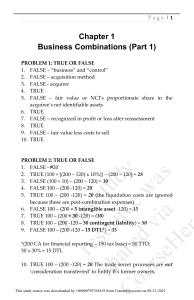

CHAPTER 3 Business Combinations (part 3) Special accounting topics for business combination: 1. Goodwill 2. Reverse acquisitions 3. Combination of mutual entities GOODWILL Only a goodwill that arises from a business combination is recognized as an asset. Goodwill arising from other sources is not recognized. Cash-generating unit (CGU) the smallest identifiable group of assets that generates cash inflows that are largely independent of the cash inflows from other assets or groups of assets. DUE DILIGENCE Due diligence audit refers to the investigation of all areas of a potential acquiree's business before an investigator agrees to a business combination transaction. Due diligence may refer to the exercise of care that a reasonable and prudent person should take before entering a contract with another party. METHODS OF ESTIMATING GOODWILL INDIRECT VALUATION - this is a residual approach wherein goodwill is measured as the excess of sum of consideration transferred DIRECT VALUATION - under this method, goodwill is measured based on expected future earnings from the business to be acquired. REVERSE ACQUISITION - the entity that issues securities (the legal acquirer) is identified as the acquiree for accounting purposes, while the entity whose equity interests are acquired (the legal acquiree) is the acquirer for accounting purposes MEASURING THE CONSIDERATION TRANSFERRED The accounting acquiree issues equity interests to the owners of the accounting acquirer for them to obtain control over the accounting acquiree. De Villa, Kaye Celine Angay, Rena Mae Angay, Renz Mark

![[Date] [Name of College] ATTN: [Department]](http://s2.studylib.net/store/data/015675584_1-19c1f2d4f2acfcfa6a51fd36241fad38-300x300.png)