Payroll Process for International Employees

advertisement

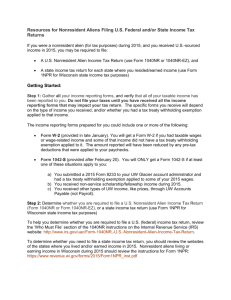

Hiring Process – HireRight Form I-9 Certification Process Glacier - Nonresident Tax Compliance System Purpose of Payroll & Tax Compliance Required Documents SSN Application Requirements Resources All International employees will receive a welcome email from the Human Resources Department outlining the process for completing all required information prior to their first day of work All International employees will be sent (2) emails, one in regards to completing Glacier (Nonresident Tax Compliance System) and another in regards to meeting with the Nonresident Tax Specialist All International employees will need to have a Social Security Number or a receipt from the Social Security Administration office showing that they have applied for their SSN Please be advised that you were recently sent an email to access Glacier, our online tax compliance system for Non United States Citizens. The email was sent from support@online-tax.net and the subject line states "Payments from Temple". Please open the email and follow the instructions to access and complete Glacier. Once you have completed the on line process, please make an appointment to bring the following to our office: > Tax Summary Report > Any required forms Glacier provides > Your immigration documents, including your passport, visa information, I94 card and social security card or the receipt/letter that you have received from the Social Security Administration that states you have applied for your social security number. We will need this information in order to process your job at Temple University. It is very important that you complete Glacier as the IRS (Internal Revenue Services) has strict rules and regulations when making payments to Non United States citizens. Our office is located at TASB, 2450 W. Hunting Park Avenue, 1st, Floor, Philadelphia, PA 19129. Please ask to see Shelley or Elizabeth when you come in to drop off your completed Glacier paperwork. Our office hours for submission of your completed paperwork are Monday through Friday from 8:00 AM to 5:00 PM Employee must complete Section 1 of the Form I-9 by his or her 1st day of employment Employer must review the employee’s documents and fully complete Section 2 within 3 business days of the first day of employment GLACIER is a secure online Nonresident Alien (NRA) tax compliance system which International employees and visitors use to provide their immigrant and tax data to Temple University. GLACIER helps determine tax residency, withholding rates, and income tax treaty eligibility. GLACIER also manages NRA paperwork, maintains NRA data, and prepares tax forms and required statements Certify Form I-9 Collect Immigration & Glacier Documents Determine correct Tax status Determine Tax Treaty eligibility U.S. Visa Passport page with expiration date of passport I-94, Arrival/Departure Record, issued electronically I-20, Certificate of Eligibility for Nonimmigrant Student Status (F1 Visa Holders) DS-2019, Certificate of Eligibility for Exchange Visitor Status. (J1 Visa Holders) SSN or Receipt from Social Security Office Students entering the US for the first time in F or J student status should wait until you are in the United States for at least 10 days before you apply for a Social Security number. If your SEVIS record is not "active" the Social Security office will not be able to verify your status with the USCIS Employment verification letter which has been signed by your supervisor as well as an International Student Advisor Immigration Documents Human Resources/Payroll Management http://www.temple.edu/hr/departments/payroll/index.html International Student and Scholar Services http://www.temple.edu/isss/index.html Glacier - Nonresident Tax Compliance System http://www.online-tax.net/