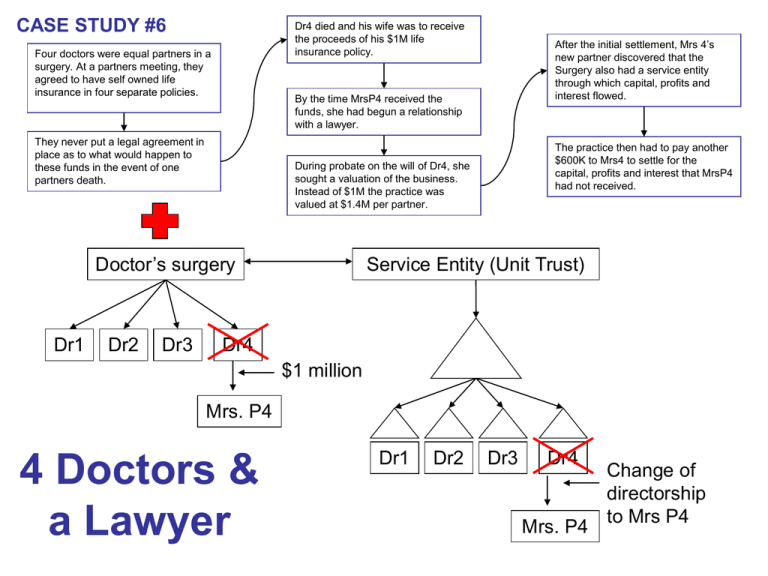

No Buy Sell Agreement

advertisement

CASE STUDY #6 Dr4 died and his wife was to receive the proceeds of his $1M life insurance policy. Four doctors were equal partners in a surgery. At a partners meeting, they agreed to have self owned life insurance in four separate policies. By the time MrsP4 received the funds, she had begun a relationship with a lawyer. They never put a legal agreement in place as to what would happen to these funds in the event of one partners death. Dr2 Dr3 The practice then had to pay another $600K to Mrs4 to settle for the capital, profits and interest that MrsP4 had not received. During probate on the will of Dr4, she sought a valuation of the business. Instead of $1M the practice was valued at $1.4M per partner. Doctor’s surgery Dr1 After the initial settlement, Mrs 4’s new partner discovered that the Surgery also had a service entity through which capital, profits and interest flowed. Service Entity (Unit Trust) Dr4 $1 million Mrs. P4 4 Doctors & a Lawyer Dr1 Dr2 Dr3 Dr4 Mrs. P4 Change of directorship to Mrs P4