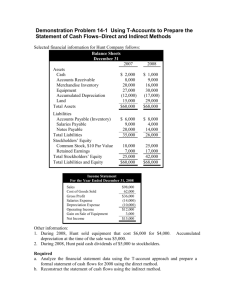

International Management Institute, New Delhi Post Graduate Diploma in Management | Batch 2023-25 Financial Management I | Term II Group Project Guidelines The title of the project will be “Financial Management I Project.” Every group is required to choose one industry and the group is further required to select as many number of companies from the selected industry as there are members in the group for conducting the analysis.1 The final submission should be one report (word document format) and one Excel workbook per group synthesizing the objectives, hypothesis, data analysis and findings of each company, thereby deriving a meaningful conclusion at the industry level. The data can be collected from the annual reports of the companies or financial websites such as Screener, TradingView, MoneyControl etc. or databases like Prowess IQ, Bloomberg, Ace Equity etc. The analysis will focus on the following four parameters – investment in non-current assets, cost of different sources of capital, weighted average cost of capital (WACC) and firm performance. The analysis relating to these parameters are segregated into two parts as follows: Impact of investment decision on financial performance (using previous 15 years’ data i.e., I. from FY 2008-2009 to FY 2022-2023 for analysis) • Analyze the relationship between cash outflow due to purchase of property, plant and equipment (or cash outflow due to purchase of investments) and average return on total assets for the following three years. • Analyze the relationship between cash outflow due to purchase of property, plant and equipment (or cash outflow due to purchase of investments) and average return on equity for the following three years. • Analyze the relationship between cash outflow due to purchase of property, plant and equipment (or cash outflow due to purchase of investments) and stock returns for the following period of three years. 1 The instructor will circulate a Google spreadsheet in this regard and each group must select one industry on first-come-first-served basis and also finalize the respective companies from that industry at the earliest to avoid any overlap with other groups. 1 • Analyze the relationship between cash outflow due to purchase of property, plant and equipment (or cash outflow due to purchase of investments) and average price-to-earnings ratio for the following three years. Based on your findings, each group is required to shed light on the theoretical reasoning behind the relationships mentioned above. Each group may use techniques like graphs, correlation, regression, etc. for conducting the analysis. II. Analysis of Cost of Capital (for financial year 2022-2023 only): • Each group is required to compute the cost of debt. • Each group is required to compute the cost of preference shares (if the company has preference shares in its capital structure). • Each group is required to compute the cost of equity (using dividend discount models, if applicable and capital asset pricing model i.e. CAPM). For CAPM, each group is required to compute beta by taking past three years’ weekly data of the company and BSE 500 or NSE 500 as the proxy for market returns. • Each group is required to compute the overall WACC using market weights. • Each group needs to make and state assumptions clearly, if any. Each group is required to support all their findings and analysis with logical arguments and facts/information given in the annual reports of the companies. Submission Details: Deadline: 20th January 2024, by EOD. The project report (in Word document format) and Excel workbook (with raw data and analysis) are to be submitted in the soft copy format on Google Drive. The link for the drive is to be created by the academic secretaries of each section separately. There will be a penalty of 1 mark per day for late submissions. Note: To mitigate free-riding problems, every group is required to mention the credit statement (on the last page) stating the contribution of each student in the group. Each group is encouraged to contact the concerned faculty for doubts and concerns related to the group project. 2