Answer to the Homework

advertisement

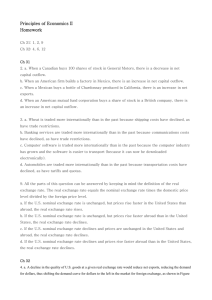

12th Week homework 1. 2. 3. 4. Questions for Review: Q2., Q3., Q4.(p694) Problems and Applications: Q4., Q8.,Q11.(p694-695) Questions for Review: Q1., Q4.(p716) Problems and Applications: Q6., Q9., Q12(p717-719) **Answer** 1. Questions for Review: Q2., Q3., Q4. Q2. Saving equals domestic investment plus net capital outflow, since any dollar sav ed can be used to finance accumulation of domestic capital or it can be use d to finance the purchase of capital abroad. Q3. If a dollar can buy 100 yen, the nominal exchange rate is 100 yen per dollar. The real exchange rate equals the nominal exchange rate times the domestic price divided by the foreign price, which equals 100 yen per dollar times $ 10,000 per American car divided by 500,000 yen per Japanese car, which eq uals 2 Japanese cars per American car. Q4. The economic logic behind the theory of purchasing-power parity is that a good must sell for the same price in all locations. Otherwise, people would pro fit by engaging in arbitrage. 2. Problems and Applications: Q4., Q8., Q11. Q4. a. When an American cellular phone company establishes an office in the Czec h Republic, U.S. net capital outflow increases, because the U.S. comp any makes a direct investment in capital in the foreign country. b. When Harrod's of London sells stock to the General Electric pension fund, U.S. net capital outflow increases, because the U.S. company m akes a portfolio investment in the foreign country. c. When Honda expands its factory in Marysville, Ohio, U.S. net capital outflow declines, because the foreign company makes a direct invest ment in capital in the United States. d. When a Fidelity mutual fund sells its Volkswagen stock to a French i nvestor, U.S. net capital outflow declines (if the French investor pays in U.S. dollars), because the U.S. company is reducing its portfolio i nvestment in a foreign country. Q8. All the parts of this question can be answered by keeping in mind the definition of the real exchange rate. The real exchange rate equals the nominal exchange rat e times the domestic price level divided by the foreign price level. a. If the U.S. nominal exchange rate is unchanged, but prices rise faster in the United States than abroad, the real exchange rate rises. b. If the U.S. nominal exchange rate is unchanged, but prices rise faster abroad than in the United States, the real exchange rate declines. c. If the U.S. nominal exchange rate declines, and prices are unchanged in the United States and abroad, the real exchange rate declines. d. If the U.S. nominal exchange rate declines, and prices rise faster abr oad than in the United States, the real exchange rate declines. Q11. a. To make a profit, you would want to buy rice where it is cheap and sell it where it is expensive. Since American rice costs 100 dollars per bu shel, and the exchange rate is 80 yen per dollar, American rice costs 100 x 80 equals 8,000 yen per bushel. So American rice at 8,000 y en per bushel is cheaper than Japanese rice at 16,000 yen per bushel. So you could take 8,000 yen, exchange them for 100 dollars, buy a bushel of American rice, then sell it in Japan for 16,000 yen, making a profit of 8,000 yen. As people did this, the demand for American rice would rise, increasing the price in America, and the supply of J apanese rice would rise, reducing the price in Japan. The process w ould continue until the prices in the two countries were the same. b. If rice were the only commodity in the world, the real exchange rate between the United States and Japan would start out too low, then r ise as people bought rice in America and sold it in Japan, until the re al exchange became one in long-run equilibrium. 3. Questions for Review: Q1., Q4. Q1. The supply of loanable funds comes from national saving. The demand for loa nable funds comes from domestic investment and net capital outflow. Supply in the market for foreign-currency exchange comes from net capital outflo w. Demand in the market for foreign-currency exchange comes from net ex ports. Q4. Capital flight is a large and sudden movement of funds out of a country. Capit al flight causes the interest rate to increase and the exchange rate to depre ciate. 4. Problems and Applications: Q6., Q9., Q12 Q6. a. When the French develop a strong taste for California wines, the dem and for dollars in the foreign-currency market increases at any given real exchange rate, as shown in Figure 6. b. The result of the increased demand for dollars is a rise in the real e xchange rate. c. The quantity of net exports is unchanged. Figure 6 Q9. a. If the elasticity of U.S. net capital outflow with respect to the real interest r ate is very high, the lower real interest rate that occurs because of t he increase in private saving will increase net capital outflow a great deal, so U.S. domestic investment will not increase much. b. Since an increase in private saving reduces the real interest rate, ind ucing an increase in net capital outflow, the real exchange rate will d ecline. If the elasticity of U.S. exports with respect to the real exch ange rate is very low, it will take a large decline in the real exchang e rate to increase U.S. net exports by enough to match the increase in net capital outflow. Q12. a. When U.S. mutual funds become more interested in investing in Canada, Can adian net capital outflow declines as the U.S. mutual funds make port folio investments in Canadian stocks and bonds. The demand for loa nable funds shifts to the left and the net capital outflow curve shifts to the left, as shown in Figure 11. As the figure shows, the real int erest rate declines, thus reducing Canada’s private saving, but increas ing Canada’s domestic investment. In equilibrium, Canadian net capita l outflow declines. b. Since Canada's domestic investment increases, in the long run, Canad a's capital stock will increase. c. With a higher capital stock, Canadian workers will be more productiv e (the value of their marginal product will increase) so wages will ris e. Thus Canadian workers will be better off. d. The shift of investment into Canada means increased U.S. net capital out flow. As a result, the U.S. real interest rises, leading to less domestic in vestment, which in the long run reduces the U.S. capital stock, lowers th e value of marginal product of U.S. workers, and therefore decreases the wages of U.S. workers. The impact on U.S. citizens would be different f rom the impact on U.S. workers because some U.S. citizens own capital that now earns a higher real interest rate. Figure 11