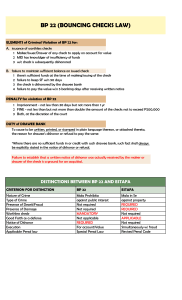

2.0 Bouncing Checks Bank that cashes in- drawee Person issuing the check- drawer Person receiving the payment- payee 2.1 Requisites to be liable under BP 22 ELEMENTS OF VIOLATION 1. The making, drawing, and issuance of any check to apply for account or for value; 2. The knowledge of the maker, drawer, or issuer that at the time of issue he does not have sufficient funds in or credit with the drawee bank for the payment of the check in full upon its presentment; and 3. The subsequent dishonor of the check OR would have been dishonored for the same reason had not the drawer, without any valid cause, ordered the bank to stop payment. Section 1. Checks without sufficient funds. Batas Pambansa Blg 22 Checks without sufficient funds Person who makes or draws a check knowing that they do not have sufficient funds in the drawee bank; check is dishonored because the drawer did not order to stop the payment Person does not keep sufficient funds or credit to cover the full amount within 90 days of the date on the check Imprisonment: 30 days to 1 year; and/or Fine: amount of check up to twice the amount of the check, not more than 200,000 For corporations: person who signed the check will be liable Prescription period: 4 years from commission or discovery of the offense Section 2. Evidence of knowledge of insufficient funds When check is refused by the drawee bank because of insufficient funds or credit, presented within 90 days from the date on the check is prima facie (at first sight or impression) knowledge of insufficiency UNLESS Drawer pays the amount due, or Makes arrangements for payment in full within 5 banking days after notice that the check was not paid by drawee (the check bounced) Section 3. Duty of drawee, rules of evidence If drawee refuses to pay, Reason must be written, printed, or stamped in plain language thereon, or attached thereto Section 4. Credit construed Credit = an arrangement or understanding with the bank for the payment of the check Section 5. Liability under the Revised Penal Code Without prejudice to any liability for violation of the Revised Penal Code Section 6. Separability clause If any provision in this Act is unconstitutional, the remaining provisions will remain in force Section 7. Effectivity 15 days from publication in the Official Gazette Evidence for violation of BP 22 To provide violation of BP 22 or for conviction of crime of BP 22 – Proof beyond reasonable doubt. To prove civil damages on civil action involving BP 22 – Preponderance of evidence. To sue or to file a case for violation of BP 22 – Probable cause or Prima Facie evidence. 2.2 Compare bouncing checks with Estafa (Art 315) An act of estafa may also violate BP 22 at the same time Good faith (informed the drawer that they cannot deposit funds) Payment of a pre-existing obligation Mere issuance of a worthless check Period to make good ESTAFA A defense in estafa BP 22 NOT a defense If in payment of a pre-existing obligation, no estafa May be held liable May still be held liable 3 days Fraudulent Insufficiency of funds to cover the check Accused both drew AND issued the check to be liable 5 banking days No fraud/deceit Insufficiency of funds and subsequent dishonor