Going.Private.Aug.2011-howard

advertisement

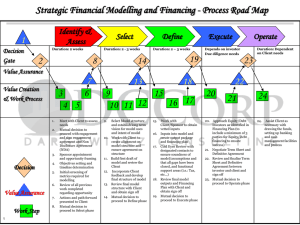

Going Private Transactions: Chinese Companies Listed in the United States Presented by Howard Zhang / Miranda So August 2011 Davis Polk & Wardwell, Hong Kong Solicitors Topics to be Covered Introduction Legal Issues and Process Financing Considerations Relisting in Hong Kong 1 Introduction 2 Introduction What are “going private” transactions? “Going private” generally refers to a transaction or series of transactions by a controlling or significant stockholder, or a leveraged buy-out by a PE fund working together with a controlling stockholder / the management, to acquire all of the publicly traded shares of a listed company The transaction takes the company “private”, by reducing the number of its stockholders, allowing the company to deregister and cease its SEC reporting obligations Why do companies go private? Traditional reasons Allow the management to focus on long-term objectives Allow the company to have a more leveraged capital structure that might not be acceptable for a public company Enable the company to save costs and avoid disadvantages of complying with U.S. reporting obligations and the Sarbanes-Oxley Act “New” trend – Many Chinese companies dissatisfied with valuations in the U.S., compared with their counterparts listed in Hong Kong or other Asian exchanges, may consider “going private”, sometimes with a goal to relist the company in Hong Kong or other Asian exchanges 3 Recent Examples Chemspec International Limited CNinsure Inc. Funtalk China Holdings Limited Fushi Copperweld, Inc. Harbin Electric, Inc. SOKO Fitness & Spa Group, Inc. 4 Legal Issues and Process 5 Preliminary Questions Where is Listco incorporated? This will impact… Structuring – merger / amalgamation / scheme / tender offer / etc. – each with different voting requirements for stockholder approval and/or for squeezing out the minority Fiduciary duty, legal standard of review – e.g., use of special committee or other procedural safeguard Litigation risk and strategy Is Listco a “Foreign Private Issuer”? This will impact… Timing and substance of disclosure obligations Application of SEC rules and exemptions – e.g., U.S. proxy rules, Tier I or II exemption for U.S. tender offer rules Other deregistration options available for FPI only Is PE fund an existing stockholder? This will impact… Strategy and approach Disclosure – e.g., may have obligation to update 13D disclosure Other considerations – e.g., Section 16 issues if it has sold any Listco stock in the last 6 months 6 Typical Structures First, controlling stockholder forms acquisition vehicle (Bidco) Controlling stockholder (and, if applicable, PE fund) will “roll over” Listco stock into Bidco PE fund / bank / other investors will provide additional equity or debt financing to Bidco to fund the transaction If Listco is incorporated in a U.S. state, transaction is generally accomplished by One-step merger Tender offer followed by back-end merger If Listco is incorporated in BVI or Cayman Islands, transaction is generally accomplished by Scheme of arrangement Consolidation and merger General offer Other possible structures (but much less common) Reverse stock split Asset acquisition 7 Key Legal Considerations UNDERSTANDING BOARD DUTIES AND POWERS Board fiduciary duties Governed by state / local law Standard of scrutiny – Enhanced scrutiny vs. business judgment rule Special committee and its powers In the U.S., use of special committee is common. Special committee should consist of disinterested and independent directors, have a clear mandate, and have its own financial and legal advisors Just say “no” is a possible response, even if offer is at a substantial premium to market For one-step merger, special committee will negotiate deal terms with bidder One-step merger requires approval of special committee Special committee may use delaying tactics to frustrate a bidder into increasing its offer price Special committee will likely demand that the merger be subject to majority-of-the-minority stockholder approval For tender offer, bidder can theoretically acquire 90% in tender offer and then complete short-form merger without needing to obtain special committee or stockholder approval In Delaware, this shifts burden of proving “entire fairness” to minority stockholders However, special committee’s decision to recommend or reject the offer (or express no opinion) will likely influence stockholder decision to tender, thereby prompting bidder to revise its offer price Controlling stockholder should make clear that the company is not otherwise for sale 8 Key Legal Considerations (cont.) DISCLOSURE, TIMING AND OTHER CONSIDERATIONS Disclosure obligations Disclosure obligations under local law In Delaware, directors have duties to ensure all “material facts” relevant to stockholders are disclosed Disclosure obligations under U.S. federal securities law Section 13(d) obligations – Is bidder a 13D or 13G filer? Is bidder a grandfathered 13G filer? Proxy statement (Schedule 14A) – Is Listco a FPI? If so, it is exempted from the U.S. proxy rules Tender offer statement (Schedule TO) – Is Listco a FPI? Is Tier I or Tier II exemption available? Schedule 13E-3 – requires enhanced disclosures regarding purpose of transaction, fairness of transaction, and reports, opinions, appraisals received Timing considerations Be patient when negotiating with special committee SEC review process may also add to timetable Risk (and likelihood) of litigation Going private transactions are often challenged in court State antitakeover statutes Can imposes certain restrictions on “business combination” with “interested stockholder” for a specified period of time 9 Overview of Legal Process Evaluation Stage Negotiation Stage Execution Stage · · · · · Perform due diligence Consider feasibility and risk Consider offer price and key conditions Consider terms of sponsor / consortium agreement Consider financing options and availability · · · · · · Submits written proposal to Target board Consider 13D disclosure obligations (if any) Target board forms special committee Special committee appoints financial and legal advisors Special committee evaluates offer, discloses its response, and where appropriate, negotiate terms Finalize all deal terms and financing · · · · · · Sign definitive documents Public announcement of signed deal File proxy statement/13E-3 (if merger) or Schedule TO (if tender offer) Receive and respond to SEC comments If one-step, hold stockholders meeting and complete merger If two-step, complete tender offer and short-form merger 10 Financing Considerations 11 Financing Considerations (cont.) TYPICAL COMPONENTS OF SPONSOR-BACKED “GOING PRIVATE” FINANCING Equity tranche Controlling stockholder (and if applicable, other select stockholders) rollover equity into Bidco Cash infusion by PE sponsor into Bidco Subordinated debt High yield bonds or interim subordinated “bridge” facility Senior secured debt Secured by pledge over assets 12 Financing Considerations (cont.) CHALLENGES AND POSSIBLE SOLUTIONS U.S. margin regulations may limit amount of debt financing used to acquire “margin stock” Regulations U and X apply to acquisition debt secured by “margin stock” “Margin stock” includes equity securities traded in the U.S. Debt financing for Bidco would generally be limited to 50% of the margin stock’s current market value Possible solutions Extend credit “outside the United States” – Regulations U and X do not apply if Each lender is “outside” the United States Loans are negotiated and disbursed outside the United States Listco securities are “non-U.S. securities” – Listco is not U.S. organized and its principal place of business is outside the U.S. Structure transaction as one-step merger Exemption for friendly acquisition effected pursuant to a definitive merger agreement 13 Financing Considerations (cont.) CHALLENGES AND POSSIBLE SOLUTIONS Challenges on the PRC side Structural subordination: offshore lending is structurally subordinated to liabilities of PRC subsidiaries PRC subsidiaries cannot provide guarantee or security in favor of foreign debt owed by foreign parent PRC subsidiaries subject to restrictions on payment of dividends and repayment of intercompany loans or advances Lenders / investors attracted by the China story willing to accept risks? 14 Relisting in Hong Kong 15 Relisting in Hong Kong QUALIFICATIONS FOR LISTING IN HONG KONG Recognized jurisdiction of incorporation Financial track record requirements Ownership continuity and control for most recent audited financial year If not on the “recognized” list of jurisdictions, need to apply to the HKSE for approval Refers to beneficial ownership and control by the controlling stockholder (stockholder holding 30% or more voting interest in the company) or, if none, the single largest stockholder General requirement to demonstrate trading record of at least 3 full financial years and management continuity for at least the 3 financial years before listing Public float and market capitalization requirements The HKSE will want to know if the minority stockholders were fully informed about the re-listing plans when the company was privatized, especially if only a short period of time has elapsed between the privatization and the re-listing 16 86 10 8567 5002 tel howard.zhang@davispolk.com Howard Zhang PARTNER Mr. Zhang is a member of Davis Polk’s Corporate Department and a resident partner in the Beijing office. He focuses on mergers and acquisitions, including private equity portfolio investments, buyouts, joint ventures and strategic investment transactions. He also advises clients on cross-border securities and general corporate matters. In his private equity practice, Mr. Zhang has represented many private equity firms on numerous transactions, including Bain Capital, Carlyle, CDH, CCMP Asia, Goldman Sachs, IDG/Accel, Merrill Lynch, SAIF Partners, Sequoia and Warburg Pincus. WORK HIGHLIGHTS Mergers and Acquisitions Representations Baidu on its US$306 million investment in Qunar Stable Investment Corporation, a wholly owned subsidiary of China Investment Corporation (CIC), on its investment in China Lumena New Materials Bar Admissions State of Massachusetts Professional History Warburg Pincus in its acquisition of a majority stake in Beijing Fanhua Datong Investment Management Company Charles River Laboratory International in its proposed agreement to acquire Wuxi Pharmatech for $1.6 billion Tianwei New Energy in its acquisition of a controlling stake in Hoku Scientific, a Nasdaqlisted company 17 86 10 8567 5002 tel howard.zhang@davispolk.com Howard Zhang (cont.) PARTNER Partner, Davis Polk, 2008-present Partner, O’Melveny & Myers, Beijing office, 2002-2008 Associate, Partner, Foley, Hoag & Eliot, 1993-2002 Warburg Pincus in its agreement to acquire a significant stake in China Biological Products, a Nasdaq-listed company A consortium led by the management team of Amdocs China and IDG Capital Partners in its agreement to acquire the China operations from Amdocs, a Nasdaq-listed company IDG Capital Partners and the management team in its acquisition of a controlling stake in Kongzhong, a wireless value-added service provider listed on Nasdaq COFCO in connection with its investment in Smithfield Foods Baring Private Equity Asia in financing a management buyout of Asian American Gas CCMP Asia in connection with its acquisition of the flue gas desulphurization business from a publicly listed company in China Merrill Lynch on several investments in China Yahoo’s acquisition of a Chinese search engine Focus Media’s acquisition of Framedia and Allyes Information Technology Shanda’s acquisition of a significant stake in Sina Securities Offerings Representing the underwriters in the initial public offerings of 21Vianet Group, Xueda and ChinaCache Representing the underwriters in China Unicom’s convertible bonds offering 18 86 10 8567 5002 tel howard.zhang@davispolk.com Howard Zhang (cont.) PARTNER China Lodging in its SEC-registered initial public offering Synutra International in its common stocking offering The initial public offering and notes offering of Shanda Interactive Entertainment The initial public offerings of Acorn International, China Finance Online, China Sunergy and ATA RECOGNITION Listed as a leading lawyer in several legal industry publications, including: Chambers Global: The World’s Leading Lawyers for Business Chambers Asia Legal Media Group’s Expert Guide to the World’s Leading Private Equity Lawyers OF NOTE Membership Member, Dean’s Advisory Board, Boston University Law School EDUCATION B.A., Shanghai International Studies University, 1981 J.D., Boston University School of Law, 1993 American Jurisprudence Award Topics Editor, International Law Journal 19 852 2533 3373 tel miranda.so@davispolk.com Miranda So PARTNER Ms. So is a Davis Polk partner resident in Hong Kong. Her work focuses on public and private company mergers and acquisitions, strategic investments, private equity transactions, securities offerings, and general corporate matters. She regularly advises major corporations and private equity clients on investments, dispositions and joint ventures across Asia and on cross-border transactions. She has also advised clients on a wide range of U.S. public company transactions, including takeovers, going private transactions, PIPEs, spinoffs and restructurings. Ms. So is admitted to practice in both New York and Hong Kong. WORK HIGHLIGHTS Kerry Mining’s auction and US$464.5 million sale of Baruun Naran coal mine in Mongolia to Mongolian Mining Corporation, a Hong Kong-listed company Charoen Pokphand Group’s concurrent sales of US$45 million of convertible preference shares in C.P. Pokphand, a Hong Kong-listed company, to the Carlyle Group and other investors Warburg Pincus’s acquisition of a significant stake in China Biologic Products, Inc., a Bar Admissions State of New York Professional History Partner, 2011 Associate, 2003-2011 Nasdaq-listed company IDG Capital Partners’ acquisition of the China operations from Nasdaq-listed Amdocs, in consortium with the management team of Amdocs China Canon Investment Holdings Limited’s proposed US$57 million acquisition of a majority stake in Altair Nanotechnologies, a Nasdaq-listed company Shanda Games Limited’s reorganization and business separation from its parent, Shanda Interactive Entertainment Limited, and subsequent IPO on Nasdaq 20 852 2533 3373 tel miranda.so@davispolk.com Miranda So (cont.) PARTNER WORK HIGHLIGHTS (cont.) Advanced Semiconductor Engineering’s US$780 million going-private acquisition of its subsidiary ASE Test Limited, a Nasdaqlisted company Morgan Stanley’s spinoff of Discover and related restructurings Health Management Associate’ US$3.25 billion recapitalization Huntington Bancshares’ US$3.6 billion merger with Sky Financial Group Commonwealth Telephone Enterprises’ auction and US$1.6 billion merger with Citizens Communications Company RECOGNITION Ms. So is listed as a leading lawyer in Chambers Global: The World’s Leading Lawyers for Business and Chambers Asia. EDUCATION B.S., Molecular Biophysics and Biochemistry, Yale University, 2000 summa cum laude Phi Beta Kappa M.S., Molecular Biophysics and Biochemistry, Yale University, 2000 summa cum laude J.D., Harvard Law School, 2003 magna cum laude 21