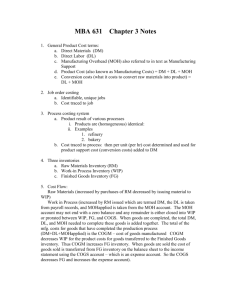

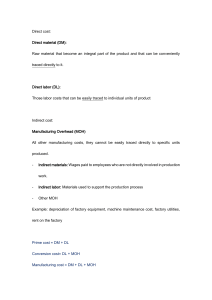

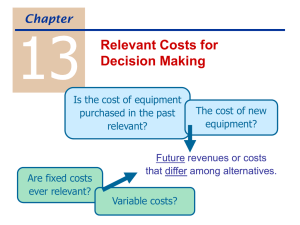

● Total MOH = P. Salary + P. Wages + Equipment + P. Depreciation + Maintenance COG Available for Sale = Merchandise Inventory𝐵𝐵+ Purchase + Freight In ○ COG Sold = COGAS - MI𝐸𝐵 DM Available for Use = DM𝐵𝐵 + purchase of direct material (incl Freight In) ○ DM Used = DM Available for Use DM𝐸𝐵 T. Manufacturing Costs= WIP𝐵𝐵 + DM + DL + MO ○ COGM = T. MC - WIP𝐸𝐵 COGAS = Finished Goods I.𝐵𝐵 + COGM ○ COGS = COGAS - FGI𝐸𝐵 Unit Costs = T. Operating Costs / T. Number of Units ● ● ● ● Operating Income = (Revenue - COGS) - Expenses ● ● ● T. Current Assets = A/R + Cash + Inventory Purchased Materials = Raw Materials I. & A/P ○ Raw Materials I. = WIP I. + MOH ○ Raw Materials I.𝐸𝐵 = (R.M.𝐵𝐵 + Purchased) - R.M.I. Wages Payable/Raw Material I. = WIP + MOH Bal. = Labor + Maintenance + Depreciation T. Costs = DM + DL + MOH Allocation Rate = T. OH Costs / T. Estimated DL Hrs. ○ Allocated OH Costs = T. Actual DL Hrs. * OH A.R. Overallocation = >Actual, Underallocation = <Actual Allocation Rate = Estimated OH Costs / Estimated Machine Hrs. Depreciation + P. Taxes + P. Wages <,> Allocated MOH ● ● ● ● ● ● ● ● ● ● ● ● ● WIP I. = Bal.𝐵𝐵 + DM + DL + Allocated MOH ● MOH = Accumulated P. Depreciation + Prepaid Insurance + Property Tax Payable Under/Over Allocated MOH = Dr. MOH - Cr. MOH Conversion Costs = DL + MOH Equivalent Units of Production = Number of Units in WIP𝐸𝐵 * Percentage Change EUP DM = Completed/In-Process Units * 100% (OR $) ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● Revenue - Expenses = Income Costs / Units = $/unit Merchandise𝐵𝐵 + Purchases = COGAS Merchandise𝐸𝐵 = COGS Sales Revenue - COGS = Gross Profit Operating Expenses = Operating Income DM + DL + MOH ○ Direct Costs = DM + DL ○ Indirect Costs = I.DM + I.DM + Other MOH DM𝐵𝐵 + Purchases = DM Available - DM𝐸𝐵 = DM Used WIP𝐵𝐵 + DM + DL + MOH = Total Manufacturing Costs - WIP𝐸𝐵 = COGM FG (didn’t sell)𝐵𝐵 + COGM = COGAS - FG 𝐸𝐵 = COGS Period Cost = selling expenses + administrative expenses Product Cost = DM used + DL incurred + MOH incurred Prime Costs = DM + DL ○ Total Manufacturing Costs = Prime Costs + MOH Conversion Costs = DL + MOH ○ Total Manufacturing Costs = DM + Conversion Costs DM Costs = (DM𝐵𝐵 + Purchased Material) DM𝐸𝐵 (DM + DL + MOH + WIP𝐵𝐵) - WIP𝐸𝐵 = (COGAS + FG𝐵𝐵) - FG𝐸𝐵 = COGM Predetermined Overhead Rate = Estimated MOH Period / Estimated Allocation Rate ○ MOH / POHR Number of Units * % Complete = Number of EU Weighted Average Costs/EU = (WIP Costs + Current Period Costs) / (WIP EU + Current Period EU) Cost per EUP for DM=Total DM costs /equiv. Units of production for DM Cost per EUP for CC= Total CC/equiv. Units of production for CC ● ● EUP Conversion Costs = Completed/In-Process Units * % (OR $) Transferred Finished Goods I. = (Production Costs + WIP𝐵𝐵) - WIP𝐸𝐵 ● Cost/Equivalent Unit = T. Cost / Equivalent Unit ● ● MOH = Cash + Accumulated Depreciation COGS = Sales * % Job Order Costing Journal Entries (Dr. = debit. Cr. = credit) ● Incurred and paid web site exp- Dr. Web exp, Cr. cash or accounts payable(on account) ● Acquisition of materials - Dr. Raw Materials, Cr. Cash or Accounts Payable ● Use of DM & IDM - Dr. WIP (direct materials) and Dr. MOH (indirect materials), Cr. Raw Materials ● Acquisition and use of direct and indirect labor - Dr. WIP (direct labor) & Dr. MOH (indirect labor), Cr. Labor or wages payable ● Acquisition of MOH - Dr. MOH, Cr. utilities payable, prepaid insurance, accumulated depreciation, cash ● Allocation of MOH - POHR=Estimated MOH/Estimated allocation base (Machine Hours, DLH, DL$) Applying MOH to WIP (POHR × Actual amount of allocation base used) - Dr. WIP, Cr. MOH ● Completion of jobs - Dr. FG, Cr. WIP ● Sale of jobs - Dr. COGS, Cr. FG AND/OR Dr. Accounts Rec./cash, Cr. Sales ● If MOH was under-allocated (actual MOH > allocated MOH) - Dr. COGS, Cr. MOH ● If MOH was over-allocated (actual MOH < allocated MOH) - Dr. MOH, Cr. COGS ● Cost of Goods Sold account increased(debited) or decreased(credited) Process Costing Journal Entries ● Use of DM and conversion costs - Dr. Dept. 1, Cr. Materials Inventory & Cr. conversion costs (or Cr. Labor and Cr. MOH separately). ● Transfer of units from one dept. to the next - Dr. WIP - Dept. 2 (or finished goods), Cr. WIP - dept. 1 Definitions: Key Concepts: ● Job order costing: one work-in-process inventory account, job cost sheets, customized, low volume ● Process costing system: Production cost reports, cost accumulated by process,repetitive, high volume Accumulate→Assign→Allocate→Adjust ● Types of firms: Service firms(have only period costs)/Merchandising Firms(Have product cost and period costs)/ Manufacturing firms(have product costs and period costs) ● Business trends: Shift toward service economy, global competition, time based competition: ERP, e-commerce, JIT, Advances in technology, TQM (value chain)