptions. A room with several unrelated persons would need several folios if each is to pay an equal share. The Folio: The Group Account Receivable Master Accounts: + Accommodate tour companies, trade associations, convention organizations, and single-entity groups. + Transient accounts receivable, not cityledger accounts. + Settled at check-out as with all folios. + Complex. They may number 25 pages and more. How Master Accounts are Structured: + Single-Entity Groups + Convention Groups + Tour Groups Split Billing: The distribution of the charges between the master account and the guest’s personal folio is called split billing or split folios. Understanding Charges and Credits This knowledge is especially helpful in understanding the interface between frontoffice records (the transient ledger) and back-office records (the city ledger). The Meaning of Debits and Credits: + Increases in assets, including accounts receivable and cash, are made with debits. + Decreases in assets, including accounts receivable and cash, are made with credits. Assets: Something a business owns. +Land, buildings, furniture, and the kitchen equipment. + Accounts receivable, which are debts that customers owe the hotel. + Cash. Sales or Incomes: + Selling services, the sale of rooms is the hotel’s major product. POSTING TO THE FOLIO (THE ACCOUNT RECEIVABLE) Folios are accounts receivable, debts owed by the guest and owned by the hotel. Posting to the folio means recording the event, usually a sale (the charge), or a payment (the credit). Paying for a bar drink or a breakfast buffet with cash or credit card does not impact the folio. Certain services, room charges, and telephone calls made from the room, must appear on the folio. Overview of the Billing Procedure Preparing the Folio: + The property management system formats the folios as guests arrive and register. + As society grows more litigious, information of all kinds is being added to the folio to protect the hotel from unwarranted lawsuits. Presenting the Bill: + Since most guests are not credit risks, bills are normally presented and paid at check-out time. + Long-term guests are billed weekly, and they are expected to pay promptly. Communicating the Charges: + Before the Age of Electronics: A voucher was used to communicate with the desk. + With Electronic Systems: The hotel’s property management system (PMS) has done away with vouchers, control sheets, runners, and late charges. Recording Charges to Accounts Receivable Understanding the Line of Posting: + It tells the reader the source of the charge, the department providing the service. Reference Numbers: + These numbers identify departments in the hotel’s chart of accounts. A chart of accounts is a coded numbering system by which the hotel classifies its records. Posting Room Charges: + Posted differently from charges from all the other departments. + Posted by the night auditor, not by the guestservice agents during the day. Sales Taxes: Taxes levied on room sales by local, county, and the state governments are universal to hotel-keeping. Taxes collected (taxes payable) make the hotel an account receivable to the government just as the guest is an account receivable to the hotel. Recording Credits to Accounts Receivable As the guest folio (an account receivable) is increased by charges (room sales, food sales and so on) so it is decreased by credits (payments). Three Methods of Settling Accounts: 1. Cash is one method. 2. Allowances, reductions to the amount owed. 3. Transfers—shifting the amount due to someone else. Settling with Allowances (Rebates, another name for allowances): + Comp Allowances + Allowance for Poor Service + Allowance to Correct Errors + Extended-stay Allowances + Recording the Allowance Settling with Transfers: + Folio Transfer of Registered Guest to Registered Guest + Transfer of Folios to the City Ledger: Credit Card + Transfer of Folios to the City Ledger: Direct + Transfer from the City Ledger to the Guest Ledger: Advance Deposits