Corporate Finance: CAPM, Risk & Cost of Capital Lecture

advertisement

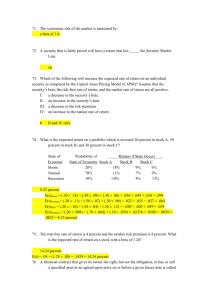

Corporate Finance and Behavior (ECB2FIN) 2023–24 Lecture 1: Introduction, CAPM, Risk and the Cost of Capital (Ch. 8,9) Textbook: ”Principles of Corporate Finance”, 14th Edition – Brealy Meyers Allen Edmans – Drs George Alexandrou Date : 4 September 2023 Place : Kinepolis Jaarbeurs (Zaal 12) Planning: 8 weeks (04/09 – 24/10) Exam: 31/10 Tuesdays: Lectures Thursdays: Tutorials Questions: during / after Lectures / Tutorials /Office hours or via Mail. E-mail address: George Alexandrou: g.alexandrou@uu.nl Your Tutorial-Group Lecturer: ecb2fin22@uu.nl Note: No recordings of Lectures & Microphones muted Office Hours (for this week): Mon 4-Sep., 15:30-16:00pm & 17:00 – 18:00pm (ICU – SPINOZA 009) 04/09/2023 2 Assessments: Course grade: 85% Final exam 15% weekly quizzes: 7 weekly quizzes NO retake of quizzes Weekly quiz structure: 60 minutes Can be taken from 07:00 – 21:00 on Fridays Consisting of: Several algorithmic exercises (highest score of 3 attempts will be taken into consideration) The build-up of your Connect© grade looks as follows: (submitted quizzes) Bonus in tutorials: 0 Connect quizzes above 50%: 1 Connect quiz above 50%: 2 Connect quizzes above 50%: 3 Connect quizzes above 50%: 4 or more Connect quizzes above 50%: Connect grade = 1 Connect grade = 3 Connect grade = 5 Connect grade = 7 Connect grade = 9 Attending 5 out of 7 Tutorials will give you 1 extra point for your Connect grade and will allow you to do a retake exam if necessary. At least 1 submission to the Quizzes is mandatory to obtain a grade for ECB2FIN. For Effort requirement => see Course Manual. 04/09/2023 3 Connect© McGraw Hill Online assignments and Quizzes are on the publisher's web page 'Connect’: For more information see Blackboard. To purchase the Connect© access code and register, follow the provided links. You then access the Course (ECB2FIN: Corporate Finance and Behaviour) where you will find the e-book, Quizzes and other supporting materials. There is a link in the course page to purchase the hard copy of the textbook, at a heavily discounted price, is you so wish. Note (from the publisher): In the link, you will buy a 360-day access to Connect© at a heavily discounted price. This is the only way to purchase access to Connect. They do not work with booksellers and retailers. 04/09/2023 4 Making the Most of Your Course Tools Connect® Course Registration for ECB2FIN: Corporate Finance and Behaviour Utrecht University School of Economics 2023-2024 Making the Most of Your Course Tools About Your Course Course Name Corporate Finance and Behaviour Course Code ECB2FIN Instructor George Alexandrou Resource Principles of Corporate Finance, 14e (Connect) Resource Author Richard A. Brealey, Stewart C. Myers, Franklin Allen, Alex Edmans Course Registration Link https://accounts.mheducation.com/connect/section/g-alexandroufall-2023---ecb2fin---corporate-finance-and-behavior-?app=newconnect.mheducation.com Course URL Link connect.mheducation.com Registration Video Link https://share.vidyard.com/watch/uCaMdm6ERF5koRxJbpUiSf? Need help logging in? Click here to speak with our Digital Technical Support team 6 Making the Most of Your Course Tools How to Register Registration Follow the steps below to register for Connect: STEP 1: Visit your instructor’s Connect Course URL (Link) & sign in or register for a new account. Need more help? Watch the registration tutorial. 7 Today’s Lecture: • What we will discuss today: - The Capital Asset Pricing Model (CAPM) – Ch. 8 - Risk and the Cost of Capital – Ch. 9 • What do we already know: - How firms are organized and managed and how we make financial decisions. - Time value of money, financial arithmetic tools. - Valuing stocks and bonds. - Investment decisions. - Risk, Diversification and Portfolio theory. 04/09/2023 8 Chapters to be studied: Chapters: 8 and 9 Introduction, CAPM, Risk and the Cost of Capital • Homework Tutorial 1 8.6, 8.8, 8.12, 8.13 9.2, 9.4, 9.5, 9.7 and 9.13 • Practice Questions see Connect© Note: No recordings of Lectures 04/09/2023 9 Chapter 8: The Capital Asset Pricing Model (CAPM) Topics: • Risk and returns, portfolio diversification • Market Risk Is Measured by Beta. • The Relationship Between Risk and Return. • Does the CAPM Hold in the Real World? • Some Alternative Theories. 04/09/2023 10 Figure 7.1 How $1 invested at the End of 1899 would have grown by the end of 2020 • How an investment of $1 at the start of 1900 would have grown by the end of 2020, assuming reinvestment of all dividend and interest payments. • Source: E. Dimson, P. R. Marsh, and M. Staunton, Triumph of the Optimists: 101 Years of Global Investment Returns (Princeton, N J: Princeton University Press, 2002), with updates provided by the authors. 3 Utility function – Risk aversion R C A 5 0.60 B 3 4 0.27 0.18 2 0.15 1 0.15 0.20 0.50 3 The Historical Risk and Return in Large Portfolios Source: CRSP, Morgan Stanley Capital International 13 Historical Volatility and Return for 500 Individual Stocks, Ranked Annually by Size Source: CRSP 14 Figure 7.13 Southwest and Amazon • The curved line illustrates how expected return and standard deviation change as you hold different combinations of two stocks. • Diversification reduces risk. 28 Effect on Volatility and Expected Return of Changing the Correlation between Intel and Coca-Cola Stock 16 Portfolios of Intel and Coca-Cola Allowing for Short Sales 17 Efficient Frontier with Ten Stocks Versus Three Stocks 18 Figure 7.12 Even Random Diversification Eliminates Specific Risk • Risk that diversification cannot eliminate is market risk, NYSE, 2010–2019. 26 Figure 7.14 Efficient Portfolios • Each dot shows the expected return and standard deviation of stocks. These are efficient portfolios, denoted with A, B, and C. 30 Figure 7.16 Lending and Borrowing • Lending or borrowing at the risk-free rate (rf) allows us to exist outside the efficient frontier. 31 The Efficient Portfolio with Borrowing and Lending 22 The Market Risk is Measured by Beta • Market Portfolio: Portfolio of all assets in the economy. In practice, a broad stock market index such as the S&P Composite is used to represent the market. • The risk that a stock contributes to a well-diversified portfolio is its market risk. • Market risk is the risk that a stock shares with the market. • Beta: Sensitivity of a stock’s return to the return on the market portfolio, defined as: 𝛽𝑖 = 𝜎𝑖𝑀 2 𝜎𝑀 (1) 𝜎𝑖𝑀 is the covariance between the returns on stock i and the returns on the market. 2 𝜎𝑀 is the variance of the returns on the market. Total risk = (Market risk) + (Specific risk) => 𝜎𝑖 = 𝜌𝑖𝑀 𝜎𝑖 + (1 − 𝜌𝑖𝑀 )𝜎𝑖 𝑀𝑎𝑟𝑘𝑒𝑡 𝑟𝑖𝑠𝑘 = 𝜌𝑖𝑀 𝜎𝑖 = 𝜎𝑖𝑀 𝜎 𝜎𝑖𝜎𝑀 𝑖 = 𝜎𝑖𝑀 𝜎𝑀 = 𝜎𝑖𝑀 2 𝜎𝑀 𝜎𝑀 = 𝛽𝑖 𝜎𝑀 ==> 𝑴𝒂𝒓𝒌𝒆𝒕 𝒓𝒊𝒔𝒌 = 𝜷𝒊 𝝈𝑴 (2) where: 𝛽𝑖 = 23 𝜎𝑖𝑀 2 𝜎𝑀 (1) Figure 8.1 The Return on Amazon Stock • The return on Amazon stock changes on average by 1.55% for each 1.00% change in the market return. Beta is therefore 1.55. 24 Security Market Line (𝑆𝑀𝐿) 𝐸𝑞𝑢𝑎𝑡𝑖𝑜𝑛: 04/09/2023 𝐸 𝑟 = 𝑅𝑓 + 𝛽 ∗ (𝑅𝑚 − 𝑅𝑓 ) 25 Table 8.1 Estimated Betas for Select U.S. Stocks. Stock Beta (β) United States Steel 2.98 Southwest Airlines 1.58 Amazon 1.55 Wells Fargo 1.14 ExxonMobil 1.14 Johnson & Johnson 0.75 Tesla 0.50 Coca-Cola 0.46 Consolidated Edison 0.31 Newmont 0.16 26 Table 8.3 Portfolio Risk, Beta (1) (2) (3) (4) (5) Deviation from Average Company Return (6) (7) Squared Deviation from Average Market Return (Columns 4×4) Product of Deviations from Average Returns (Columns 4×5) Month Market Return Company Return Deviation from Average Market Return 1 −8% −11% −10 −10 100 130 2 4 8 2 6 4 12 3 12 19 10 17 100 170 4 −6 −13 −8 −15 64 120 5 2 3 0 1 0 0 6 8 6 6 4 36 24 Average 2 2 Total 304 456 • Beta is the ratio of the covariance of the returns on the stock to the returns on the market: 𝛽𝑖 = 𝜎𝑖𝑀 2 𝜎𝑀 • Calculating the covariance between the returns on the market and those of Anchovy Queen and the variance of the market returns here: • Covariance = 𝜎𝑖𝑀 = (456 / 6) = 76; 2 Variance = 𝜎𝑀 = (304 / 6) = 50.67; Beta (𝛽𝑖 ) = (76 / 50.67) = 1.5 27 Why Betas Determine Portfolio Risk We know that: 1. The market risk of a stock is measured by its beta. 2. The risk of a well-diversified portfolio is given by its market risk. • We also know the beta of a portfolio is the weighted average of the betas of the individual stock in the portfolio. • Beta measures undiversifiable risk. So, there is no diversification effect when adding a stock to a well-diversified portfolio. • If a portfolio includes a large number of randomly selected stocks, its beta is 1.0 • Adding low-beta stocks to a portfolio lowers the overall risk, but this is NOT “Diversification” it is “de-risking” • Investing higher proportion of your wealth in Treasury bills is another way of de-risking. 28 The relationship between Risk and Return – CAPM We know that the market risk of a stock is measured by its beta. • How much extra return an investor expects for bearing market risk? From Chapter 7: Capital Market Line: 𝑟𝑝 = 𝑟𝑓 + 𝑟𝑀 −𝑟𝑓 𝜎𝑀 𝜎𝑝 (3) This equation gives the expected return for an efficient portfolio that combines borrowing or lending and the market portfolio. • An investor is rewarded only for market risk (𝛽𝑖 ,eq.2) (we replace 𝜎𝑝 with 𝛽𝑖 ): 𝑟𝑖 = 𝑟𝑓 + 𝑟𝑀 − 𝑟𝑓 𝑟𝑀 − 𝑟𝑓 𝑚𝑎𝑟𝑘𝑒𝑡 𝑟𝑖𝑠𝑘 𝑜𝑓 𝑠𝑡𝑜𝑐𝑘 𝑖 = 𝑟𝑓 + (𝛽𝑖 𝜎𝑀 ) = 𝑟𝑓 + 𝛽𝑖 (𝑟𝑀 − 𝑟𝑓 )=> 𝜎𝑀 𝜎𝑀 𝒓𝒊 = 𝒓𝒇 + 𝜷𝒊 (𝒓𝑴 − 𝒓𝒇 ) (4) or: 𝒓𝒊 = 𝒓𝒇 + 𝜷𝒊 (𝒓𝑴 − 𝒓𝒇 ) The risk premium of a stock depends only on its beta: 𝛽𝑖 = (5) CAPM 𝜎𝑖𝑀 2 𝜎𝑀 29 Risk and Return - Capital Market Line The risk in the horizontal line is measured by the standard deviation. 04/09/2023 30 Figure 8.3 Capital Asset Pricing Model The risk in the horizontal axis is measured by the beta (𝛽) Security Market Line (𝑆𝑀𝐿) 𝐸𝑞𝑢𝑎𝑡𝑖𝑜𝑛: 𝑬 𝒓 = 𝑹𝒇 + 𝜷 ∗ (𝑹𝒎 − 𝑹𝒇 ) 31 Figure 8.4 Equilibrium What if a stock did not Lie on the security Market Line? • In equilibrium, no stock lies below the security market line. • Instead of buying Stock A, investors lend part of their money and put the balance in the market portfolio. • Instead of buying Stock B, they borrow and invest in the market portfolio. 32 Capital Market Line and Security Market Line • The Capital Market Line (CML) applies only to efficient portfolios. • Individual stocks and inefficient portfolios carry more risk and lie below the CML. • Investors still hold them as part of a diversified portfolio, but they get rewarded only for systematic risk. • The Security Market Line (SML) applies to all stocks, securities and portfolios. The expected returns in the vertical axis are drawn against… …the total risk 𝜎𝑝 in the horizontal axis (CML), …the market risk 𝛽𝑖 on the horizontal axis (SML). • An investor may hold inefficient assets as part of their portfolio because the inefficiencies (specific risk) are wash away. • Specific (idiosyncratic) risk is not compensated. • An efficient portfolio is comprised of individual inefficient securities. 33 The Capital Market Line and the Security Market Line 34 Does CAPM Hold in the Real World? • The CAPM makes several assumptions: 1. Investors choose portfolios based on expected return and risk (variance of returns). 2. All investors have the same estimates of mean returns, variances, and covariances. 3. Investors trade in perfect capital markets. • no Taxes. • no Transaction Costs. • no restrictions on Short Sales. 4. Investors can borrow and Lend at the same risk-free rate. 5. Investors are price takers. 6. The supply of all assets is fixed. Pros: • Asset classes with more risk command a higher expected return • The expected returns should not depend on diversifiable risk (only on market risk - beta) • Most financial managers use it (73% in a survey by Graham, Harvey 2001) • Questions: Unrealistic assumptions – empirical evidence. 35 Figure 8.5 CAPM (1931–2020) • Beta Versus Average Risk Premium. 36 Figure 8.6 Relationship Between Beta and Average Return (mid-19 60s) 37 Figure 8.6 Relationship Between Beta and Average Return (19 66–2020) • Source: F. Black, “Beta and Return,” Journal of Portfolio Management 20 (Fall 19 93), pp. 8–18. Updates courtesy of Adam Kolasinski. 38 Figure 8.7 Return Versus Book-to-Market • http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html 39 Arbitrage Pricing Theory (APT) ATP is an Alternative to CAPM CAPM: How investors construct efficient portfolios. Which portfolios are efficient. ATP: Assumes that each stocks risk premium depends on pervasive macroeconomic “factors”. 𝑹𝒆𝒕𝒖𝒓𝒏 = 𝜶 + 𝒃𝟏 𝒓𝒇𝒂𝒄𝒕𝒐𝒓 𝟏 + 𝒃𝟐 𝒓𝒇𝒂𝒄𝒕𝒐𝒓 𝟐 + 𝒃𝟑 𝒓𝒇𝒂𝒄𝒕𝒐𝒓 𝟑 + ⋯ + 𝒏𝒐𝒊𝒔𝒆 (6) 𝑛𝑜𝑖𝑠𝑒 stands for specific, diversifiable risk. The expected risk premium on a stock depends on the expected risk premium associated with each ‘factor’ and the sensitivity of the stock returns to each factor: 𝑬𝒙𝒑𝒆𝒄𝒕𝒆𝒅 𝑹𝒊𝒔𝒌 𝑷𝒓𝒆𝒎𝒊𝒖𝒎 = 𝒓 − 𝒓𝒇 = 𝒃𝟏 𝒓𝒇𝒂𝒄𝒕𝒐𝒓 𝟏 − 𝒓𝒇 + 𝒃𝟐 𝒓𝒇𝒂𝒄𝒕𝒐𝒓 𝟐 − 𝒓𝒇 + ⋯ (7) 40 Three-Factor Model • Steps to Identify Factors: 1. Identify a reasonably short list of macroeconomic factors that could affect stock returns. 2. Estimate the expected risk premium on each of these factors: 𝒓𝒇𝒂𝒄𝒕𝒐𝒓 𝟏 − 𝒓𝒇 etc. 3. Measure the sensitivity of each stock to the factors (𝒃𝟏 , 𝒃𝟐 , etc.) Factor Measured by Market factor Return on market index minus risk-free interest rate Size factor Return on small-firm stocks less return on large-firm stocks Book-to-market factor Return on high book-to-market-ratio stocks less return on low book-to-market-ratio stocks 41 Table 8.5 Estimates of Expected Equity Returns Using Three-Factor Model and CAPM Three- Factor Model Factor Sensitivities a CAPM B market B size B book-to-market Expected Return a Expected Return b Autos 1.12 0.26 0.31 11.9% 10.2% Banks 1.18 0.09 0.65 13.1 10.5 Chemicals 1.19 0.26 0.41 12.8 10.7 Computers 1.30 −0.18 0.03 10.5 10.9 Construction 0.96 0.49 0.04 10.4 9.3 Food 0.67 −0.38 0.02 5.6 6.3 Oil and gas 1.17 0.49 0.90 15.3 11.0 Pharmaceuticals 0.91 0.20 −0.38 7.5 8.5 Telecoms 0.78 −0.24 0.12 7.2 7.2 Utilities 0.46 −0.36 −0.08 3.7 4.8 The expected return equals the risk-free interest rate plus the factor sensitivities multiplied by the factor risk premiums, that is: 2.0 + 𝑏𝑀𝑎𝑟𝑘𝑒𝑡 ∗ 7.0 + 𝑏𝑧𝑖𝑠𝑒 ∗ 3.1 + 𝑏𝑏𝑜𝑜𝑘−𝑡𝑜−𝑚𝑎𝑟𝑘𝑒𝑡 ∗ 4.0 . b Estimated as 𝑟𝑓 + 𝛽 𝑟𝑚 − 𝑟𝑓 , that is: 𝑟𝑓 + 𝛽 ∗ 7.0 Note that we use simple egression to estimate beta in the CAPM formula. This beta may, therefore, be different from 𝑏𝑀𝑎𝑟𝑘𝑒𝑡 that we estimated from a multiple regression of stock returns on the three factors. Source: The industry indexes are value-weighted indexes from Kenneth French’s website, mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.xhtml. 42 Chapter 9: Risk and the Cost of Capital Topics: • Company and Project Costs of Capital. • Measuring the Cost of Equity. • Analyzing Project Risk. • Certainty Equivalents: Another way to adjust for Risk. 04/09/2023 43 Company and Project Costs of Capital • A firm’s value can be stated as the sum of the value of its various assets. • “The value-additivity principle.” • If firm is composed of assets A and B: Firm value = PV(AV) = PV(A) + PV(B) The value of an asset or project is estimated by discounting its expected cash flows by the discount rate that reflects is market risk (beta). • The true cost of capital for a project depends on the project, not on the company. • Projects within a firm should be evaluated using discount rates based on their market risk (beta) not the overall cost of capital of the company. 44 Figure 9.1 Company Cost of Capital • J&J’s company cost of capital is about 7.3%. This is the correct discount rate only if the project beta is 0.75. 45 The Company Cost of Capital – Debt and Equity rassets Cost of Capital D E = rE rE V V V DE D market value of debt E market value of equity rD YTM on bonds rE rf rm rf • Important: E, D, and V are all market values of equity, debt, and total firm value 46 Estimating Beta - Figure 9.2 U.S. Steel The SML shows the relationship between return and risk. CAPM uses beta as a proxy for risk. Other methods can be employed to determine the slope of the SML and thus beta. • U.S. Steel Mar. 2010- Feb. 2015 • U.S. Steel Mar. 2015-Feb. 2020 47 Estimating Beta - Figure 9.2 ExxonMobil • ExxonMobil Mar. 2010- Feb. 2015 • ExxonMobil Mar. 2015-Feb. 2020 48 Figure 9.2 Consolidated Edison • Consolidated Edison Mar. 2010- Feb. 2015 • Consolidated Edison Mar. 2015-Feb. 2020 49 Table 9.1 Estimated Betas and Standard Errors Beta Standard Error Canadian Pacific 1.07 0.18 CSX 1.18 0.24 Kansas City Southern 0.97 0.20v Norfolk Southern 1.33 0.18 Union Pacific 1.09 0.16 Industry portfolio 1.13 0.14 50 Asset Beta • Company cost of capital (COC) is based on the average beta of the assets. • The average beta of the assets is based on the percentage of funds in each asset. • Assets = debt + equity D E β assets β debt β equity V V 51 Example 9.3 Allowing for Possible Bad Outcomes • Example • Project Z will produce just one cash flow, forecasted at $1 million at year 1. It is regarded as average risk, suitable for discounting at a 10% company cost of capital: PV C1 1,000,000 $909,100 1 r 1.1 52 …Example 9.3 Allowing for Possible Bad Outcomes • Example …But now you discover that the company’s engineers are behind schedule in developing the technology required for the project. They are confident it will work, but they admit to a small chance that it will not. You still see the most likely outcome as $1 million, but you also see some chance that project Z will generate zero cash flow next year. Possible Cash Flow Probability Probability-Weighted Cash Flow 1.2 0.25 0.3 1.0 0.50 0.5 0.8 0.25 0.2 Unbiased Forecast 1.0, or $1 million 53 …Example 9.3 Allowing for Possible Bad Outcomes • Example continued • This might describe the initial prospects of project Z. But if technological uncertainty introduces a 10% chance of a zero cash flow, the unbiased forecast could drop to $900,000. Possible Cash Flow Probability Probability-Weighted Cash Flow 1.2 0.225 0.27 1.0 0.45 0.45 0.8 0.225 0.18 0 0.10 0.0 PV 0.90 $818,000 1.1 Unbiased Forecast 0.90, or $900,000 54 Example 9.4 Correcting for Optimistic Forecasts • The CFO of EZ Corp. finds that the cash-flows forecasts are always 10% optimistic. What is the right response? To increase the cost of capital 10% from 12% to 22% or to reduce the expected cash flows by 10%? 1 2 3 4 5 … 10 … 15 1. Original cash flow forecast $1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 … $1,000.00 … $1,000.00 2. PV at 12% $ 892.90 $ 797.20 $ 711.80 $ 635.50 $ 567.40 … $ 322.00 … $ 182.70 3. Corrected cash flow forecast $ 900.00 $ 900.00 $ 900.00 $ 900.00 $ 900.00 … $ 900.00 … $ 900.00 4. PV at 12% $ 803.60 $ 717.50 $ 640.60 $ 572.00 $ 510.70 … $ 289.80 … $ 164.40 5. PV correction −10.0% −10.0% −10.0% −10.0% −10.0% … −10.0% … −10.0% 6. Original forecast discounted at 22% $ 819.70 $ 671.90 $ 550.70 $ 451.40 $ 370.00 … $ 136.90 … $ 50.70 −8.2% −15.7% −22.6% −29.0% −34.8% … −57.5% … −72.3% Year 7. PV “correction” at 22% discount rate 55 Valuation by Certainty Equivalents PV Ct 1 r t 1 CEQt 1 r t f Figure 9.3 Risk, DCF and CEQ 56 Valuation by Certainty Equivalents 2 • Example • Project A is expected to produce CF = $100 mil for each of 3 years. Given a risk-free rate of 6%, a market risk premium of 8%, and beta of 0.75, what is the PV of the project? r rf rm rf 0.06 0.75 0.08 0.12, or 12% • Project A Year Cash Flow PV at 12% 1 100 89.3 2 100 79.7 3 100 71.2 Total PV 240.2 57 Valuation by Certainty Equivalents 3 • Example: Project A is expected to produce CF = $100 mil for each of 3 years. Given a risk-free rate of 6%, a market premium risk of 8%, and beta of 0.75, what is the PV of the project? • Then assume that the cash flows change but are RISK FREE (CEQ). What is the new PV? Year 1 100 94.6 1.054 100 89.6 1.0542 100 Year 3 84.8 1.0543 Year 2 The difference between the 100 and the certainty equivalent (94.5) is 5.4% This % can be considered as the annual premium on a risky cash flow. Certain Equivalent Cash Flow (CEQ) = (Risky Cash Flow) / (1.054) 58 End of Lecture Thank you for your attention! 04/09/2023 59