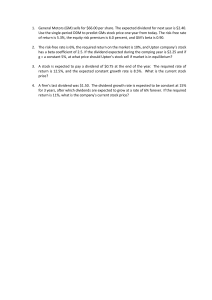

ACCA (AFM) ADVANCED FINANCIAL MANAGEMENT COMPLETE SUBJECT NOTES BY VERTEX LEARNING SOLUTIONS Valid Until Dec 2024 Copyright Notice ©️ https://vls-online.com 2023. All Rights Reserved The material contained within this electronic publication is protected under International and UK Copyright Laws and treaties, and as such any unauthorized reprint or use of this material is strictly prohibited. You may not copy, forward, or transfer this publication or any part of it, whether in electronic or printed form, to another person, or entity. Reproduction or translation of any part of this work without the permission of the copyright holder is against the law. You’re downloading and use of this eBook requires, and is an indication of, your complete acceptance of these ‘Terms of Use.’ You do not have any right to resell or give away part, or the whole, of this eBook. 1 VERTEX LEARNING SOLUTIONS - https://vls-online.com Click to go to Table of Content TABLE OF CONTENTS CHAPTER TOPIC PAGE NO. 1 Financial Strategy Formulation 3 2 Financial Strategy Evaluation 16 3 Discounted Cash Flow Techniques 30 4 Application of Option Pricing Theory to Investment 40 Decisions 5 International Investment Decisions 44 6 Cost of Capital and Changing Risk 51 7 Financing and Credit Risk 60 8 Valuation for Acquisitions and Mergers 69 9 Acquisitions Strategic Issues and Regulation 84 10 Financing Acquisitions and Mergers 94 11 The Role of the Treasury Function 105 12 Managing Currency Risk 111 13 Managing Interest Rate Risk 132 14 Financial Reconstruction 148 15 Business Reorganization 153 16 Planning and Trading Issues for Multinationals 160 2 VERTEX LEARNING SOLUTIONS - https://vls-online.com Click to go to Table of Content Chapter 1 - Financial Strategy Formulation The Principal Financial Objective of a Company Financial Objectives Traditionally Financial objectives have been considered as the basic financial objective of a company. The primary financial objectives are to maximize shareholders wealth in terms of increasing in value of entity (Increase in share value) and providing returns to investors in form of dividends Non-Financial Objectives Achieving Non-Financial objectives is essential for long term sustainability of an entity. These non-financial objectives can be achieved along with financial objectives e.g., a manufacturing company that is aiming to differentiate itself based on quality will require targets for defect rates. This does not negate the importance of financial objectives but emphasizes the need for companies to have other targets than the maximization of shareholders' wealth Financial Strategy Formulation Financial strategy should organize an organization’s resources to maximize return to shareholders Financial management is often described in terms of the three basic decisions to be made Investment decisions Financing decisions Dividend decisions 3 VERTEX LEARNING SOLUTIONS - https://vls-online.com Click to go to Table of Content Investment Decisions Investment decisions are often seen as the key mechanism for creating shareholders wealth. A company may invest in one of the three basic areas 1. Capital assets 2. Financial assets 3. Working capital Investment decisions has been covered in significant details in later chapters Financing Decisions For making investment decisions successful, financial managers need to carefully decide how to finance these investments Before finalizing any financing decision, financial manager should consider the total funds required whether these should be internally or externally sourced Should Debt or equity Finance be raised Long term debt or short-term debt should be suitable Financing decisions has been covered in later chapters in great details Dividend Decisions Dividend is the amount of return to be paid in cash to shareholders. Dividend decisions may affect the view of long-term prospects of the company. Payment of dividend limits the amount of retain earnings available for reinvestment. Due to this reason, it is very critical decision to be made by financial managers as How much dividend shall be paid Risk Management Decisions Risk management decisions, in the AFM exam, mainly involve management of exchange rate and interest rate risk and project management issues. 4 VERTEX LEARNING SOLUTIONS - https://vls-online.com Click to go to Table of Content Volatility of the organization cashflows may have a significant influence on organization’s approach to risk management Dividend Policy Dividend decisions relate to the determination of how much and how frequently cash can be paid out of the profits of an organization as income for its owners The owners of profit-making organization will be rewarded in two ways 1) Capital gain (rise in value of shares) 2) Dividend (cash paid out to owners) Factors Influencing a Dividend Policy The following factors will be considered when deciding the dividend policy of an organization Profitability Dividend is paid out of profits and a company cannot pay dividends which is higher than its distributable profits. A company with stable profits is more likely to be able to pay out a higher percentage of earnings than a company with fluctuating profits Liquidity Cash should be available to pay out dividends. Even more profitable companies might not be liquid enough and find it difficult to pay dividends to its owners Debt Repayment Dividend policy will be affected if debt is schedule to be repaid. This is a concern when debt is not replaced by other source of finance 5 VERTEX LEARNING SOLUTIONS - https://vls-online.com Click to go to Table of Content Covenants Companies article of association or the debt holder may impose restrictive covenants limiting the amount of dividend to be paid to its shareholders Expansion Companies may be encouraged to finance their investment from retain earnings rather than other sources of finance. Therefore, they will limit the amount of dividend to be paid and prefers to invest in more profitable projects which will ultimately enhance shareholders value Signaling effect Dividends are seen as signal from the company to financial markets and Shareholders. Investors perceive dividend announcements as signals of future prospects for the company Taxations Dividends and capital gains are subject to tax in various jurisdictions. Normally dividend payment is taxed higher than capital gains. This fact also put an influence on dividend policy of an organization Practical Dividend Policies One of the following patterns a company could adopt to pay out dividends over time 1. Constant Payout Ratio A company can pay a constant proportion of earnings as dividends to its Shareholders e.g., 10% of profits Dividend per share will be fluctuated by increase or decrease in profits 6 VERTEX LEARNING SOLUTIONS - https://vls-online.com Click to go to Table of Content 2. Stable Dividend Policy A company will pay a fixed amount of dividend per share irrespective of the earnings available to its shareholders 3. Residual Policy All positive NPV Projects will be invested from retain earnings first. Remaining amount will be paid out as dividends to shareholders 4. Zero Pay-Out Policy A company may wish to retain earnings for reinvestment and do not pay any dividend to its shareholders. This usually occurs in fast growing companies or those in financial distress Dividend Policy and Shareholders Wealth Does the dividend policy adopted by a company have an influence on its shareholders’ wealth? There are two school of thoughts to answer this question 1. Dividend relevance theory 2. Dividend Irrelevance theory 1. Dividend Relevance Theory The argument is that dividend policy has an influence on the market value of the company due to the following reasons Signaling Effect Dividends are seen as signal from the company to financial markets and Shareholders. Investors perceive dividend announcements as signals of future prospects for the company 7 VERTEX LEARNING SOLUTIONS - https://vls-online.com Click to go to Table of Content Clientele Effect Clientele effect says that shareholders are attracted to the companies as a result of their dividend policies. A company with an established dividend policy is therefore likely to have an established dividend clientele. The existence of this dividend clientele implies that the share price may change if there is a change in the dividend policy of the company Secured Income One argument is that income inform of dividend is more secured than income inform of capital gain. Therefore, investors place value on high pay out shares Dividend as Income Many investors require cash dividends to finance their daily routine consumptions e.g., Retired individuals. Therefore, prefers cash dividend rather than increase in share price 2. Dividend Irrelevance Theory (M&M) Theory: Modigliani and miller say that change in dividend policy will not affect shareholders wealth because value of company is dependent upon investment decisions alone and not on its dividend or financing decisions According to them, investors react to the reasons for change not the change itself. For example, if dividend is reduced in order to finance expansion, the share price will not automatically fall. It would be the shareholders’ expectations with respect to the expansion that influences the share price. Most of the positive NPV projects will be undertaken. Therefore, a cash lost now will be compensated by increase in the share price. Given a set investment policy, a dividend cut now to finance new projects will be compensated by higher dividends at a later stage. Since investors had perfect 8 VERTEX LEARNING SOLUTIONS - https://vls-online.com Click to go to Table of Content information, they will be indifferent between dividends and capital gains. Shareholders who are unhappy with the level of dividend declared by a company could gain a ‘home-made dividend’ by selling some of their shares. This was possible since there are no transaction costs in a perfect capital market. It theoretically makes no difference whether the new investment is funded by retention of dividend or new equity raised. Alternative to Cash Dividends Rather than paying dividend as cash, companies have adopted different ways of rewarding shareholders. The most common are scrip dividends and share buybacks which are discussed as under. Scrip Dividends Scrip dividend is a process of providing shareholders with an option to receive shares in form of dividend instead of cash. It allows shareholders to increase the size of shareholding with the company. Scrip dividend will boost liquidity position of the company because it will reduce the cash outflow and enables the company to reinvest these funds in positive NPV projects. Scrip dividend will also lead to a decrease in gearing because of the increase in issued shares and may help to increase the company’s debt capacity. A drawback of scrip dividends is that it may lead to increased dividend payment in future due to issue of additional shares being issued (Assuming constant dividend per share. Another issue is that scrip dividend is optional, and shareholders might not accept it. 9 VERTEX LEARNING SOLUTIONS - https://vls-online.com Click to go to Table of Content Share Buybacks Companies with cash surpluses, but having no positive NPV projects, may choose to introduce a share buy-back scheme where they buy back their own shares in open market. Advantages of share buybacks: Avoids increasing expectations of higher dividends in future (which may be a problem if dividends are increased). Provides disaffected shareholders with an exit route, in this sense it is a defense against a takeover. Taxed as a capital gain which may be advantageous if the tax on capital gains is below the rate used to tax dividend income. If shares are under-valued, the company may be able to buy shares at a low price which will benefit the remaining shareholders. Fewer shares will improve EPS and DPS ratios Special Dividend Another way of returning a significant amount of cash to shareholders is by a special dividend, a cash payment far in excess of the dividend payments that are normally made. This has a similar effect of returning significant amounts of cash to shareholders, but unlike a share buyback it impacts all shareholders. A special dividend is more attractive than a share buy-back if shares are over-valued, and avoids shareholders potentially diluting their control by participating in a share buyback. Ethics For financial strategy to be successful it needs to be communicated and supported by key stakeholder groups. 10 VERTEX LEARNING SOLUTIONS - https://vls-online.com Click to go to Table of Content Stakeholders can broadly be categorized into: 1. Internal – Directors, employees 2. Connected – shareholders, banks, customers, suppliers 3. External – government, pressure groups, general public Many of these groups may have conflicting objectives which may create ethical issues that need to be carefully managed. Ethics And Stakeholder Conflict Ethical issues often arise from a conflict between the needs of different stakeholder groups. There is a need to balance the needs of all groups in relation to their relative strength. Example of Stakeholder Conflict 1. Shareholders vs Directors Shareholders generally want the company’s profits to increase because it affects the dividend and capital gains so that they will be reluctant if company pays high wages to its management The relationship between management and shareholders is sometimes referred to as an agency relationship, in which managers’ act as agents for the shareholders 2. Shareholders vs Debt Holders Debt holders may be more risk averse than shareholders, because it is only shareholders who will benefit if risky projects succeed. 3. Shareholders and External Stakeholders The impact of a company's activities may impact adversely on its environment, e.g., noise, pollution. 11 VERTEX LEARNING SOLUTIONS - https://vls-online.com Click to go to Table of Content 4. Governance Safeguarding against the risk of unethical behavior may also include the adoption of a corporate governance framework of decision making that restricts the power of executive directors (ED’s) and increases the role of independent non-executive directors (NED’s) in the monitoring of their duties. In some countries this can include a non-executive supervisory board with representatives from the company's internal stakeholder groups including the finance providers, employees and the company's management. It ensures that the actions taken by the board are for the benefit of all the stakeholder groups and to the company as a whole. 5. Integrated Reporting Aim of integrated reporting is to explain to providers of financial capital how an organisation creates value over time Integrated reporting is a combination of qualitative and quantitative information which can be explained by the help of six capitals These capitals are: 1. Financial Capital Funds available, obtained through financing or generated through operations 2. Human Capital Support for organisation's governance framework and ethical values 3. Intellectual Capital Intangibles providing competitive advantage (patents, copyrights e.tc) 12 VERTEX LEARNING SOLUTIONS - https://vls-online.com Click to go to Table of Content 4. Social Capital Shared norms, common values and behaviors Key stakeholder relationships, willingness to engage with stakeholders 5. Manufactured Capital Manufactured physical objects used (buildings, equipment, and infrastructure) 6. Natural Capital Renewable and non-renewable environmental resources and processes Triple Bottom Line(3BL) 3BL aims to measure entity’s performance from three perspective. 1. Economic 2. Social 3. Environmental The concept behind the triple bottom line is that companies should focus as much on social and environmental issues as they do on profits. Focusing on and reporting the company’s environmental and social impact may build and enhance its reputation. Increasing reputation may increase the longterm revenue of the company Consideration and improvement of working standards and consulting employees as part of this process, when assessing social factors, may help in retaining and attracting high performing, high caliber employees. This will benefit the company in the long term because of increased employee motivation and performance. Employee involvement may also help reduce the 13 VERTEX LEARNING SOLUTIONS - https://vls-online.com Click to go to Table of Content costs related to the company’s risk management activity and thus have a direct cost reduction impact. Monitoring and reporting on the performance of employees and managers as part of the assessment of economic and social factors may help identify areas where work can be done more effectively and efficiently. It may help managers reconsider business processes and question areas where improvements can be made. Behavioral Finance Financial management theories assume that decisions will always be made in a rational manner. However, managers may make irrational decisions due to various psychological factors. Some of the main psychological factors affecting managerial decision-making are: Managerial Decisions Overconfidence Investor tends to overestimate their own abilities as a result they make irrational decision Entrapment Managers are also reluctant to admit that they are wrong (they become trapped by their past decisions). This helps to explain why managers persist with financial strategies that are unlikely to succeed. Agency Issues Managers may follow their own self-interest, instead of focusing on shareholders 14 VERTEX LEARNING SOLUTIONS - https://vls-online.com Click to go to Table of Content Investors Decisions Search for Patterns Investors look for patterns which can be used to justify investment. This might involve analysing a company's past returns and using this to extrapolate future performance. Narrow Framing many investors fail to see the bigger picture and focus too much on short-term fluctuations in share price movements Availability Bias people will often focus more on information that is prominent (available). Prominent information is often the most recent information; this may help to explain why share prices move significantly shortly after financial results are published Conservatism Investors may be resistant to changing their opinion, for example, if a company's profits are better than expected the share price may not react significantly because investors underreact to this news. 15 VERTEX LEARNING SOLUTIONS - https://vls-online.com Click to go to Table of Content Chapter 2 - Financial Strategy Evaluation Financing Decisions The primary objective of a profit-making company is normally assumed to be to maximize shareholder wealth To be able to minimize the overall cost of finance, it is important initially to be able to estimate the costs of each finance type. Cost of Equity Cost of equity can be determined by one of the following two methods 1. Capital asset pricing model 2. Dividend valuation model Capital Asset Pricing Model (CAPM) Capital asset pricing model is used to estimate cost of equity (ke). The CAPM model is based upon the assumption that investors are well diversified so will have eliminated all the unsystematic (specific) risk from their portfolios so only systematic risk is relevant. Unsystematic Risks Unsystematic risks are company specific risks which can be eliminated by diversification. Systematic Risks: Risk that will remain even if a diversified portfolio has been created because it is determined by general market factors. 16 VERTEX LEARNING SOLUTIONS - https://vls-online.com Click to go to Table of Content Market risk is caused by factors which affect all industries and businesses e.g. Interest rates, tax legislation, exchange rates and economic boom or recession e.tc Systematic risk is the sum of business risk and financial risk. The systematic risk of a company can be assessed by equity beta of the company. If company is financed entirely by equity, the systematic risk representing equity beta will be business risk alone, in which case the equity beta will be the same as the asset beta. If the company has debt and equity both in its capital structure, the systematic risk reflected by the equity beta will include both business risk and financial risk. Business Risk Business risk arises from the type of business an organization is involved in and relates to uncertainty about the future and the organization’s business prospects. Some common business risks are political risk , economic risk, fiscal risk, operational risk, reputational risk e.tc Financial Risk Financial risk is volatility of earnings due to the financial policies of a business. Financial risk arises due to the use of debt as a source of finance, and hence is related to the capital structure of a company. It brings volatility to shareholders returns because of Interest rate payments on these debts . 17 VERTEX LEARNING SOLUTIONS - https://vls-online.com Click to go to Table of Content Relationship Between Business and Financial Risk A business with high business risk may be restricted in the amount of financial risk it can sustain because, if financial risk is also high, this may push total risk above the level that is acceptable to shareholders. CAPM Formula 𝒌𝒆 = 𝑹𝑭 + (𝑩 × (𝑹𝑴 − 𝑹𝑭) Where, Ke = the cost of equity Rf = risk free rate of return Rm = expected return in the market Rm – Rf = Rp = Risk premium B =Beta factor (discussed below) Beta Factor Beta factor is a measure of the sensitivity of a share to movements in the overall market. A beta factor measures market risk. A beta factor of 1 is average because it means that the average change in the return on a share has been the same as the market. Therefore, beta greater than 1 can be riskier and beta less than 1 can be less risky to the market Further we need to distinguish the difference b/w beta asset and beta equity. 18 VERTEX LEARNING SOLUTIONS - https://vls-online.com Click to go to Table of Content Beta Equity Beta equity represents both business and financial risk. In case of geared company Beta equity will be Greater than Beta asset because of inclusion of financial risk along with business risk of an entity. Beta Asset Beta asset (Ba) reflects Business risk only. Ungeared company will have no financial risk in its capital structure therefore its Beta asset will be equal to beta equity (Which will ultimately be used in CAPM formula to arrive at cost of equity) Example: Ali plc has an equity beta of 1.2. Assume there is a market premium for risk of 6%, and the risk-free rate is 4% Solution: Using CAPM formula we can estimate cost of equity as 𝒌𝒆 = 𝑹𝒇 + (𝑩𝒆𝒕𝒂 𝒙 𝑹𝒊𝒔𝒌 𝒑𝒓𝒆𝒎𝒊𝒖𝒎 𝟒% + (𝟏. 𝟐 𝒙 𝟔%) 𝒌𝒆 = 𝟏𝟏. 𝟐% Dividend Valuation Model Cost of equity can also be estimated using dividend valuation model (DVM). This model assumes that Dividend will grow at constant rate for a foreseeable future. The formula for DVM is shows as under 𝒌𝒆 = 𝑫(𝟏 + 𝒈) +𝒈 𝑴𝑽 19 VERTEX LEARNING SOLUTIONS - https://vls-online.com Click to go to Table of Content Where D = current year dividend G = Growth on dividends MV = Market value is the ex-dividend share price means share price excluding any declared dividend Example A company's share price is $10. The company has just paid an annual dividend of $1.20 per share, and the dividend is expected to grow by 2% into the foreseeable future Required: Estimate cost of equity? Solution: 𝒌𝒆 = 𝑫(𝟏 + 𝒈) +𝒈 𝑴𝑽 $𝟏. 𝟐𝟎(𝟏 + 𝟐%) + 𝟐% $𝟏𝟎 Ke= 14.24% How to Estimate Growth? Growth can be estimated using one of the following two methods 1. Average Growth model 2. Garden Growth model 20 VERTEX LEARNING SOLUTIONS - https://vls-online.com Click to go to Table of Content Average Growth Model This model estimates growth on historic dividends .therefore it is also knowing as historic growth model 𝟏⁄ 𝐂𝐮𝐫𝐫𝐞𝐧𝐭 𝐲𝐞𝐚𝐫 𝐝𝐢𝐯𝐢𝐝𝐞𝐧𝐝 𝒏 ( ) −𝟏 𝑯𝒊𝒔𝒕𝒐𝒓𝒊𝒄 𝒅𝒊𝒗𝒊𝒅𝒆𝒏𝒅 For example: 2018 Dividend per 18 2019 2020 2021 20 21 24 share Required: estimate Growth? Solution: 𝟏 𝟐𝟒 ⁄𝟑 ( ) −𝟏 𝟏𝟖 G=10% Garden Growth Model This model estimates Growth on Future dividends, can be expressed by a formula 𝑮 = 𝒃𝒓 Where as b = the proportion of earnings reinvested for growth r = the rate of return on those reinvested earnings (return on equity) 21 VERTEX LEARNING SOLUTIONS - https://vls-online.com Click to go to Table of Content Example A company has reported profits of $4 million and declared a dividend of $2million dollars and requires return on equity of 10%. Estimate Growth? Solution: Out of $4million profit for year, $2million has been paid out as dividends suggests that remaining $2million (50%) has been retained for reinvestment Using Garden growth model, Growth can be estimated as 𝑮 = 𝟓𝟎% 𝒙 𝟏𝟎% G=5% Cost of Debt Bank Loan A company will obtain tax relief on a bank loan therefore the post-tax cost of debt for a bank loan will be 𝑰𝒏𝒕𝒆𝒓𝒔𝒕 % 𝒙 (𝟏 − 𝒕𝒂𝒙 𝒓𝒂𝒕𝒆 ) Example A company has obtained a $5 million loan charging 15% Interest on it. Tax rate is 30%. Calculate cost of debt for a bank loan? 𝟓% 𝒙 (𝟏 − 𝟑𝟎%) 𝟑. 𝟓% 22 VERTEX LEARNING SOLUTIONS - https://vls-online.com Click to go to Table of Content Irredeemable Loan Notes Cost of debt for irredeemable loan notes will be 𝒌𝒅 = 𝑰𝒏𝒕𝒆𝒓𝒆𝒔𝒕 𝑨𝒎𝒐𝒖𝒏𝒕 𝒙 (𝟏 − 𝒕𝒂𝒙 𝒓𝒂𝒕𝒆) 𝒙 𝟏𝟎𝟎 𝑴𝒂𝒓𝒌𝒆𝒕 𝒗𝒂𝒍𝒖𝒆 Example The 10% irredeemable loan notes of Ali plc having a market value of $120. Tax is payable at 30%. Calculate cost of debt Solution: Note: par value will always be $100 therefore Interest amount will be $10($100*10%) $𝟏𝟎 ∗ (𝟏 − 𝟑𝟎%) 𝒙𝟏𝟎𝟎 $𝟏𝟐𝟎 = 𝟓. 𝟖𝟑% Redeemable Loan Notes Cost of debt for a redeemable loan note can be estimated using IRR functions. The following steps needs to be followed. 1. Calculate after tax interest 2. Calculate NPV Using Any two rates of cost of capital e.g., 10% and 1% or any other two 3. Calculate IRR .This will be the cost of debt for redeemable loan notes Example The current market value of a company’s 6% loan stock is $99. The bonds will be redeemed at $102 after four years. The rate of taxation on company profits is 20%. Calculate the after-tax cost of debt for the company. 23 VERTEX LEARNING SOLUTIONS - https://vls-online.com Click to go to Table of Content Solution: 1. Interest $𝟔 ∗ (𝟏 − 𝟎. 𝟐𝟎) = $𝟒. 𝟖 2. NPV using 2 rates Years Cash flows DF@5% ($) Market Present values($) 0 (99) 1 (99) 1-4 4.8 3.546 17.02 102 0.823 83.95 value Interest Redemption 4 value NPV 1.97 Years Market Cash flows DF@10% Present ($) values($) 0 (99) 1 (99) 1-4 4.8 3.170 15.22 102 0.683 69.67 value Interest Redemption 4 value NPV (14.11) 24 VERTEX LEARNING SOLUTIONS - https://vls-online.com Click to go to Table of Content 3. IRR 𝑳 𝒏𝒑𝒗 𝑳 + 𝑳 𝒏𝒑𝒗−𝑯 𝑵𝒑𝒗 𝒙 𝑯 − 𝑳 𝟓% + 𝟏. 𝟗𝟕 𝒙(𝟏𝟎% − 𝟓%) 𝟏. 𝟗𝟕 − (−𝟏𝟒. 𝟏𝟏) 𝟓. 𝟔% This 5.6% is the estimated cost of debt for redeemable bonds Convertible Loan Notes Cost of debt for a redeemable loan note can be estimated using IRR functions. In convertible loan notes Investor has a choice to redeem its investment or convert it into ordinary shares at the end of loan notes life. Example Continuing from previous example, let’s say Loan notes will be redeemed at $102 or converted into 50 ordinary shares with a market value of $2.10 per share. In this case Investor will Accept the most lucrative option. Now investor will either get $102 as redemption amount or $105 (50 x $2.10) as share conversion option. Share conversion option being the most beneficial will be accepted by investor. The cost of debt for convertible option will now be calculated as Years Cash DF@5% flows ($) Market Present Df@10% values($) Present values 0 (99) 1 (99) 1 (99) Interest 1-4 4.8 3.546 17.02 3.170 15.22 Conversion 4 105 0.823 86.42 0.683 71.72 value value NPV 4.44 (12.06) 25 VERTEX LEARNING SOLUTIONS - https://vls-online.com Click to go to Table of Content 𝟓% + 𝟒. 𝟒𝟒 𝒙(𝟏𝟎% − 𝟓%) 𝟒. 𝟒𝟒 − (−𝟏𝟐. 𝟎𝟔) 6.35% Weighted Average Cost of Capital (WACC) The weighted average cost of capital (WACC) is the rate that a company is expected to pay on average to all its providers of capital to finance its assets. WACC commonly include cost of Equity, Preference and Debt Sources. How to calculate WACC? 1. Calculate cost of each finance source (Discussed above ) 2. Calculate market value of each finance source (discussed below) 3. Use the following function to derive wacc 𝒌𝒆 [ 𝑽𝒆 𝑽𝒅 ] + 𝑲𝒅(𝟏 − 𝒕) [ ] 𝑽𝒆 + 𝑽𝒅 𝑽𝒆 + 𝑽𝒅 Where, Ve = total market value of equity Vd = total market value of debt Ke = cost of equity Kd = cost of debt 26 VERTEX LEARNING SOLUTIONS - https://vls-online.com Click to go to Table of Content Market Value of each Finance Source Market value of Equity 𝒎𝒂𝒓𝒌𝒆𝒕 𝒗𝒂𝒍𝒖𝒆 𝒑𝒆𝒓 𝒔𝒉𝒂𝒓𝒆 𝒙 𝒏𝒐. 𝒐𝒇 𝒔𝒉𝒂𝒓𝒆𝒔 Hint: Market value per share should exclude any dividends declared .it should be ex dividend share price Market Value of Debt Bank Loan Bank loan normally have no market value, its book value will be assumed as market value Other Loan Notes 𝑩𝒐𝒐𝒌 𝒗𝒂𝒍𝒖𝒆 𝒙 𝒎𝒂𝒓𝒌𝒆𝒕 𝒗𝒂𝒍𝒖𝒆 𝟏𝟎𝟎 Credit Rating A bond's credit rating will also affect the return that is required by investors. Credit rating agencies uses its own system to determine creditworthiness of individuals, companies and even countries. An example of the ratings used by a major credit ratings agency are shown below Standards & poor’s Definitions AAA, AA+, AAA–, AA, AA–, A+ Excellent quality, lowest default risk A, A–, BBB+ Good quality, low default risk BBB, BBB–, BB+ Medium rating BB or below Junk bonds (speculative, high default risk) 27 VERTEX LEARNING SOLUTIONS - https://vls-online.com Click to go to Table of Content Credit rating is inversely proportional to cost of debt means that higher the credit rating lowers the cost of debt obtained and vice versa A company with AA+ credit rating will have low cost of debt because of having low credit risk as compared to a company having B+ ratings Yield Spread The extra return (or yield spread) required by investors on a bond will depend on its credit rating, and its maturity. These are often quoted as basis points over the risk-free rate of return. 𝟏𝟎𝟎 𝑩𝒂𝒔𝒊𝒔 𝒑𝒐𝒊𝒏𝒕𝒔 = 𝟏% Assessing Corporate Performance You may be expected to use ratio analysis to evaluate the success of a financial strategy. Ratios are normally split into four categories: profitability, debt, liquidity, and shareholder investor ratios. In the context of assessing performance, it is most likely that profitability and shareholder investor ratios will be most relevant. You need to learn these formulas Key Profitability Ratios Return on capital employed (ROCE) 𝑷𝑩𝑰𝑻 𝑪𝒂𝒑𝒊𝒕𝒂𝒍 𝒆𝒎𝒑𝒍𝒐𝒚𝒆𝒅 or 𝒑𝒓𝒐𝒇𝒊𝒕 𝒎𝒂𝒓𝒈𝒊𝒏 𝒙 𝒂𝒔𝒔𝒆𝒕 𝒕𝒖𝒓𝒏𝒐𝒗𝒆𝒓 Shareholders Investor Ratio Total Shareholders Return 28 VERTEX LEARNING SOLUTIONS - https://vls-online.com Click to go to Table of Content 𝒅𝒊𝒗𝒊𝒅𝒆𝒏𝒅 𝒚𝒊𝒆𝒍𝒅 + 𝒄𝒂𝒑𝒊𝒕𝒂𝒍 𝒈𝒂𝒊𝒏 Return on Equity 𝑬𝒂𝒓𝒏𝒊𝒏𝒈𝒔 𝑺𝒉𝒂𝒓𝒆𝒉𝒐𝒍𝒅𝒆𝒓𝒔 𝒇𝒖𝒏𝒅𝒔 Earnings Per Share 𝑷𝒓𝒐𝒇𝒊𝒕 𝒂𝒇𝒕𝒆𝒓 𝒕𝒂𝒙 𝒏𝒐. 𝒐𝒇 𝒔𝒉𝒂𝒓𝒆𝒔 𝒊𝒔𝒔𝒖𝒆𝒅 Price Earnings Ratio 𝑴𝒂𝒓𝒌𝒆𝒕 𝒑𝒓𝒊𝒄𝒆 𝒑𝒆𝒓 𝒔𝒉𝒂𝒓𝒆 𝑬𝒂𝒓𝒏𝒊𝒏𝒈𝒔 𝒑𝒆𝒓 𝒔𝒉𝒂𝒓𝒆 29 VERTEX LEARNING SOLUTIONS - https://vls-online.com Click to go to Table of Content