Power Point - Texas A&M University

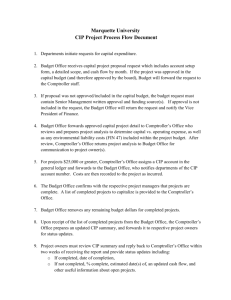

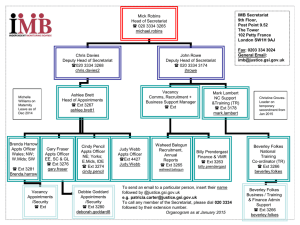

advertisement

Marcy A. Flores Assistant Comptroller & Director of Accounting kamag00@tamuk.edu Ext. 4192 Judy Murdoch Accounts Payable Specialist III kajlm00@tamuk.edu Ext. 3951 Vilma Castillo Property Management vilma.castillo@tamuk.edu Ext. 2713 Funding Sources Purchasing Guidelines Expense Object Codes Controlled & Capitalized Object Codes State - Education and General (E&G) Local – Student Fee Accounts Indirect Cost Accounts Local Accounts (all others) Restricted Accounts Account Numbers Range (1xxxxx – 19xxxx; 87xxxx – 879999) Voucher Numbers Begin with zero Strict Guidelines State guidelines and law must be followed and show direct benefit to the University Account Numbers Range (2xxxxx, 3xxxxx; 4xxxxx; 5xxxxx; 6xxxxx) Voucher Numbers Begin with five Strict Guidelines Texas A&M University System Policies and Regulations must be followed and show direct benefit to the University Reviewing Each Payment Request ◦ ◦ ◦ Items to be included on a payment request Invoices / Receipts Required State Documentation State of Texas Prompt Payment Law 30 day rule Interest (4.25% of unpaid balance) Disputed payments (21 days) Vendor Information W-9 Vendor and Employee Payments Direct Deposit Advance Payments Prepayment Certification Advertising Original Tear Sheet of Advertisement Alcoholic Beverages Unallowable State Expenditure With approval on local funds Alumni Activities State funds may not be used for the support or maintenance of alumni organizations or activities. Auxiliary Enterprises State funds may not be used for support of auxiliary enterprises. Charitable Organizations State agency may not provide money, goods or services to a charitable organization. Conference Registration Fees Advance payment (6 weeks in adv) Required information on payment request: Name of person attending; Full name of conference; Dates of conference; Reason for prepayment (certification); Agenda. Employee Certification/Licensure Job-related Employment of Retirees 30-day rule (contact payroll) Flowers, Floral Arrangements, and Plants Unallowable State Expenditure (donation in lieu of flowers not allowed regardless of fund source) Food Purchases State funds (Code 4050) (Food purchase with State funds are very limited.) Example of allowable expenditure: Nursery School Required documentation: purpose clearly stated. Local funds Code 6339 – Other than Business Meals Code 6340 – Business Meals Required documentation: Names of attendees and purpose of business meeting. Gifts and Awards State Funds ($100.00 ceiling) Honoraria or Speaking Fees Contract ( all expenses included) A&M System Employee (contact payroll) Memberships/non-professional organizations Memberships/professional organizations All memberships must be approved by the Assistant Comptroller & Director of Accounting Moving Expenses Process all payments through payroll. Notary Fees Employees not required to be bonded. http://www.sorm.state.tx.us/Risk_Management/Bonds_and_Insurance/notary_forms.php Professional Services Accountant Architect Engineer Land Surveyor Physician Registered Nurse Recruitment of Students Unallowable State Expenditure Speakers A&M System Member Subscriptions Taxes – Federal and State Exempt from most federal and state Tips and Gratuities Unallowable State Expenditure Object Codes Remember The 5 W’s Who? Who will be using it? What? What is it and what is it being used for? Why? Why are we purchasing it? When? When will it be used? Where? Where will it be used? Travel 3000 Supplies & Materials 4000 Utilities 5000 Telecommunications 5100 Fees 5200 Consultant Services 5350 Professional Services 5400 Maintenance & Repair 5500 Other Services 5600 - 3415 4899 5039 5199 5259 5399 5499 5555 5699 There’s More!!!! Non Capitalized Furn. & Equipment 5799 Non Inventoried 5774 Rental & Leasing Scholarships Grants Other Items Purchased for Resale 5700 5750 - 5800 5900 6000 6200 6900 - 5899 5929 6049 6450 6999 4050 – Food Purchases (Research, Seminars, Teaching) To record payment for the purchase of food used in a research, seminar or teaching capacity. This code does not include purchase of food for student activities, business meals (6340) or animals purchased for immediate slaughter for food. (Ex: Walmart, HEB, etc.) 4051–Not Used 6338 – Catering Services To record payment for catering or other food services provided by any external vendor. Examples: Sodexho, Linda’s Main Street Café, Young’s Pizza (when catering) 6339 – Food Purchases (not business meals) To record payment for the purchase of food. This includes purchase of food for student activities other than room and board. Excludes business meals (6340), food research, seminars, teaching (4050) or animals purchased for immediate slaughter for food. ( Ex: Walmart, HEB, Lydia’s Pizza Hut, etc. (not allowed on state accounts) Should be used to capture TRUE Office supplies such as: Pens, pencils, paperclips, rubber bands Paper, envelopes, post its, index cards Folders, notebooks Calendars, tape, calculator ribbon Should NOT include items such as: Stapler, hole punches, rubber stamps, nameplates, rulers, blank video tapes, easels (4085) Diskettes, computer toner, printer cartridges, cd’s (4020) Printer (5760) Surge Protector (4090) Should include items used for janitorial purposes such as: Disinfectant Disposable gloves Paper Towels Any Cleaning Solutions Air Filters Napkins & Paper Plates Light Bulbs (not 4076) This code should be used to capture TRUE Research expenses such as: DNA Samples Test Tubes Jars or Viles Venom Tags for Wildlife Microscope Slides Thermometer Covers Not used for items such as: •Freezers (5752) •Ice Chests (5752) •Books (5765) •Chemicals (4040) •File Cabinets (5750) •Deer Feed (4055) 4014 – Supplies Ammunition Should be used strictly for ammunition 4030 – Fuels and Lubricants Should be used for items such as: grease, oil, antifreeze and fuel additives. Should not be used for Gasoline (4036) Diesel (4037) or Propane (4038) 4040 – Chemicals & Gases Should be used for items such as: dry ice, oxygen, liquid nitrogen, refrigerant gases etc. 4055 – Farm, Ranch and Nursery Supplies Should include animal feed, veterinary drugs, hay, block salt, and halters. Does not include fertilizer (4056) or pesticides(4058) 4076 – Building Supplies and Materials Includes countertops, breaker boxes, electrical outlets, lumber, door locks, paint etc. 4080 – Fabric and Linens Includes blankets, pillow cases, fabric for theatre costumes, This does not include uniforms (5755) or t-shirts for camp participants (5641) 5211 – Membership Dues Includes all Business, Technical and Professional Organizations Must be approved by Asst. Comptroller & Dir. of Acct. (Marcy Flores) 5213 – Membership Dues Other – NOT USED 5215 – Employee Training Registration Fees; Includes payment of registration or other associated fees for seminars and conferences attended by state employees. Must include names, dates, itinerary for event and no acronyms can be used 5217 – Employee Training – Tuition – Not Used 5767 – Purchase of Animals Used to record payment for purchase of animals, cadavers, birds, fish, mammals, reptiles, rabbits and insects, dead or alive 5840 – Rental of Motor Vehicles To record payment for the rental or lease of motor vehicles. Example: Renting a vehicle to transport non employees. Controlled (at any cost) Object Code Property Item More Description 5775 Hand Guns All Hand Guns 5775 Rifles All Rifles Controlled ( $500.00 - $4,999.99) Object Code Property Item More Description 5780 Stereo Systems Stereo Systems 5781 Cameras Cameras &Digital Cameras 5782 VCR’s & Televisions VCR’s, Televisions, DVD, Camcorders Computers; Data Projectors Desktop & Laptop Computers; Digital Projectors (used with computer) Printers Non-portable 5787 5788 Items that are required to be reported to State Comptroller Must know who is responsible for the item Must know where the item is at all times Single unit cost is $5,000 or more ◦ ◦ ◦ ◦ Do Do Do Do not include cost of extended warranty not include maintenance agreements not include parts listed separately include freight and installation cost Object Code Property Item More Description 8410 Motor Vehicles – Passenger Car Mini-Vans, Cars, Full Size Vans 8415 Motor Vehicles – Other Trucks, SUVs, Buses, Golf Carts, Motorcycles, Trailers, All terrain 8420 Classroom Teaching Equipment Lecturns, Chalkboards, Globes, Stands, Gym Equipment, Hurdles 8421 Office Furnishings and Equipment Bookcases, Cradenzas, Cabinets, Desks, 8422 Medical, Scientific, and Laboratory Equipment Oscilloscopes, Spectophotometers, Cetrifuges, Chromatographs, All Med/Sci/Lab equipment 8423 Artifacts/Historical Treasures Works of Art, Collections 8424 Other Institutional Furnishings and Equipment Printing Machines,Projectors, Stereo Syst, Cameras, TV, VCR, DVD, Camcorder, GPS Equipment, Hand Guns, Rifles, Appliances 8425 Shop and Industrial Equipment Wagons, Conveyer Syst, Tractors, Machinery, Drills, Gin Mach., Grinders, Lathes, Milling, Forklifts, Saws, Lifts, Shears, Textile Tools 8426 Marine Equipment Dept Finders, Buoys, Radar 8430 Aircraft Helicopter, Jet, All Aircraft 8435 Computer Equipment Servers, Desktops, Laptops, Drives, Printers, Scanner, Smartboards, Monitors, Docking Station, Rack, Shelving, Chassis, Mainframe 8440 Software, no license agreements or upgrades All Software 8445 Telecom Equipment Call Distributors, Fax Machines, TTVN Equipment, Teletypes 8455 Purchase of Boats Boats, Boat Motors & Accessories, Ferries, Canoes Tagging required by State regulations Tag number needs to be assigned and adhered within ten days Will be on department physical inventory Expendit: State of TX Purchase Policies and Procedures Guide https://fmx.cpa.state.tx.us/fm/pubs/purchase/index.php The Texas A&M University System Policies and Regulations http://tamus.edu/offices/policy/index.html: Texas Government Code http://www.statutes.legis.state.tx.us/?link=GV Internal Revenue Service Forms and Publications http://www.irs.gov/formspubs/ Judy Murdoch Accounts Payable ext 3952 Vilma Castillo Property Management ext. 2713 Questions?