The Evolution of the Finance

advertisement

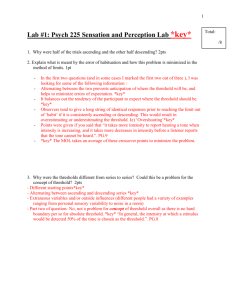

June 30, 2011 17th Dubrovnik Economic Conference Paul Wachtel Stern School of Business. New York University 1 Discussion of: Sustainable Financial Obligations and Crisis Cycles Mikael Juselius and Moshe Kim 2 Overview The first – to my knowledge – serious stab at an important problem. Provides explicit thresholds for the danger level for aggregate credit But, fails to address the next question What is a central banker to do when a threshold is crossed? 3 Background A sentence on the first page struck me (italics mine) “Close association between high aggregate leverage and subsequent credit and output losses has been empirically established.” I probably wrote something similar years ago 4 My sentence “Close association between deepening of financial markets and subsequent real growth has been empirically established.” 5 Words matter What is the difference between aggregate leverage and deep financial markets? They are the same thing except one generates crisis and the other growth. 6 Tales of the Croatian economy Early on there was a banking crisis (98-99) And then a period of financial deepening All of a sudden, the message changed Domestic credit to private sector to GDP ratio doubled – reached 70% in 2006 Financial deepening [leverage] was creating growth I was told that there was a dangerous credit boom Although the credit to GDP ration was not unusually high for a middle income country The central bankers realized that some dangerous threshold had been crossed How did they know? Policy changed and crisis was averted. 7 Juselius-Kim tell us how….. With US data they estimate the threshold that distinguishes episodes of financial deepening from credit booms. Debt to income ratios are not always the best thing to look at so they use a related concept – Financial obligations ratio (i.e. debt servicing + ammortization to income) Which is effected by stock of debt, loan maturities and interest rates. 8 What is the issue in the US? Ratio increased by about one-third in the 80s and again in the 00s. Figure 2b US Nonfinancial domesticdebt to GDP 1960Q1-2010Q1 300.00 250.00 200.00 Total nonfiancial domestic debt 150.00 Private only 100.00 50.00 Jan-08 Jan-04 Jan-00 Jan-96 Jan-92 Jan-88 Jan-84 Jan-80 Jan-76 Jan-72 Jan-68 Jan-64 Jan-60 0.00 Digitalization 9 Finance does matter, even if crisis may follow Industrialization Modernization Figure 2a US financial Intermeidary assets to GDP, 1870-1929 120.00 100.00 % 80.00 60.00 40.00 20.00 0.00 1860 1870 1880 1890 1900 1910 1920 1930 1940 10 Financing growth or crisis? Credit Booms Digitalization Modernization Industrialization 11 My warning History is complex – interaction between leverage-deepening and crisis-growth – has been around for a while Need to look at more than the last 25 years used by J-K 25 years with 3 cycle episodes And, you can Synthetic financial obligations ratio can be constructed. Loss rates – for bank loans to business – can be extended back. 12 Too little data…. Much is made of the difference between 90-91, 08-09 recessions and the milder (non-real estate) recession of 01. Each is a special case. S&Ls and subprime mortgages Are these two failures of regulation or consequence of credit excesses? Are we making inferences from 100 quarterly observations or from 2 recessions? Moreover, there is only one really different observation – the crisis. 13 What if we identify the threshold? It’s a financial obligations ratio of about 10% for both household and business. What should the central bank do when it is crossed? What should the central bank do if very gradual de-leveraging keeps us about the threshold for years? 14 We know what central bankers thought pre crisis How would central bankers have responded if they had been informed by J&K that the critical threshold had been reached. Greenspan (1999) told Congress that policy should ‘mitigate the fallout when it occurs’ role of the central bank is to mop up after the bubble bursts. Bernanke (2002) said ‘“leaning against the bubble” is unlikely to be productive in practice’ The danger of false positives – tightening when there really was not a bubble – was viewed as too great to warrant any concern ex ante about bubbles. 15 Central bankers This impressive paper would not have made it on to a Fed research seminar in those days. But, it would now in a world where fear of systemic risk is everywhere: Risk from aggregate macro conditions Risk from financial sector stability And, as Janet Yellin argued ‘Monetary policy cannot be a primary instrument for systemic risk management.’ 16 World of central banking is in turmoil Even if central bank wanted to respond to a move over the J-K threshold, it might not know what tools to use. The new US FSOC needs to develop indicators of financial fragility and instability Let’s hope that they include the tools developed here in their arsenal – Sometimes important ideas can be based on two just two observations 17