Document 14164248

advertisement

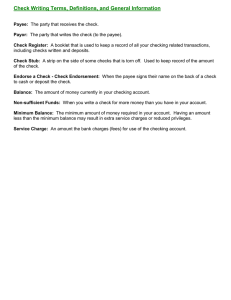

Checks × Order a payment. × Bank account from which a check is ordered is called a checking account. The Parts of a Check × Payee – the party to whom the check is written. × Drawer – the party who wrote the check and is drawing the money. × Drawee – the bank or financial institution where the drawer has the account. Checkbook Register × When you write a check, record the check number, the amount of the check, the date, and the name of the payee. × Where you keep a record of all of your checking transactions. Making Deposits × Endorsement × × The signature of the payee on the back of the check Required when depositing or cashing a check. Bank Statement × The bank’s record of all the transactions in your checking account × Includes: withdrawals, deposits, interest, fees, and canceled checks. × Canceled check-checks that have been cashed; a canceled check is proof that the money has been paid to a payee Reconciling Your Account Records × Bank reconciliation × × process of seeing whether an account holder’s records agree with the banks records for the account. To reconcile is to bring to agreement or balance Balancing Your Checkbook × The first step to reconciling your account is to see whether the bank has processed all of your checks and deposits × Outstanding checks × × Checks that have been written but have not yet been cashed Ex. p. 522 Figure 29.3