Tavira Monaco SAM

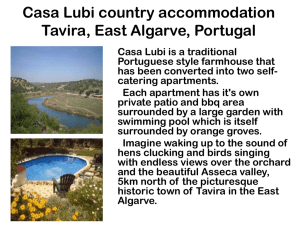

advertisement

Disclaimer This document was created by Alphea Fund SPC and all rights thereto are owned and reserved by Alphea Fund. This strictly private and confidential document was prepared exclusively for information purposes only and for discussion with the Investor. The document does not constitute an offer or solicitation with respect to the purchase or sale of any, asset, security or direct investments and neither this presentation nor anything contained herein shall form the basis of or be relied upon in connection with any contract or commitment whatsoever by an investor. The following document was prepared primarily to aid “strictly confidential, in-person” presentation to certain sophisticated investors. Hence, this presentation is incomplete without reference to – and should be viewed solely in conjunction with–the oral briefing provided by Alphea Fund. While all reasonable care has been taken to ensure that the facts stated herein are accurate and that the opinions contained herein are fair and reasonable, this document is selective in nature and is intended to provide an introduction to, and overview of, the proprietary investment opportunity described herein. Any opinions expressed in this document are subject to change without notice and neither Alphea Fund nor any other person is under any obligation to update or keep current the information contained herein. With the given information no representation, undertaking, promise or warranty, express or implied, is or will be made, or given as to, and no responsibility or liability is or will be accepted by Alphea Fund, its respective directors, officers, agents or employees. This presentation may contain forward-looking statements, which include all matters that are not historical facts. By their nature, forward- looking statements involve risks and uncertainties, because they relate to events and depend on circumstances that may or may not occur in the future. We caution you that forward-looking statements are not guarantees of future performance and that actual financial condition, results of operations and cash flows, and the development of the relevant industry, may differ materially from those made in or suggested by forward-looking statements contained in this presentation. No obligation is assumed to update any forward-looking statements. This presentation and its content is confidential and of proprietary nature and may not be reproduced or redistributed outside the recipient's organisation or publicised in whole or in part for any purpose without the express written consent of Alphea Fund. This document must not be distributed to the press or any media organization. By accepting this presentation, the recipient agrees to be bound by all the limitations stated herein. Alphea Fund shall not be liable for any damages that have been caused by or in connection with this document according to the applicable law. Alphea Fund is not responsible for and disclaim any liability for any indirect, incidental, consequential and special damages, that have been caused by or in connection with the use of this presentation. No right or entitlement to an implementation of the presentation or the concepts presented herein arises from this presentation. Alphea Overview Tavira Monaco SAM Monaco Based Investment Manager of Alphea Fund SPC Directors •Eliot Goodfellow •Patrick Fietje •CTS Management Ltd. Alphea Fund SPC BVI Located Segregated Portfolio Company Sub-Funds Systematic Trading Fund Dockview Fund Special Sits Fund Trading, Clearing and Custodian Services Tavira Securities Ltd. FSA Regulated London Based Brokerage Business Structure Chart Tavira Monaco SAM Monaco Based Investment Manager of Alphea Fund SPC Execution: Tavira Securities Auditor: KPMG N.V. Prime Broker: Morgan Stanley Int. Systematic Trading Fund Ltd (BVI) Additional Segregated Portfolio Cell (BVI) Administrator: Circle Partners N.V. Depositary Bank: ABN Amro Guernsey Price and Costing Segregated Portfolio Company Cell Set-Up/ Cost estimates (assuming launch under USD5-10mln) Legal Fees Current Alphea Costs Set Up USD Running USD 11,000 2,600 Legal Disbursements BVI Fees 4,000 Admin Fees 15,000 Admin Disbursements (10% Admin Fees) Initial Set Up Fee Audit Fees 11,000 Total Annual Cost (Year 1 Only) 15,000 Set Up Costs Only 15,000 28,600 or EUR 22,000 Tavira Hedge Fund Platform Combined with Tavira Monaco’s specialist prime broking capabilities, in house trading facilities and Monaco’s beneficial tax structure HF’s can launch with a much lower AUM of USD 10 million vs. USD 70 million in the UK and still running a viable business. Tavira Monaco SAM (TM) proposes to redomicile non Monegasque Alternative Investment Vehicles (AIVs) under its authorisation in the Principality of Monaco Proposal Ultimately, re-direction of positive cash flow maybe made from TM to the jurisdiction directed from AIV. AIVs may have optimal flexibility by retaining marketing, sales and support functions in the jurisdiction of their choice. However, investment cash flows must be directed in the first instance via Monaco. Tavira Hedge Fund Platform Structure AIV staff may retain in the jurisdiction of their choice under an investment Advisor/sub-advisor structure. AIV staff receive Monaco residency by being employed by TM Under either structure, profits can be directed to remain in Monaco or re-directed to a jurisdiction of the AIV’s choice. Tavira Hedge Fund Platform Why do you need a Specialist Prime Broker? Setting up an asset management company is complex and has many moving parts. There are many requirements of incorporation, legal and regulatory procedures, fund set up, investment strategy determination, trading and settlement. All the elements of this set up need careful co-ordination and are fully supported by Tavira Monaco. 88 Wood Street London EC2V 7DA United Kingdom Le Montaigne 6 Bd Des Moulins 98000 Monaco Rodus Building, 4th floor P.O. Box 4064 VG 1110 British Virgin Islands