Power Point format

advertisement

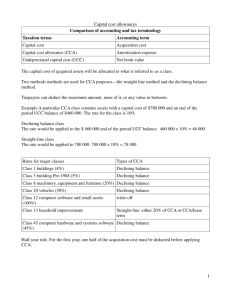

T2.1 Chapter Outline Chapter 2 Financial Statements, Taxes, and Cash Flow Chapter Organization 2.1 The Balance Sheet 2.2 The Income Statement 2.3 Cash Flow 2.4 Taxes 2.5 Capital Cost Allowance CLICK MOUSE OR HIT SPACEBAR TO ADVANCE T2.2 The Balance Sheet (Figure 2.1) T2.2 The Balance Sheet Components Assets Current: Will convert to cash within 12 month Long-Term: Capital assets (tangible: machinery, Intangible: patent) Liabilities: Current: Life less than a year Long-Term: Bonds Owners’ Equity: Residual value of the firm T2.2 The Balance Sheet Key concepts of a balance sheet Liquidity: Ease with which an asset can be converted to cash. Most liquid assets are listed first Net Working Capital (NWC) • Current Assets minus Current Liabilities. NWC>0: Cash that will be received in the next 12 month is greater than what has to be paid during that period. Sign of a healthy firm. Debt vs Equity = Assets – Liabilities Financial Leverage: debt act as a lever, it magnifies both losses and gains. Equity Market vs Book Value Assets entered at historical costs Inventory, fixed assets, equity T2.6 Cash Flow Summary (cont’d) II. Cash flow from assets Cash flow from assets = Operating cash flow – Net capital spending – Additions to net working capital (NWC) where Operating cash flow = Earnings before interest and taxes (EBIT) + Depreciation – Taxes Net capital spending = Ending net fixed assets – Beginning net fixed assets + Depreciation Change in NWC = Ending NWC – Beginning NWC III.Cash flow to creditors Cash flow to creditors = Interest paid – Net new borrowing IV.Cash flow to stockholders Cash flow to stockholders = Dividends paid – Net new equity raised T2.7 Taxes Key issues: What is an average tax rate? What is a marginal tax rate? Why do we pay attention to marginal tax rates? What are corporate tax rates? What are individual tax rates? How does the difference between corporate and individual tax rates affect corporate finance? Ideal Tax system An ideal tax system has three features: The tax burden is equitably distributed among tax payers Distortions are minimal Easy to administer Q: What is a distortion? T2.7 Federal Individual Tax Rates (2001) Taxable Income $ 1 Tax 0 + .16×Income 30,754 4,921 + .22×(Income – 30,754) 61,509 11,687 + .26×(Income – 61,509) 100,000 21,687 + .29×(Income – 61,509) T2.7 Ontario Tax Rates (2002) Taxable Income $0 – 31,892 31,892 – 63,786 >63,786 Tax Rate .0605×Income 1,930 + .0915 ×(Income – 31,892) 4,848 + .1116 ×(Income – 63,786) Average vs Marginal Tax Rate Consider and individual with an income of $70,000. Marginal tax rate is the tax paid on the next dollar earned, i.e. 0.26 + 0.1116 = 37.16% (Ontario taxes, excluding surtaxes) Average tax rate is total taxes paid ÷ income Average tax rate < marginal tax rate T2.7 Tax Rates (2002) Tax rates for top bracket incomes (>$100,000), including surtaxes Ordinary income (wages, salary, unincorporated income, interest income): 46.41% Capital gains: 50% of income tax 23.20% Canadian dividends: 31.34% 1.25 × (fed tax rate - .1333) + (prov tax rate) + surtaxes T2.8 Example Marginal Tax Rate Dividends Gross up at 25% Grossed up dividends Federal Tax on dividends 16% 22% 26% $1,000 $1,000 $1,000 250 250 250 1250 1250 1250 200 275 325 Less Dividend Tax Credit (13.333% x $1,250) (166.67) (166.67) (166.67) Federal Tax Payable 33.33 108.33 158.33 Provincial Tax: applied on $1,000 60.50 91.50 111.60 Total Tax 93.83 199.83 269.93 Effective Combined Tax Rates 9.4% 20% 27% T2.9 Corporate Tax Rates (2002) FEDERAL ONTARIO COMBINED Basic Corporations 25% 12.5% 38.62% Manufacturing and 21 11.0 33.12 12 6.0 19.12 Processing All Small Corporations (Taxable Income below $200 thousand) Capital Gains, Carry-Forward and Carry-Back Asset sold at a price higher (lower) than purchase price = capital gain (loss) for the firm Capital gains taxed at 50% of marginal tax rate Capital losses can be carried back over the three preceding years; forward for up to seven years Carry-back and carry forward features reduces previous and future taxable capital gains Capital Cost Allowance (CCA) Depreciation for tax purposes in Canada CCA may not be the same as depreciation under GAAP Income actually taxed may be lower than taxable income under GAAP if CCA rate is higher than depreciation rate for GAAP reporting Class Rate Assets 1 4% Buildings acquired after 1987 8 20% Furniture, photocopiers 10 30% Vans, trucks, tractors and computer equipment 13 Straight-line Leasehold improvements 16 40% Taxicabs and rental cars 22 50% Pollution control equipment 43 30% Manufacturing equipment Incentive behind CCA: lower taxes increase cash flow Half-year rule: Only half of the asset value can be used for CCA purposes in the first year. Measure to discourage business owners to purchase significant capital assets on the last day of the taxation year. T2.11 CCA Example Depreciation on $22,000 Photocopier (CCA Class 8) Year UCC t CCA UCC t+1 1 11,000 2,200 $19,800 2 19,800 3,960 15,840 3 15,840 3,168 12,672 4 12,672 2,534 10,138 5 10,138 2,028 8,110 6 8,110 1,622 6,488 UCC: undepreciated capital cost Asset Purchases and Sales When an asset is sold, UCC in its class is reduced by the sales proceeds or original cost, whichever is less adjusted cost of disposal Example: photocopier sold for $12,000 at the end of the fourth year: UCC = $10,138 asset pool is reduced by $12,000 If photocopier is sold for $9,000 at the end of the fourth year asset pool is reduced by $9,000 and $1,138 depreciates forever When a pool is terminated, the sale of asset creates a terminal loss or terminal gain Terminal gain: proceeds from sale greater than UCC, the difference is added to income and taxed; CCA is recaptured Terminal loss: proceeds from sale smaller than UCC, the difference is deducted from income; tax savings Example of a terminal loss An import-export business decided to sell its warehouse, because it is better to lease instead. The business received $30,000 for the warehouse. The business had then no more assets this class. UCC = $35,000 Warehouse sold for $30,000 Terminal loss = $5,000, which can be deducted from the business income Example of a Terminal Gain A clothing company bought a sewing machine in 1999 for $10,000. The company has decided to concentrate solely on retailing. The sewing machine was sold in 2001 for $12,000. UCC = $9,500 Capital gain = $2,000, taxed at 50% of marginal tax rate $10,000 - $9,500 = $500 is the terminal gain, which will be added to income and taxed as income A pool need not be terminated to have a recapture CCA. There is a recapture of CCA whenever Net sales of assets in a pool outweighs the UCC of the pool Ex: UCC of pool of assets of class 10 (cars, etc) is $10,000 total. A luxury car, with original cost $50,000, is sold for $70,000. Capital gain: $20,000 Adjusted cost of disposal, $50,000, is greater than $10,000 Recaptured CCA = $50,000 - $10,000 = $40,000 A terminal gain is not a capital gain There need not be a capital gain to have a terminal gain