File

advertisement

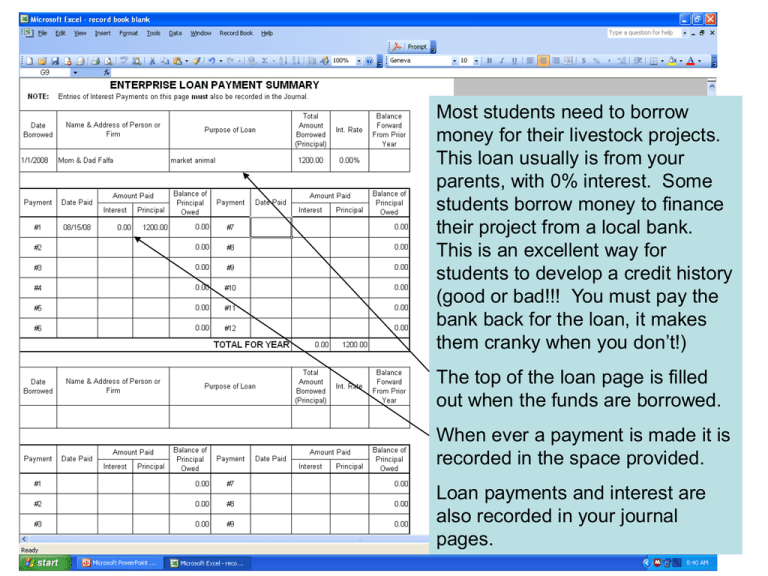

Most students need to borrow money for their livestock projects. This loan usually is from your parents, with 0% interest. Some students borrow money to finance their project from a local bank. This is an excellent way for students to develop a credit history (good or bad!!! You must pay the bank back for the loan, it makes them cranky when you don’t!) The top of the loan page is filled out when the funds are borrowed. When ever a payment is made it is recorded in the space provided. Loan payments and interest are also recorded in your journal pages. There are three inventory pages. All very confusing, but once you understand, they are not that bad! All are accessed under “record book”, “inventory”, and another menu will appear to the right. Current/Operating inventory (non-depreciable property inventory) are items that will consumed: feed, medicines, fertilizer, livestock for resale (market animals purchased in 08 for 09’s fair) crops and nursery stock. Non-Current/Capital Non-Depreciable Inventory (Non-Depreciable Property Inventory) includes only TWO items! Breeding livestock raised and land. Non-Current/Capital Depreciable Inventory (Depreciable Property Inventory) are for items that you will have for more than one year. Items such as equipment, machinery, trucks, breeding animals purchased, horses & tack, perennial crops, trees, buildings are entered here. Current/Operating inventory (nondepreciable property inventory) are items that will consumed: feed, medicines, fertilizer, livestock for resale (market animals purchased in 08 for 09’s fair) crops and nursery stock. Information is entered ONLY at the beginning and end of the year. When you end a book and have operating inventory left over it is listed here under “End of year” ONLY. You did not have it when you started this book!!! You will bring this information forward to your next book, the program will do it for you and the information will appear under “Beginning of Year” in your next year’s book. So, in December you will list what operating inventory you have left over on December 31st. Those items have a value and will still have a value the next day, which is January 1st. That value needs to be recorded so that it does not fully show up on your income summary page (no, we have not done this page yet). Current/Operating inventory items should be entered in your journal pages when the items were purchased. In this example there is hay and grain left over from the market animal, that will be used for the next year’s project animal. You typically have these items one year or less before they are used. Non-Current/Capital Non-Depreciable Inventory (Non-Depreciable Property Inventory) includes only TWO items! Breeding livestock raised are entered here. If you raise any species of livestock and retain females or males for breeding purposes only are entered here. They have a worth and increase the total value of your enterprise project. If you personally (not your family) own land that is use for your enterprise the value is entered on this page. The information is only entered on December 31st. It will be transferred to your next record book automatically. Non-Current/Capital Depreciable Inventory (Depreciable Property Inventory) are for items that you will have for more than one year. Items such as equipment, machinery, trucks, breeding animals purchased, horses & tack, perennial crops, trees, buildings are entered here. If you take care of these items they have a “useful life” of more than one year, many lasting numerous years. This items ARE NOT ENTERED IN THE JOURNAL PAGES!!! Information is entered on the date of purchase. If an item is sold that information is entered in the two far right columns. “Description” enter a description of the items purchased. If you bought several items together, you may enter the information together for a total basis cost. “Date of Purchase” enter the date the items were bought. Enter in the format mm/dd/yyyy. “Basis (cost)” is the amount you paid. Enter whole numbers only, no decimals or cents. “Class (Years)” is how long the useful life of the item is. The next slide will tell you how to determine this! Once the useful life of an item is determined, enter it into the space provided. The rest of the calculations will be done for you. Go up to “record book”, drop down the menu, scroll down to “weights & measures”, click on this page. Scroll down to the bottom of the page and there is a depreciation schedule for you to use as a guide! Select the appropriate number of years and enter that into the “class, years” column on your NonCurrent/Capital Depreciable Inventory (Depreciable Property Inventory) If you do this, you will have to go back to Inventory, noncurrent/capital depreciable inventory page. Enter your items as they are purchased. The program will not let you enter information in columns 5 or 6. That information will be in your next book when it is brought forward. Be sure you are entering the information for the correct enterprise project. There are four locations to list inventory information, double check that you are using the correct location! The program will automatically calculate the depreciation and total the columns. This information will be transferred to your summary pages for you. The reason we keep track of Non-Current/Capital Depreciable Inventory (Depreciable Property Inventory) is the items you purchased have a value for many years. By depreciating their value over several years, the current value is part of your financial statement. This way you are not subtracting the entire value of the items in one year, but over the life of the item. The depreciation, or value the item lost each year, is calculated. Purchase price Depreciation for year Current value If you sell a NonCurrent/Capital Depreciable Inventory (Depreciable Property Inventory) the sale price is entered in the appropriate column. The program will calculate your capital gain or loss for you. Now, you need to change to the “Income Summary” page. We will come back to the “Financial Statement” page. This is the Income Summary page. Information from your journal pages and inventory pages has been automatically transferred for you. Expenses are at the top of the page. The bottom of the page indicates your total income and hours for each enterprise project. This information is important for the completion of the financial summary page. Change to the “Financial Statement” page. Some information has been transferred for you and reflects values of inventory that you entered. If this is your first year in FFA, the column for “Beginning of year” will be left blank. If you were in 4-H and had livestock, equipment, etc. those items need to be “purchased” from your 4-H project by your FFA enterprise and entered in the correct section of your FFA record book. Totals are calculated for you. This top section is for enterprise assets only. This does not include earnings from non-agriculture areas. 1 a) indicates the amount of money that you still have from the operating income of your project. IMPORTANT!!! Line 2 on the Financial Statement page CAN NOT EXCEED the amount on line 15 of your Income Summary page. Personal Assets is money that you have in a savings account, checking account, etc. It is not required that you enter this information. If you do not have any personal assets, yet do not have a loan for items purchased for your enterprise project, where did the money come from? Enterprise Liabilities refers to money that you owe to someone else. This includes loans and accounts payable. Personal liabilities might include the balance owed for a vehicle used for nonagricultural purposes. It is not required that you enter personal liabilities. Your Enterprise Net Worth and Total Net Worth are calculated for you at the bottom of the page. There are three FFA Activities pages, each will contain different activities that you have participated in. The first one listed “FFA Activities” is for public speaking, parliamentary procedure, offices held, committee work. FFA Activities (2) is for chapter level activities only. If only your chapter members participated, it is listed on this page. FFA Activities (3) is for activities above the chapter level. Sectional, regional, state and national activities are included here. Put the date you received your Greenhand, Chapter or State FFA degrees in the space provided. Only list the degree that you received covered by this record book. If you passed a test on parliamentary procedure in your agriculture class, indicate the date you took and passed the test. If you successfully performed proper parliamentary skills, list them in the location provided. Speaking engagements are listed here. Only agricultural topics are listed. The speech or discussion can be given to any group or organization. If you hold an FFA office during the year covered by this record book, it is recorded here. Any time you serve on an FFA committee, record the information in this location. On FFA Activities (2) page, only chapter level activities are listed. The date is entered mm/dd/yy. Be sure to indicate what activity you attended and what your responsibility or placing was. FFA Activities (3) is for activities above the chapter level. Be sure to indicate what level the participation was at. Only list activities that occurred during the year that is covered by this record book. Community service and school activities are listed on the same page, but are different types of activities. Enter the activities as they occur, they do not have to be grouped together: community service and then all school activities. Hours are only listed for community service. To earn your State FFA degree you must have a total of 20 hours community service. This is a total from all your record books, not just one year. You must have a minimum of two school activities to receive your State FFA degree.