Glacier: Nonresident Alien Tax Software

advertisement

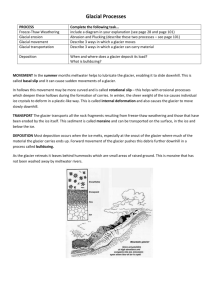

Glacier: Nonresident Alien Tax Software Glacier Procedures • Student notifies awarding department (if scholarship recipient) of their International status — • 2 This usually happens with the completion of the scholarship form Awarding department will set up the student in the Glacier Software, which will send an email to the student Sample Glacier Email Notification 3 After logging in with the User ID and password given to you in the email, you will be prompted to create a new User ID and password. Enter them and click submit 4 Login with your new ID and password and click submit 5 Read the disclaimer and click I Accept 6 Choose create/update/view my individual record and click next 7 Check the box that describes your relationship with UAA 8 Check Scholarship/Fellowship, tuition awards/waivers click next 9 Verify your name and email. Enter your social security number if you have one. If not check the statement that applies and click next 10 Enter your U.S. address and phone numbers and click next 11 Enter your address in your country of residence (foreign address) and click next 12 Choose your country of citizenship and tax residence from the drop down menu and click next 13 Choose your country of citizenship and tax residence from the drop down menu and click next Choose your current U.S. immigration status from the drop down list and click next 14 Enter the date of entry to the U.S. for this visit, your visa expiration date and the date you plan to leave the U.S. and click next 15 Choose the statement that applies and click next 16 Choose the statement that applies to you. If you have been in the U.S. previously enter the information for each visit and click next 17 Review the information and click next 18 click next 19 If a tax treaty applies to you, choose if you want to claim it or not and click next 20 Review Glacier’s assessment and click next 21 Print, review and sign each form and click next 22 Send the signed documents to the address listed. Click next to exit and save your record 23 Keep in mind, you need to send Form I20, I-94, Visa Stickers along with the Tax Summery Report. 24 I-20 I-94 Visa Sticker 25 Questions and Answers UAA Accounting ServiceDisbursement office Email: fqi@uaa.alaska.edu Phone: 907-786-1440 option 7. 26

![[Date] Dear [Visitor],](http://s2.studylib.net/store/data/015382282_1-6d55577f030728c4eed44ea3dcf0b42f-300x300.png)