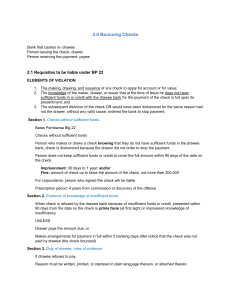

ANS A (Section 1) C (Section 2) C (Section 3) B (Section 4) A (Section 5) A (Section 6) A (Section 7) # STATEMENTS AND CHOICES 1 The person who issues check upon his knowledge of his insufficient account balance may be fined not exceeding this amount of money. A. TWO HUNDRED THOUSAND PESOS B. THO HUNDRED FIFTY THOUSAND PESOS C. THREE HUNDRED THOUSAND PESOS 2 Such is evidence of knowledge of insufficiency of funds or credit of a drawer which can be used against him unless he pays the holder the amount due from him or makes arrangements for payment in full by the drawee of such check within (5) banking days after receiving notice that such check has not been paid by the drawee. A. A CHECKED REFUSED BY THE CORPORATION WHO IS THE HOLDER B. A CHECKED REFUSED BY THE DRAWER HIMSELF C. A CHECKED REFUSED BY THE DRAWEE BANK 3 It has the duty to present in written, printed or stamped form, in plain language, the reason for dishonoring and refusing to pay the check holder when the drawer has insufficient funds in his account. A. CORPORATION AS THE CHECK HOLDER B. BANK AS A DRAWER C. DRAWEE BANK 4 It refers to an arrangement or understanding with the bank for the payment of such check. A. DEBIT B. CREDIT C. BALANCED 5 Prosecution under the Batas Pambansa Blg. 22 shall be without prejudice to any liability for violation of any provision 6 If any case the Batas Pambansa Blg. 22 is declared as such in any separable provision, the remaining provisions shall continue to be in force. A. UNCONSTITUTIONAL B. PENDING C. INVALID 7 After publication in the Official Gazette, the Batas Pambansa Blg. 22 shall take effect after this specific number of days. A. FIFTEEN DAYS B. TWENTY DAYS C. THIRTY DAYS