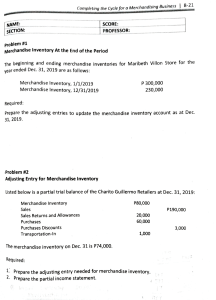

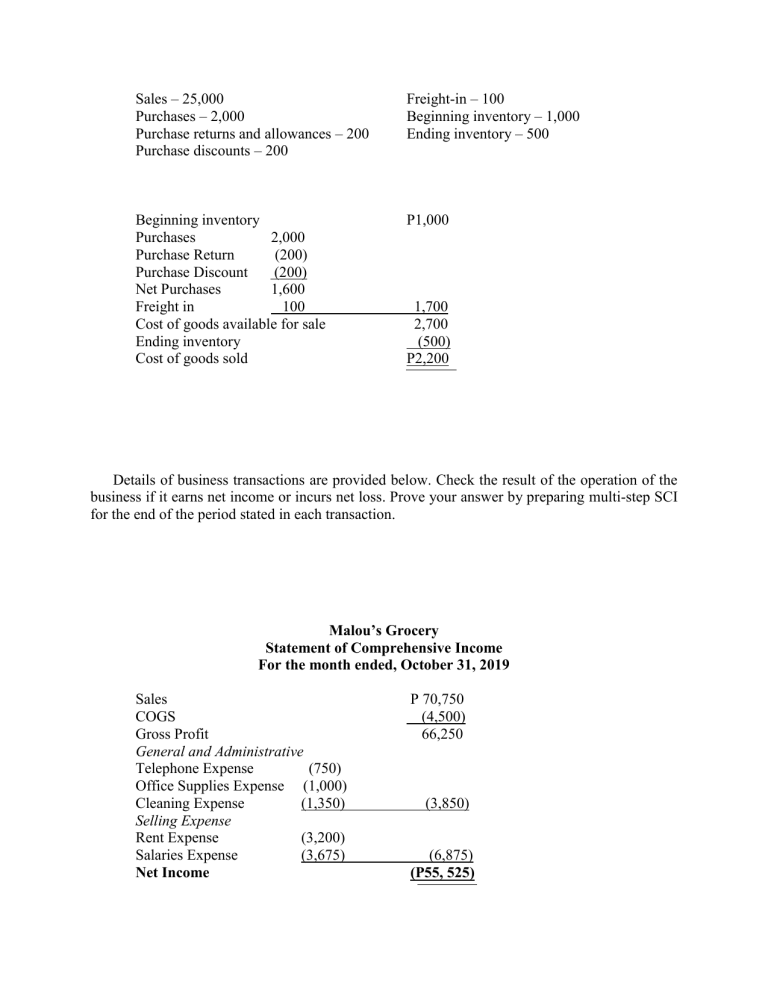

Sales – 25,000 Purchases – 2,000 Purchase returns and allowances – 200 Purchase discounts – 200 Freight-in – 100 Beginning inventory – 1,000 Ending inventory – 500 Beginning inventory Purchases 2,000 Purchase Return (200) Purchase Discount (200) Net Purchases 1,600 Freight in 100 Cost of goods available for sale Ending inventory Cost of goods sold P1,000 1,700 2,700 (500) P2,200 Details of business transactions are provided below. Check the result of the operation of the business if it earns net income or incurs net loss. Prove your answer by preparing multi-step SCI for the end of the period stated in each transaction. Malou’s Grocery Statement of Comprehensive Income For the month ended, October 31, 2019 Sales COGS Gross Profit General and Administrative Telephone Expense (750) Office Supplies Expense (1,000) Cleaning Expense (1,350) Selling Expense Rent Expense (3,200) Salaries Expense (3,675) Net Income P 70,750 (4,500) 66,250 (3,850) (6,875) (P55, 525)