BASIC ACCOUNTING

Lecture Week 8

FINANCIAL STATEMENTS OF A MERCHANDISING OPERATION

Illustration:

Toribio Cayanan Tires have just started its operation entered into the following

transactions during the month of June 2019:

June

2

2

4

5

6

7

11

13

22

30

30

30

30

Toribio Cayanan invests P1,000,000 to his Toribio Cayanan Tires.

Purchased 1,000 tires at a cost of P600 per tire. Terms of payment: 1/10, net 45.

Paid trucking firm to ship the tires purchased on June 2.

Purchased 600 tires at a cost of P600 per tire. Terms of payment: 2/10, net 30.

Paid trucking firm P5,000 to ship the tires purchased on June 5.

Returned 150 of the tires purchased on June 2 because they were defective.

Received a credit on open account from the seller.

Paid for tires purchased on June 2.

Sold 700 tires purchased from those purchased on June 2. The selling price was

P900 per tire. Terms: 1/10, net 30.

Received cash from sale of tires on June 13.

Paid for tires purchased on June 5.

Paid rent for the month, P5,000.

Paid utilities for the month, P9,000.

Paid monthly salaries of staff, P10,500.

Step 1: Journalizing

For Periodic Inventory System:

DATE

Jun

ACCOUNTS TITLES

DEBIT

CREDIT

2 Cash

P

1,000,000.00

T. Cayanan, Capital

P

To record capital investment of Toribio Cayanan.

1,000,000.00

2 Purchases

600,000.00

Accounts Payable

To record purchase of Inventory (P600 x 1,000 tires).

600,000.00

4 Transportation In

Cash

To record transportation in.

8,000.00

8,000.00

5 Purchases

360,000.00

Accounts Payable

To record purchase of Inventory (P600 x 600 tires).

6 Transportation In

Cash

To record transportation in.

360,000.00

5,000.00

7 Accounts Payable

90,000.00

Purchase Returns and Allowances

To record returns of defective purchases from June 2.

11 Accounts Payable

510,000.00

Cash

Purchase Discounts

To record payment of purchases from June 2 with 1% discount.

{(P600,000-P90,000 returned purchases)*.01}

5,000.00

90,000.00

504,900.00

5,100.00

DATE

Jun

ACCOUNTS TITLES

13 Accounts Receivables

Sales

To record sales of 700 tires at P900.

DEBIT

P

CREDIT

630,000.00

P

630,000.00

22 Cash

623,700.00

Sales Discount

6,300.00

Accounts Receivables

To record collections from June 13 sales with 1% discount.

(P630,000*.01)

630,000.00

30 Accounts Payable

Cash

To record payment of purchases from June 5.

360,000.00

360,000.00

30 Rent Expense

Cash

To record payment of rent.

5,000.00

30 Utilities Expense

Cash

To record payment of monthly utilities.

9,000.00

30 Salaries Expense

Cash

To record payment of monthly salaries.

10,500.00

Step 2: Posting

5,000.00

9,000.00

10,500.00

Step 3: Preparing Trial Balance

DEBIT

Cash

Accounts Receivables

Accounts Payable

T. Cayanan, Capital

Sales

Sales Discount

Purchases

Purchase Discounts

Purchase Returns and Allowances

Transportation In

Rent Expense

Utilities Expense

Salaries Expense

CREDIT

721,300.00

1,000,000.00

630,000.00

6,300.00

960,000.00

5,100.00

90,000.00

13,000.00

5,000.00

9,000.00

10,500.00

1,725,100.00

1,725,100.00

Since no adjustments occurred, proceed to Step 6 Preparation of Financial Statements.

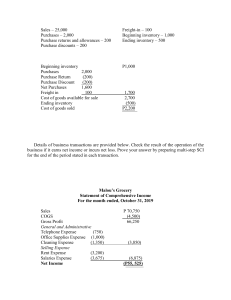

Step 6: Preparation of Financial Statements

STATEMENT OF FINANCIAL PERFORMANCE / INCOME STATEMENT

TORIBIO CAYANAN TIRES

Income Statement

For the month ended June 30, 2019

Net Sales

Sales

Less: Sales Discounts

P

Cost of Sales

Inventory, Beginning

Add: Purchases

P

Less: Purchase Returns and Allowances

Purchase Discounts

Add: Transportaion In

Net Purchases

Less: Inventory, End*

630,000.00

6,300.00 P

623,700.00

960,000.00

90,000.00

5,100.00

13,000.00

877,900.00

449,100.00

P

Gross Profit

Less: Operating Expenses

Rent Expense

Utilities Expense

Salaries Expense

5,000.00

9,000.00

10,500.00

Net Income

428,800.00

194,900.00

24,500.00

170,400.00

Take note:

Computation of Ending Inventory using FIFO (First-In First Out Inventory Method):

June 2 Purchases

Purchased inventory

Less: Returned inventory

Sold inventory*

came

Multiply: Cost

(P600 - (P600*1% discount))

Total Ending Inventory for June 2

First – In First –

Out method of

inventory valuation is a cost flow assumption that the first

1,000goods purchased are also the first

150goods sold. And therefore in our

illustration, the 700 tires sold on June 13

700

from June 2 purchases.

150

P

June 5 Purchases

Purchased inventory

Less: Returned inventory

Sold inventory*

Multiply: Cost

Total Ending Inventory for June 5

Total Ending Inventory

Purchases

Returned

Total inventory available for sale

Sold in June 13

Ending Inventory in Quantity

P

594.00

P

89,100.00

P

P

360,000.00

449,100.00

600

600

600.00

June 2

1,000

(150)

850

(700)

150

June 5

600

600

600

STATEMENT OF FINANCIAL POSITION / BALANCE SHEET

STATEMENT OF CASH FLOWS

Cash Flow from Operating Activities:

Cash received from Customers

Payments to Suppliers

Payments for Transportation In

Payments to Employees

Payments for Office Rent

Payments for Utilities

623,700.00

(864,900.00)

(13,000.00)

(10,500.00)

(5,000.00)

(9,000.00)

(278,700.00)

Net Cash flow from Operating Activities

Cash Flow from Investing Activities:

Payments to acquire service vehicles

Payments to acquire office equipment

-

Net Cash flow from Investing Activities

Cash Flow from Financing Activities:

Cash received as investments by the owner

1,000,000.00

Net Cash flow from Financing Activities

1,000,000.00

Net Increase/(Decrease) in cash

Cash balance at the beginning of the period

721,300.00

721,300.00

STATEMENT OF

T. Cayanan, Capital, Beginning

Initial Investments

Withdrawals

Net Income

T. Cayanan, Capital, Ending

CHANGES IN OWNER’S EQUITY

1,000,000.00

170,400.00

1,170,400.00