Demonstration Problem 14-1 Using T

advertisement

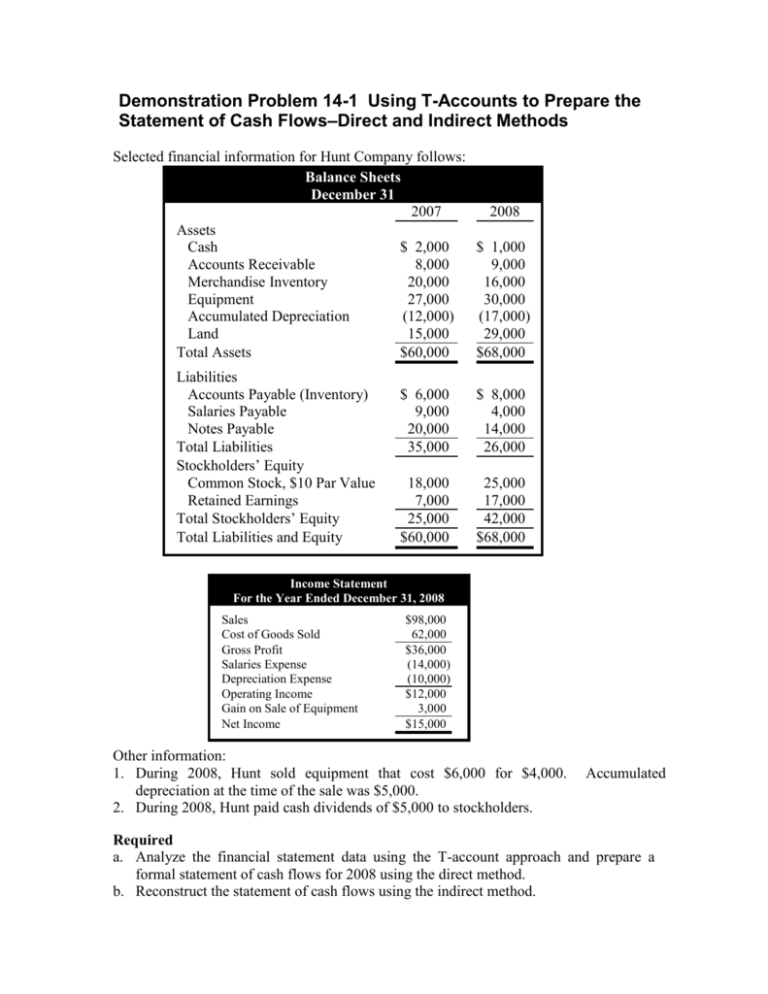

Demonstration Problem 14-1 Using T-Accounts to Prepare the Statement of Cash Flows–Direct and Indirect Methods Selected financial information for Hunt Company follows: Balance Sheets December 31 2007 2008 Assets Cash $ 2,000 $ 1,000 Accounts Receivable 8,000 9,000 Merchandise Inventory 20,000 16,000 Equipment 27,000 30,000 Accumulated Depreciation (12,000) (17,000) Land 15,000 29,000 Total Assets $60,000 $68,000 Liabilities Accounts Payable (Inventory) Salaries Payable Notes Payable Total Liabilities Stockholders’ Equity Common Stock, $10 Par Value Retained Earnings Total Stockholders’ Equity Total Liabilities and Equity $ 6,000 9,000 20,000 35,000 $ 8,000 4,000 14,000 26,000 18,000 7,000 25,000 $60,000 25,000 17,000 42,000 $68,000 Income Statement For the Year Ended December 31, 2008 Sales Cost of Goods Sold Gross Profit Salaries Expense Depreciation Expense Operating Income Gain on Sale of Equipment Net Income $98,000 62,000 $36,000 (14,000) (10,000) $12,000 3,000 $15,000 Other information: 1. During 2008, Hunt sold equipment that cost $6,000 for $4,000. depreciation at the time of the sale was $5,000. 2. During 2008, Hunt paid cash dividends of $5,000 to stockholders. Accumulated Required a. Analyze the financial statement data using the T-account approach and prepare a formal statement of cash flows for 2008 using the direct method. b. Reconstruct the statement of cash flows using the indirect method. Demonstration Problem 14-1 Accounts a. Work Paper T- T-Accounts Cash Bal. 2,000 Operating Activities Investing Activities Accounts Payable Common Stock Salaries Payable Retained Earnings Financing Activities Notes Payable Bal. 1,000 Accounts Receivable Merchandise Inventory Equipment Accumulated Dep. Land Demonstration Problem 14-1 a. Work Paper Statement of Cash Flows—Direct Method Hunt Company Statement of Cash Flows For the Year Ended December 31, 2004 Cash Flows from Operating Activities Cash Inflow from Revenue Cash Outflow for Inventory Cash Outflow for Salaries Expense Net Cash Flow from Operating Activities Cash Flows from Investing Activities Cash Inflow from Equipment Sale Cash Outflow for Equipment Purchase Cash Outflow for Land Purchase Net Cash Flow from Investing Activities Cash Flows from Financing Activities Cash Inflow from Stock Issue Cash Outflow for Debt Payment Cash Payments for Dividends Net Cash Flow from Financing Activities Net Decrease in Cash Beginning Cash Balance Ending Cash Balance Demonstration Problem 14-1 b. Work Paper Statement of Cash Flows—Indirect Method Hunt Company Statement of Cash Flows For the Year Ended December 31, 2004 Cash Flows from Operating Activities Net Income Add Depreciation Expense (noncash) Decrease in Inventory Increase in Accounts Payable Deduct Increase in Accounts Receivable Decrease in Salaries Payable Gain on Sale of Equipment Net Cash Flow from Operating Activities $ 22,000 Cash Flows from Investing Activities Cash Inflow from Equipment Sale Cash Outflow for Equipment Purchase Cash Outflow for Land Purchase Net Cash Flow from Investing Activities (19,000) Cash Flow from Financing Activities Cash Inflow from Stock Issue Cash Outflow for Debt Payment Cash Payments for Dividends Net Cash Flow from Financing Activities Net Decrease in Cash Beginning Cash Balance Ending Cash Balance (4,000) $(1,000)