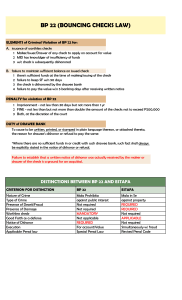

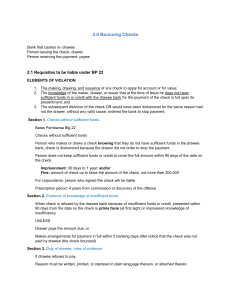

1. What is the purpose of the law? The purpose of the law is to penalize the making or drawing and issuance of a check without sufficient funds or credit and for other purposes. In order to afford protection to business and the public in general, and prevent the circulation of worthless checks, Batas Pambansa (BP) Blg. 22, also known as “An Act Penalizing the Making or Drawing and Issuance of a Check Without Sufficient Funds or Credit and For Other Purposes,” was approved in April 1979. The law punishes the acts of making and issuing a check with knowledge by the issuer that at the time the check is issued, that he does not have sufficient funds, and the failure to keep sufficient funds to cover the full amount of the check if presented within a period of 90 days from the date appearing on the check. Section 1 of the law provides: “Where the check is drawn by a corporation, company or entity, the person or persons who actually signed the check in behalf of such drawer shall be liable. The officer who is accused of signing the check must receive the notice of dishonor. Penalty imposable for conviction for issuance of bouncing check • Court has not decriminalized B.P. 22 violations, nor have removed imprisonment as an alternative penalty. • Imprisonment of 30 days to 1 year and/or Fine of not less than the amount, but not more than double the amount of the check, which shall not exceed Php. 200,000.00 The penalty is not removed, but the courts should reserve imposing imprisonment as a penalty for serious cases. When the violation of BP 22 negatively affects the social order The essential elements: 1. A check is postdated or issued in payment of an obligation contracted at the time the check is issued; 2. Lack or insufficiency of funds to cover the check; and 3. Damage to the payee thereof. It is the deceit or fraud attendant to the issuance of the check which is punished. There are two ways of violating the said law: By making or drawing and issuing a chack to apply on account of for value. Knowing that, at the time of issue, that the check is not sufficiently funded. Elements: 1. The making, drawing, and issuance of any check to apply for an account or for value; 2. The knowledge of the maker, drawer, or issuer that at the time of issue he does not have sufficient funds in or credit with the drawee bank for the payment of such check in full upon its presentment; and 3. The subsequent dishonor of the check by the drawee bank for insufficiency of funds or credit or dishonor for the same reason had not the drawer, without any valid cause, ordered the bank to stop payment. By having sufficient funds in or credit with the drawee bank at the time of issue but failing to do so to cover the full amount of the check when presented to the drawee bank without a period of ninety (90) days. Elements: Any person makes or draws and issues a check; 1. Such a person has sufficient funds in or credit with the drawee bank; 2. Failure to keep sufficient funds or to maintain a credit to cover the full amount of the check if presented within a period of ninety (90) days from the date appearing thereon; and 3. For which reason, it was dishonored by the drawee bank.