Maintaining an Inventory of Assets

advertisement

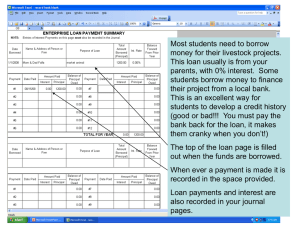

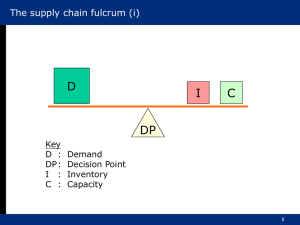

Agribusiness Library LESSON L060090: MAINTAINING AN INVENTORY OF ASSETS Objectives 1. Explain why it is important to maintain an accurate inventory of assets, and analyze logistic strategies. 2. Identify and describe the types of items that are included in inventories. 3. Compare and contrast current nondepreciable assets and non-current nondepreciable assets, and list examples of each. Terms •Capital assets •Consumable supplies •Current assets •Current non-depreciable assets Maintaining an accurate inventory of assets is important for every business for multiple reasons, such as loans, insurance, taxes, and logistic strategies. A. When applying for a loan, most banks and lending institutions will require all assets to be listed on a financial statement to be used as collateral. All current and non-current assets should be listed on the financial statements. B. Insurance companies require businesses to provide a list of assets to insure. 1. A current inventory list will save time and ensure that all items are insured in the event of a natural disaster. 2. Insurance companies require individuals and businesses to list all assets to receive insurance payment. C. Tax accountants use inventory lists to calculate depreciation on non-current assets and to calculate tax payments each year. D. Inventory lists are important to analyze logistic strategies and to maintain a constant evaluation of the age and quality of assets. 1. Logistically, assets should be repaired and used to the point where it costs more to repair them than what they are worth. 2. Inventory lists of products, crops, or livestock are important to determine a logistic strategy regarding how many, if any, products are remaining to sell. Inventory lists can include three major categories of items: current assets, consumable supplies, and capital assets. A. Current assets are nondepreciable inventory items that will be sold during the current year or that can be sold quickly to generate cash. 1. Examples of current assets include actual cash on hand, a checking account, or a savings account value. Other examples of current assets are marketable livestock or harvested grain that will be sold during the current year. 2. Non-depreciable business supplies (e.g., inexpensive equipment for an animal, plant, horticulture, or ag mechanics business) are also current assets. B. Consumable supplies are non-depreciable inventory items that will be used and need to be replaced. 1. Potting soil, seed, fertilizer, and chemical supplies are all consumable items. 2. In a livestock operation, consumable items would include veterinary medicine supplies, feed, hay, straw, and disposable materials like plastic gloves. C. Capital assets include all non-current depreciable items (e.g., breeding livestock, machinery and equipment, real estate, or investments). Any land, buildings, barns, sheds, machinery, equipment, or livestock purchased for breeding purposes will be classified as a capital asset. Non-depreciable assets can be divided into current or non-current inventory items. A. Current non-depreciable assets are inventory items that can be sold to generate cash quickly or are consumable for a business. 1. Inexpensive equipment 2. Consumable items (e.g., feed, fertilizer, seed, machine oil, and welding rods) 3. Marketable livestock 4. Products for resale B. Capital assets are usually depreciable items. However, some capital assets are classified as noncurrent, non-depreciable. 1. Machinery, equipment, and buildings that have maximized their depreciable value could be considered capital assets. Sometimes, these items are older or unusable due to a variety of conditions. 2. Some assets appreciate in value over time. Pleasure horses and land values often appreciate in value over time because of factors affected by supply and demand. Some antique equipment, even though it has maximized its depreciable life, can appreciate in value as restored or antique collector items. REVIEW •Why is it important to maintain an accurate inventory of assets and to analyze logistic strategies? •What types of items are included in inventories? •What are the similarities and differences between current non-depreciable assets and non-current non-depreciable assets? What are some examples of each?