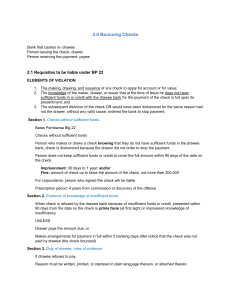

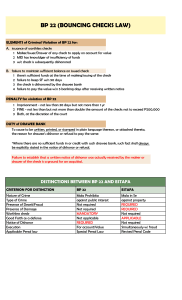

RFBT3 – REVIEWER BATAS PAMBANSA 22, BOUNCING CHECKS LAW APRIL 03, 1979 Checks: - Negotiable Instrument Bill of Payment Drawer, Drawee, and Payee o Drawer – Person who makes, draws, or issues the check. o Drawee – Person who pays the check. o Payee - Person who receives the payment after presentment or to whom the check is named after. - - OBJECTIVE 1: REQUISITES TO BE LIABLE UNDER BP. 22: 1. The making, drawing, and issuance of a check to apply for account or for value. 2. Knowledge of the maker, drawer, and issuer that at the time of issue he does not have sufficient funds in or credit with the drawee bank for the payment of check in full upon its presentment. 3. The subsequent dishonor of the check by the drawee bank for insufficiency of funds or credit or would have been dishonored for the same reason had not the drawer, without any valid cause, ordered the bank to stop payment. OBJECTIVE 2: CHECKS WITHOUT SUFFICIENT* FUNDS: - - Checks made, drawn, and issued without sufficient funds in or credit that causes it to bounce. Any person who makes, draws, or issues checks without sufficient funds can be liable for: o Imprisonment for not less than 3o days and not more than 1 year o A fine of not less than but not more than double the amount of the check which fine shall not exceed 200,000 PHP. o Both Imprisonment and Fine at the discretion of the courts. Any person who has sufficient funds in or credit with the drawee bank but fails to maintain a credit to cover the full amount of the check if presented within a period of 90 days from the date appearing thereon, which causes the dishonoring of the check is also liable for the same penalties. Where the check is drawn by a corporation, company or entity, the person or persons who actually signed the check in behalf of such drawer shall be liable under this Act. OBJECTIVE 3: EVIDENCE OF KNOWLEDGE OF SUFFICIENT FUNDS: 1. - The drawer is presented a notice that the check was dishonored 90 days from the date of the check. 2. The drawer, after 5 days of the receipt of notice, fails to pay the holder of the check. *Both elements should be present to constitute knowledge of the insufficiency. It is the hardest evidence to prove in BP. 22 cases because it is a state of mind. OBJECTIVE 4: DUTY OF THE DRAWEE*: - It shall be the duty of the drawee of any check , when refusing to pay the check to the payee upon presentment, to produce a written, printed, or stamped in plain language thereon, or attached thereto, the reason for drawee’s dishonor or refusal to pay. RFBT3 – REVIEWER BATAS PAMBANSA 22, BOUNCING CHECKS LAW APRIL 03, 1979 OBJECTIVE 5: CREDIT CONSTRUED: - The word "credit" as used herein shall be construed to mean an arrangement or understanding with the bank for the payment of such check. ESTAFA: • Criminal offense in the Philippines that involves fraud or deceit to obtain money, property, or other benefits at the expense of another person. OBJECTIVE 6: BP. 22 VS ESTAFA: - - - - - Good faith is a defense in Estafa. o BP. 22 does not accept the intent of the accused in making judgments. Mere act and knowledge is enough to hold one liable. Payment of a Pre-Existing Obligation o If the check is in payment of preexisting obligation, there is no deceit, hence Estafa cannot exist. Issuance of a Worthless Check o Estafa may be committed by mere issuance of the check while BP. 22 provides that the accused must draw and issue the check. ▪ Issuance – Handing the check over ▪ Drawing – Writing and signing the check Period to pay the check (Escape Clause) o Estafa provides 3 days while BP. 22 provides 5 banking days. Both Estafa and BP. 22 have Civil and Criminal Aspects o In Estafa, the criminal aspect is the deceit to incur benefits at the expense of another the civil aspect may be the damages from the act. o In BP.22 the criminal aspect is the drawing and issuance of a check with insufficient funds while the civil aspect may be from non-fulfillment of preexisting obligation. ▪ The law provides that a person cannot file a civil case and a criminal case for bouncing checks at the same time as it provides that the civil punishment is already under the criminal case. ▪ It is highly advised by law that one should file a civil case first for the non-fulfillment of the obligation before proceeding with the criminal case under BP. 22.