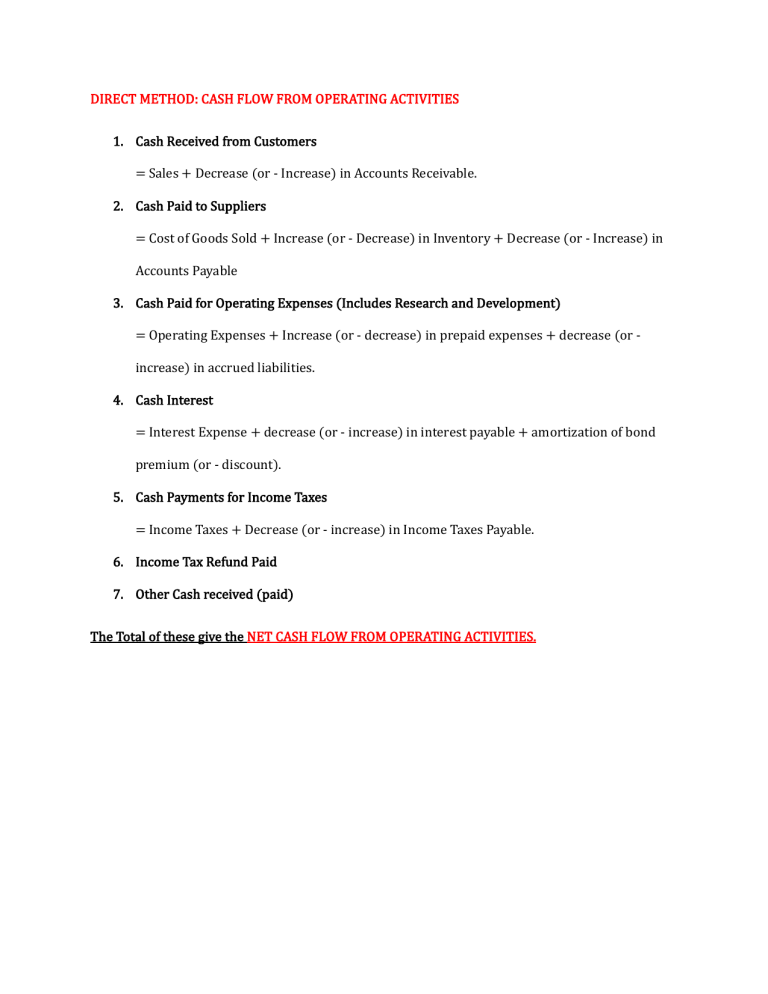

DIRECT METHOD: CASH FLOW FROM OPERATING ACTIVITIES 1. Cash Received from Customers = Sales + Decrease (or - Increase) in Accounts Receivable. 2. Cash Paid to Suppliers = Cost of Goods Sold + Increase (or - Decrease) in Inventory + Decrease (or - Increase) in Accounts Payable 3. Cash Paid for Operating Expenses (Includes Research and Development) = Operating Expenses + Increase (or - decrease) in prepaid expenses + decrease (or increase) in accrued liabilities. 4. Cash Interest = Interest Expense + decrease (or - increase) in interest payable + amortization of bond premium (or - discount). 5. Cash Payments for Income Taxes = Income Taxes + Decrease (or - increase) in Income Taxes Payable. 6. Income Tax Refund Paid 7. Other Cash received (paid) The Total of these give the NET CASH FLOW FROM OPERATING ACTIVITIES.