depositary receipt industry briefing

advertisement

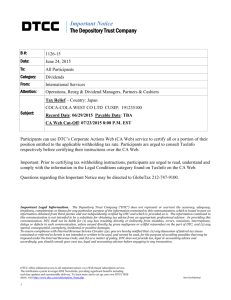

DEPOSITARY RECEIPT INDUSTRY BRIEFING ON RUSSIAN FEDERAL LAW NO. 415-FZ PRESENTED TO: SIFMA MONTHLY MEETING October 10, 2013 AGENDA I. II. Depositary Receipts – Represented by BNY Mellon a) Overview of Russian Federal Law No. 415-FZ b) Impact of New Regulation c) Response of Depositary Receipts Industry Banks and Brokers – Represented by SIFMA Corporate Actions Section III. Proxy Service Providers – Represented by Broadridge IV. Next Steps – BNY Mellon Depositary Receipts V. Questions VI. Contacts VII. Appendix 2 I. Depositary Receipts Michael O’Brien Vice President, Senior Corporate Governance Analyst BNY Mellon Depositary Receipts OVERVIEW OF RUSSIAN FEDERAL LAW NO. 415-FZ • Adopted by the Russian Federation on December 7, 2011, enacted on January 1, 2012. • Law will require disclosure of beneficial owner information in order to receive dividends and for votes to be accepted. Law took effect on January 1, 2013, but the practical implementation of the law is delayed until likely the third quarter 2013 with the deadline of November 6. • Dividend component of the law will cease on January 1, 2014. Thus, the period of compliance for this law will be relatively short. • Voting aspect of the law will remain in effect indefinitely. • Law requires the disclosure of the following information for votes to be accepted as valid: Beneficial owner name Address Share/DR position Country of Residence (for individuals) or Country of Incorporation (for companies) • No exceptions made for Objecting Beneficial Owners (OBOs). OBOs will also need to disclose to validly cast their proxy. • Information on Federal Law No. 415-FZ: http://www.adrbnymellon.com/files/PB36636.pdf 4 IMPACT OF NEW REGULATION • Vote participation Potential reduction in voter turnout due to: Philosophical objections - beneficial owners may object to release of information, particularly amongst OBO holders Logistical considerations - “hiccups” involved in implementing new process may lead to diminished voting returns. According to the BNY Mellon 2013 Russian Proxy Season Study, average DR vote participation was 38% of the outstanding. Some issuers may have quorum issues. • Operational 5 Production and Delivery of Beneficial Owner List Required Format Infrastructure Considerations RESPONSE OF THE DEPOSITARY RECEIPTS INDUSTRY • Convened industry group to: Achieve consensus on the interpretation of new legislation Guidance from FSFM (Russian regulator) Agreement on party required to be disclosed under different scenarios – voting authority key determinant Assembled all parties in proxy voting chain (depositaries, banks/brokers, foreign depositories, voting distribution and tabulation agents, proxy advisory firms) to gain insight into hurdles facing each section of chain. Brainstorming Promote education of financial industry and investors on the new regulation. • 6 Voting agents are not acceptable Solutions to New Requirements Resulting from Regulation Beneficial owners, advisors and proxy advisory groups will be alerted to beneficial owner disclosure requirement through language on VIF or prominent separate notice Agreement with banks/brokers on procedures to receive disclosure on OBO account holders Engagement with proxy advisory firms to alert clients of disclosure requirements RESPONSE OF THE DEPOSITARY RECEIPTS INDUSTRY • 7 Depositaries advised issuers to avoid paying dividend during end of year period when the disclosure requirement is applicable II. Banks/Brokers SIFMA Corporate Actions Section of the Operations and Technology Society Lawrence Conover Vice President National Financial Services LLC, a Fidelity Investment Company Steven P. Dapcic Director Pershing LLC, a BNY Mellon Company Veronica O’Neill Vice President Bank of America Merrill Lynch BROKERS PERSPECTIVE • Two (2) Disclosure Requirements mandated by the Russian Federation: Proxy voting - Beneficial owner disclosure will be required to the depositories in order for your client to have their vote transmitted and accepted into the market at a proxy meeting. This information includes the beneficial owner name, address, and country of residence. This is effective for meetings with a record date of November 6, 2013 and forward. Receipt of Dividend Payments – the law also requires the mandatory disclosure of beneficial owner information in order to receive any declared dividend payments. This requirement is also effective November 6, 2013, but amendments to the law will cease this requirement on January 1, 2014. The practical implication of this disclosure period is less than 2 months. The Depository banks have been working with the Russian Issuers to avoid any dividend payments during this period. 9 BROKERS PERSPECTIVE • Beneficial Owner Disclosure- Country of Residence • Beneficial Owner Information Disclosed- Regulation permits disclosure of Advisor’s beneficial information but not 3rd Party Voting Agent 10 Country of Residence- Service Providers will derive country of residence from the mailing file received from each broker. For U.S. addresses, state and zip code will be interpreted to determine U.S.A. for country of residence and Foreign addresses include country of residence in the mailing file. Four (4) scenarios: 1. End Client – Mail to End Client – Disclose End Client 2. End Client – Advisor relationship – Mail to Advisor – Disclose Advisor 3. End Client – Advisor relationship – 3rd Party Voting Agent relationship – Mail to 3rd Party Voting Agent relationship – Disclose Advisor 4. End Client – 3rd Party Voting Agent relationship – Mail to 3rd Party Voting Agent relationship – Disclose End Client Issue- Each Firm needs to analyze how data is provided to Service Providers to ensure the right level of disclosure. Firms may have different ways of interacting and consolidating/re-directing material with their Service provider; the data for the right level of disclosure might not be sent to the Service Provider. BROKERS PERSPECTIVE • 11 Communication Review if beneficial owner disclosure through VIF, prominent separate notice and proxy advisory firms is sufficient. (See Appendix) Firms should strongly consider separate internal communication of this regulation to their clients. SIFMA Corporate Actions Board- Discussed in July and September Meetings. SIFMA Corporate Actions Proxy Working Group- Monthly Meetings. Email Notification sent on September 19th to SIFMA Corporate Actions Membership. Today’s Webinar discussing the new Russian Federation Regulation. III. Proxy Service Providers Chip Pasfield V.P. Client Service, Broadridge Financial Solutions PROXY DISTRIBUTION & TABULATION AGENTS • Job set-up and record date notice remain the same. • Authorization to disclose shareholder name is requested. • Voting is reported as it is today. • File containing name, address, and number of shares is released at the end of the solicitation. • The file will be separated, based on address, into domestic and foreign accounts. 13 IV. Next Steps Robert Martello Managing Director, Global Custody and DR Operations BNY Mellon Depositary Receipts NEXT STEPS • Banks and Brokers to clean up data files to proxy service providers • Depositaries to meet with voting agents to ensure they notify clients of beneficial owners requirements • Depositaries to continue to meet with SIFMA and other entities involved in the proxy chain to ensure a successful implementation of solutions to comply with new requirements • Finalizing non-DTC proxy process with Euroclear, Clearstream, Broadridge International, and ISS 15 V. Questions / Comments VI. CONTACTS ROBERT MARTELLO PAUL F MARTIN MANAGING DIRECTOR, GLOBAL CUSTODY AND DR OPERATIONS EXECUTIVE DIRECTOR, DEPOSITARY RECEIPTS CLIENT SOLUTIONS BNY MELLON DEPOSITARY RECEIPTS J.P. MORGAN PHONE: 212-815-5117 PHONE: 212-552-3735 EMAIL: ROBERT.MARTELLO@BNYMELLON.COM EMAIL: PAUL.F.MARTIN@JPMORGAN.COM MICHAEL O’BRIEN VICE PRESIDENT, SENIOR CORPORATE GOVERNANCE ANALYST BNY MELLON DEPOSITARY RECEIPTS LAWRENCE CONOVER VICE PRESIDENT NATIONAL FINANCIAL SERVICES LLC, A FIDELITY INVESTMENT COMPANY PHONE: 212-815-6007 EMAIL: MICHAEL.O'BRIEN@BNYMELLON.COM PHONE: 201-915-8405 EMAIL: LAWRENCE.CONOVER@FMR.COM MARK GHERZO VICE PRESIDENT STEVEN P. DAPCIC CITI , GLOBAL STRUCTURING DEPT. DIRECTOR PHONE: 212-816-6657 PERSHING LLC, A BNY MELLON COMPANY EMAIL: MARK.GHERZO@CITI.COM PHONE: 201-413-3853 EMAIL: SDAPCIC@PERSHING.COM BEVERLY GEORGE VICE PRESIDENT, GLOBAL EQUITY SERVICES VERONICA O’NEILL TRUST AND SECURITIES SERVICES VICE PRESIDENT DEUTSCHE BANK TRUST COMPANY AMERICAS BANK OF AMERICA MERRILL LYNCH PHONE: 212 250-1504 PHONE: 1-855-259-3431, OPTION 2, THEN 3 EMAIL: BEVERLY.A.GEORGE-NY@DB.COM EMAIL: RONNIE.O’NEILL@BAML.COM CHIP PASFIELD V.P. CLIENT SERVICE, BROADRIDGE FINANCIAL SOLUTIONS PHONE: 631-254-7533 EMAIL: CHARLES.PASFIELD@BROADRIDGE.COM 17 VII. APPENDIX 18