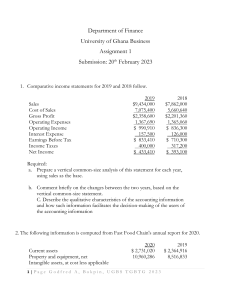

UGBS 205 Fundermental of Accounting ASANTE WISHES YOU WELL Godfred and Rita, UGBS Slide 1 UGBS 205 Fundamentals of Accounting Methods Week 1 – Introduction to Accounting College of Humanities Business School 2017/2018 Overview • The economic history of an organization is essential for decision making. Accounting provides the means for recording/writing the economic history which has facilitated the dealings between business enterprises. Thus, it has been described as the common language of businesses. This session seeks to introduce students to the nature and purpose of accounting. Godfred and Rita, UGBS Slide 3 Learning Objectives • At the end of this session, you should be able to – Define and explain the meaning and purpose of accounting – Understand the accounting process – Identify the sub-fields of accounting and the kind of accounting information they provide. – Explain the types of business organizations and identify their characteristics – Identify the users of accounting information and explain their informational needs – Explain the kinds of financial statements and their purpose(s) Godfred and Rita, UGBS Slide 4 Reading List • Read Chapter 1 of Recommended Text – – Chapter 1 of Marfo-Yiadom, Asante & Tackie (2015) – Chapter 1 of Wood, F. & Sangster, A. (2008). Frank Wood’s Business Accounting 1. Volume 1. Pearson Education. • Other Financial Accounting text books available to students Godfred and Rita, UGBS Slide 5 What is Accounting? Identification Communication Godfred and Rita, UGBS It is a process of identifying, measuring and communicating financial information about an entity to permit informed judgements and decisions by users of the information. 6 Measurement The Purpose of Accounting To provide useful financial information about economic entities to decision makers Godfred and Rita, UGBS 7 Bookkeeping and Accounting • Bookkeeping is the process of recording daily transactions in a consistent way. It comprises of; • Recording transactions • Posting • Producing invoice • Maintaining ledgers Godfred and Rita, UGBS 8 Accounting Process • • • • • Sales Journal Purchases journal Returns Journal Cashbook General Journal • Sales ledger • Purchases ledger • General ledger JOURNALS LEDGERS FINANCIAL STATEMENTS TRIAL BALANCE • Income statements • Balance Sheets • Cash flow Statements Godfred and Rita, UGBS •Balance off accounts •Adjusted Trial Balance 9 Subfields of Accounting Financial Accounting • The field of accounting that serves external decision makers and is concerned with the preparation of financial statements. Management Accounting • Provision of information to people within the organization for decision making Cost Accounting • Deals with the collection and allocation and control of cost of production or service Taxation • Proper accounting for the incomes and expenditures of taxable entities Auditing • Giving independent assurance as to the true and fair view of financial reports. Public Sector Accounting Godfred and Rita, UGBS • Identification of sources and uses of resources for government entities 10 Business Organizations Profit Motive Activities Godfred and Rita, UGBS A business is an organization in which basic resources (inputs) are assembled and processed to provide goods or services (outputs) to customers. 11 Ownership Types of Business – Profit Motive Profit Oriented Organizations • Businesses set up with the sole aim of making profits. Governmental Organizations • Public sector entities set up to provide public goods and services. Non-Governmental Organizations • Organizations set up to achieve other objectives in society and not for profit Godfred and Rita, UGBS 12 Types of Business - Activities Manufacturing Business • Change basic inputs into goods that are sold to customers. Merchandising Business • Purchase goods from other businesses and sell to customers (either wholesaling or retailing). Service Business • Provide services rather than goods to customers. Godfred and Rita, UGBS 13 Types of Business - Ownership Sole Proprietorship Partnership Company • Owned by a single individual. • Least regulated – registration at the Registrar General Department • Formed by 2 or more individuals. • Operate with partnership agreements (formal or informal). • Regulated by the Private Incorporated Partnership Act (Act 152) of 1962 • Partners could be dormant or active partners. • Owned by one or more persons (shareholders). • Regulated by Companies Code and other statutes. • Formation requires at least 2 directors. • Public or private • Limited (by shares or guarantee) or unlimited Godfred and Rita, UGBS 14 Characteristics of Sole Proprietor Easy Formation Quick Decision Making Difficulty in ownership transfer Godfred and Rita, UGBS Less Expensive to Operate All profits and losses Sole Proprietorship Unlimited Liabilities Limited Source of Funds Lacks Perpetual Succession 15 Characteristics of Partnership Pooling of Skills and Resources Possible disagreement between partners Difficulty in ownership transfer Godfred and Rita, UGBS Severally and jointly liable Share Profits and losses Unlimited Liabilities Partnership Lacks Perpetual Succession Limited Source of Funds 16 Characteristics of Companies Legal separate entity Separation of ownership and Management Share (dividends) /reinvest profits Delayed Decision Making Companies Limited Liabilities Ease in ownership transfer Godfred and Rita, UGBS Perpetual Succession Wide access to raising funds 17 Why Businesses Need Accounting Information Sole Proprietorship • tax collecting purposes. • lending purposes. • Business valuation purposes. Partnership • Fairness in sharing of partnership profits. • Tax purposes • Lending / financing purposes • The purpose of admitting other partners into the partnership. Companies Godfred and Rita, UGBS 18 Users of Accounting Information Internal Users External Users Direct Interest – For example: owners, creditors, customers For example: Management, employees. Indirect interest – For example: government, public, trade unions. Godfred and Rita, UGBS 19 Informational Needs of Users Shareholders / Investors • Investment Decisions • Assess the future profitability and risk of the company; cash generating abilities of the company; the stewardship of management Management • Operating and strategic decisions such as Financing the entity; Investing resources of entity; Managing employees etc. Employees Godfred and Rita, UGBS • The stability and profitability of the company • The ability of the company to provide remuneration, working conditions, retirement benefits , pensions and job security 20 Informational Needs of Users Creditors / Lenders Government / Regulatory Agencies Suppliers Customers Godfred and Rita, UGBS • Assess the company’s ability to pay periodic interest and principal amount; risk of default and its consequences; future prospects for investing and lending decisions; company’s need for additional financing. • Exercise of their supervisory functions. • Reveal trends in the economy • Check and determines entities’ tax liabilities • Determine creditworthiness of companies and in establishing credit terms • Evaluate staying power of their suppliers and supplier relationships, price, product details and conditions of sale 21 Financial Statements Income Statement Notes to the Accounts A statement prepared to provide information on the financial performance, financial position and the cash flows of a business entity Statement of Changes in Equity Godfred and Rita, UGBS Statement of Financial Position(Balance Sheet) Cash Flow Statement 22 Financial Statements Statement of Financial Position • Shows the financial position of an entity at a point in time. • It is a position statement. • It summarizes the assets, liabilities and owners equity of an entity at a particular point in time Income Statement • Shows the financial performance of an entity over a period of time. • It is a periodic statement. • It summarizes the revenue (income) and (expenses) expenditure of an entity over time. Cash Flow Statement • Shows the actual cash inflows and outflows of an entity at a point in time. Godfred and Rita, UGBS 23 Financial Statements Statement of Changes in Equity • Shows the change in owners equity over an accounting period • Net profit or loss during the period attributable to shareholders • Increase or decrease in share capital reserves • Dividend payments to shareholders • Gains and losses recognized directly in equity etc… Notes to the Accounts • Notes provide supplemental information about the financial condition of a company. • Three types . . . • Description of accounting rules and policies adopted and applied. • Presentation of additional detail about an item on the financial statements. • Provision of additional information about an item not on the financial statements. Godfred and Rita, UGBS 24 End of Session Questions • Distinguish between the following – Cost Accounting and Management Accounting – Bookkeeping and Accounting • What are the information needs of the following accounting information users: – Financial Analysts – Auditors – Public Godfred and Rita, UGBS 25 UGBS 205 Fundamentals of Accounting Methods Week 2 – Accounting concepts, principles, bases and standards College of Humanities Business School 2017/2018 Overview • The different users of financial information and their information needs make it necessary that a common framework for the preparation and presentation of information in the financial statement be adopted. This is important because the different users of financial information have different interests. This session seeks to introduce students to the general concepts, principles, bases and standards underlying the preparation of financial statements. Bekoe, Asare, Donkor and Appiagyei, UGBS Slide 27 Learning Objectives • At the end of this session, you should be able to – Explain the conceptual framework of accounting – Identify the elements in the International Accounting Standard Board’s (IASB’s) conceptual framework of accounting – State and explain the qualitative characteristics of accounting information – Explain accounting standards and their importance – Explain and apply the fundamental concepts and principles of accounting – Explain the different bases of accounting Bekoe, Asare, Donkor and Appiagyei, UGBS Slide 28 Reading List • Read Chapter 10 of Recommended Text – – Chapters 2 & 3 of Marfo-Yiadom, Asante & Tackie (2015) – Chapter 10 of Wood, F. & Sangster, A. (2008). Frank Wood’s Business Accounting 1. Volume 1. Pearson Education. • Other Financial Accounting text books available to students Bekoe, Asare, Donkor and Appiagyei, UGBS Slide 29 Conceptual Framework Framework for setting accounting standards No repetition of Fundamental principles Bekoe, Asare, Donkor and Appiagyei, UGBS Statement of principles which provide generally accepted guidance for the development of new reporting practices and for challenging and evaluating the existing practices Basis for resolving disputes 30 Elements of the IASB’s Framework Users of Accounting Information Measurement Informational needs of Users IASB’s Framework Kinds of Financial Statements Recognition Bekoe, Asare, Donkor and Appiagyei, UGBS Characteristics of Financial Statements 31 Qualitative Characteristics of Accounting Information • Complete • Faithful representation • Neutrality • Prudence • Influence user’s decisions • Predictive value • Confirmatory value • Timeliness RELEVANCE COMPARABILITY • Similarities and differences can be discerned and evaluated • Consistency • Disclosure of accounting policies Bekoe, Asare, Donkor and Appiagyei, UGBS RELIABILITY UNDERSTANDA BILITY • Explain complex matters 32 Generally Accepted Accounting Principles (GAAP) GAAP The term used to describe how financial statements are prepared in a given environment It changes with time in accordance with changes in business environment Sources of GAAP Regulatory framework Bekoe, Asare, Donkor and Appiagyei, UGBS Statutes Accounting Standards Best Practices 33 Accounting Concepts and Principles Accounting Concepts • Broad assumptions, which underlie the preparation of periodic financial accounts of business enterprises. Accounting Principles • General decision rules derived from the objectives and the theoretical concepts of accounting that govern the development of accounting techniques Bekoe, Asare, Donkor and Appiagyei, UGBS 34 Accounting Techniques and Bases Accounting Techniques • Specific rules derived from accounting principles that account for specific transactions and events faced by the entity. E.g. provision for depreciation Accounting Bases • These are particular methods which have evolved and developed for expressing or applying the concepts of the recording of financial transactions e.g. depreciation methods Bekoe, Asare, Donkor and Appiagyei, UGBS 35 Accounting Policies and Standards Accounting Policies • The specific accounting principles and methods of applying those principles judged by business entities to be most appropriate to their company’s circumstances and adopted in the preparation and presentation of their financial statements. Accounting Standards • Provide guidelines relating to the accounting treatment as well as reporting of important accounting items with a view to standardize the diverse accounting procedures or policies Bekoe, Asare, Donkor and Appiagyei, UGBS 36 APPLICABLE ACCOUNTING STANDARDS Ghana International Financial Reporting Standards (IFRS) International Public Sector Accounting Standards (IPSAS) Others US GAAP Australian Accounting Standards International Standards on Auditing Bekoe, Asare, Donkor and Appiagyei, UGBS 37 Fundamental Accounting Concepts Going Concern Concept Accrual (Matching) Concept Bekoe, Asare, Donkor and Appiagyei, UGBS • A business will continue in operational existence for the foreseeable future, and that there is no intension to put the company into liquidation or to cease its operations. • Assets of the business should not be valued at their realizable/saleable value. • The effects of transactions and events should be recognised when they occur and recorded in the accounting books and reported in the financial statements in the period in which they relate. • Basis for preparation of financial statements 38 Accounting Concepts Business Entity Concept A business is distinct and separate from its owners. Capital provided by the owner is reckoned as liability of the firm. Bekoe, Asare, Donkor and Appiagyei, UGBS Money Measurement Concept Financial accounting should record only transactions which can be measured in monetary terms. Money does not have a constant value through time. 39 Accounting Concepts Prudence (Conservatism) Concept Historical Cost Concept Where alternative procedures, or alternative valuations, are possible, the one selected should be the one which gives the most cautious presentation of the business’s financial position or results. Assets and expenses should be shown at acquisition cost and not current market value (i.e. their actual cost to the business) Do not anticipate for profit but to make provision for all possible losses. Objectivity and Verifiability. Bekoe, Asare, Donkor and Appiagyei, UGBS 40 Accounting Concepts Consistency Concept Periodicity (Time Interval) Concept It requires that there is consistency of accounting treatment of like terms within each accounting period and from one period to the next. Financial statements should be prepared and produced at regular intervals. Similar items should be accorded similar accounting treatments Ensure effective internal decision making. Bekoe, Asare, Donkor and Appiagyei, UGBS An entity’s life is divided into time periods. 41 Accounting Concepts Materiality Concept Only material items are recorded and presented on financial statements. Requires full disclosure of all important / significant / material information or events Bekoe, Asare, Donkor and Appiagyei, UGBS Substance Over Form Concept The economic substance of a transaction should be reflected in the accounts , rather than simply the legal form Under pins accounting for leasing, hire purchase etc. 42 Accounting Concepts Duality Concept Every transaction has two effects or aspects. The basis of the double entry system of book keeping. Bekoe, Asare, Donkor and Appiagyei, UGBS 43 Bases of Accounting Cash Bases Revenues are recognized when cash is received and expenses are recognized when cash is paid. Bekoe, Asare, Donkor and Appiagyei, UGBS Accrual Bases Revenues and expenses are recognized on an economic basis regardless of the actual cash flow. 44 UGBS 205 Fundamentals of Accounting Methods Week 3 – Recognition and Measurement of Elements of Financial Statements College of Humanities Business School 2017/2018 Overview • This session presents the various elements of financial statements and how they are recognized and measured. It further examines how the elements in financial statements relate to each other. Godfred and Rita, UGBS Slide 46 Learning Objectives • At the end of this session, you should be able to – – – – Identify the components of financial statements Discuss the elements of financial statements Explain the accounting equation Determine the effects of transactions on the accounting equation – Explain the concept of double entry in accounting Godfred and Rita, UGBS Slide 47 Reading List • Read Chapter 1 and 10 of Recommended Text – – Chapters 4 & 6 of Marfo-Yiadom, Asante & Tackie (2015) – Chapters 1 and 10 Wood, F. & Sangster, A. (2008). Frank Wood’s Business Accounting 1. Volume 1. Pearson Education. • Other Financial Accounting text books available to students Godfred and Rita, UGBS Slide 48 Classes of Financial Statements • Do you recall the components of financial statements prepared by business organizations? Godfred and Rita, UGBS Slide 49 Classes of Financial Statements Financial statements can be classified into; –General Purpose Financial Statements • Information to wide range of users –Special Purpose Financial Statements • Information to a particular user or group Godfred and Rita, UGBS 50 Elements of Financial Statements • • • • • Income Expenses Assets Liabilities and Equity – Are the elements of the financial statements – Hence they are the building blocks used in constructing financial statements Godfred and Rita, UGBS Slide 51 Elements of Financial Statements Directly related to performance • Income • Expenses Directly related to financial position Godfred and Rita, UGBS 52 • Assets • Liabilities • Equity Assets Economic resources Probable future economic benefits obtained or controlled by a particular entity as a result of past transactions or events Godfred and Rita, UGBS 53 Classification of Assets Current Assets • Assets from which future economic benefits are expected to flow to the entity in not more than a year after the reporting period • The intention to turn them into cash within one year • Examples; inventories/stock, trade receivables/debtors, accounts receivables/prepayments, bank, cash etc… NonCurrent Assets • Assets from which future economic benefits are expected to flow to the entity in more than a year after the reporting period • Acquired for continuing use within the business with a view to earning income or making profit from its use • Not acquired for resale • Examples; Land & building, plant & machinery, motor vehicles, fixtures and fittings, goodwill Godfred and Rita, UGBS 54 Liabilities Present obligations Probable future sacrifices of economic benefits arising from present obligations to transfer assets or provide services to other entities in the future as a result of past transactions or events Godfred and Rita, UGBS 55 Classification of Liabilities Current liability • Liability that is required to be settled in not more than a year after the reporting period • Examples; Trade payables/creditors, accounts payable/accruals, bank overdraft, short-term loans etc… Noncurrent liability • Liability that is required to be settled in more than a year after the reporting period • Examples; Long-term loan, debentures, bonds (issued) Godfred and Rita, UGBS 56 Equity or Net assets Stated Capital (Share Capital) Owners contribution to the business in the form of assets, cash or other forms of contribution. The residual interest in assets of the business after deducting all its liabilities. Godfred and Rita, UGBS 57 Income Occur in the form of Increases in economic benefits which result in increase in equity Godfred and Rita, UGBS 58 • Increase in assets • Reduction in liabilities Classification of Income Revenue Gains Godfred and Rita, UGBS • From delivering or producing goods, rendering services, or other activities that constitute the entity’s ongoing major or central operations • From peripheral or incidental transactions of an entity 59 Expenses Occur in the form of • Outflows or depletions of assets • Incurrences of liabilities Expenses are decreases in economic benefits that result in decreases in equity Godfred and Rita, UGBS 60 Expenses and Losses • Expenses and Losses lead to decrease in economic benefits that result in decreases in equity. • However; – Expenses arise in the course of ordinary activities of a business – Losses arise from peripheral activities • recognition criteria • Bases of measurements Godfred and Rita, UGBS 18 Recognition and Measurement of Elements in Financial Statements Godfred and Rita, UGBS Slide 62 Recognition What is meant by “recognition”? The process of including in the financial statement an item that meets the definition of an element of financial statement and the fundamental recognition criteria Godfred and Rita, UGBS 63 Fundamental Recognition Criteria • For an element to be recognized in the financial statement, it must meet the fundamental recognition criteria; – Definition – Measurability – Relevance – Reliability Godfred and Rita, UGBS Slide 64 Fundamental Recognition Criteria • Definitions – The item meets the definition of an element of financial statements. • Measurability – The item has a relevant attribute measurable with sufficient reliability • Relevance – The information about it is capable of making a difference in user decisions • Reliability – The information about it is representationally faithful, verifiable, and neutral Godfred and Rita, UGBS 65 Recognition of Elements • Asset – Probable that future economic benefits will flow to the enterprise – Item has cost or value that can be measured reliably • Liability – Probable outflow of resources embodying economic benefits from the settlement of obligation – Amount to be settled can be measured reliably Godfred and Rita, UGBS 66 Recognition of Elements • Income – When increase in future economic benefits related to an increase in an asset or a decrease of a liability has arisen and can be measured reliably • Expense – When decrease in future economic benefits related to a decrease in an asset or an increase of a liability has arisen and can be measured reliably Godfred and Rita, UGBS 67 Measurement What does “measurement” mean? Putting monetary amount on an element of financial statement Godfred and Rita, UGBS 68 Bases of measurement Historical Cost • Based on acquisition cost or the original cost of the item Current (Replacement) value •Based on the cost that will be incurred in acquiring a similar item on the market in its current state Net Realizable (Settlement) Value •Based on the net amount that would be realized in the event of disposing off the item Present (Discounted) Value Godfred and Rita, UGBS •Based on the discounted future cash flows associated with the usage of the item. 69 DOUBLE ENTRY AND ACCOUNTING EQUATION Godfred and Rita, UGBS 70 Accounting Equation • Financial accounting is based upon a simple idea known as Accounting Equation Claims over the resources of the business Resources of a business Godfred and Rita, UGBS 71 Accounting Equation Assets Godfred and Rita, UGBS Liabilities 72 Accounting Equation Equity (Owner’s Equity) Assets Godfred and Rita, UGBS 73 Accounting Equation Assets Godfred and Rita, UGBS Equity (Owner’s Equity) 74 Liabilities Effects of Transactions on Accounting Equation Identify the items involved in the transactions Determine whether the item is an asset, a liability or capital (owner’s equity) Determine whether the item has increased or decreased as a result of the transaction Explain the effect of the transaction on the accounting equation Godfred and Rita, UGBS 75 CHANGES IN COMPONENTS OF ACCOUNTING EQUATION ASSETS Causes of Changes LIABILITIES EQUITY Godfred and Rita, UGBS 76 Double Entry Principle • All transactions affect two items. • Accounting shows the effect of the transactions on the two items by: a debit entry (left of a/c) a credit entry (right of a/c) • Each transaction must have a debit and corresponding credit entry A Debit Entry Godfred and Rita, UGBS 77 A Credit Entry Double Entry Principles Summarized Accounts To record Entry in account Asset Increase Decrease Debit Credit Expense Increase Decrease Debit Credit Liability Increase Decrease Credit Debit Equity Increase Decrease Credit Debit Revenue Increase Decrease Credit Debit Godfred and Rita, UGBS 78 End of Session Questions • What are the elements of financial statements? • Show how each of the following transactions can affect the accounting equation (Statement of Financial Position) – Purchased goods on credit GH¢250,000 from Adwoa – Paid rent expenses for last month with cheque GH¢250 – Sold goods costing GH¢50,000 on credit GH¢ 90,000 to Anas – Returned goods GH¢25,000 to Adwoa a trade payable Godfred and Rita, UGBS Slide 79 UGBS 205 Fundamentals of Accounting Methods Week 4– Recognition and Measurement of Elements of Financial Statements College of Humanities Business School 2017/2018 Overview • The accounting process begins with the recording of transactions. However, transactions are first recorded chronological in details in the books of original entry (journal). This session introduce students to the first stage of recording transactions in the books of original entry, which precedes the double entry. Bekoe, Asare, Donkor and Appiagyei, UGBS Slide 81 Learning Objectives • At the end of this session, you should be able to – Identify the books of accounting and explain their nature and purpose – Identify the kind of transactions to be recorded in each type of journal – Record transactions in the books of original entry Bekoe, Asare, Donkor and Appiagyei, UGBS Slide 82 Reading List • Read Chapter 11, 13 to 18 of Recommended Text – – Chapters 5 & 7 of Marfo-Yiadom, Asante & Tackie (2015) – Chapters 11, 13, 14, 15, 16, 17, 18, and 20 of Wood, F. & Sangster, A. (2008). Frank Wood’s Business Accounting 1. Volume 1. Pearson Education. • Other Financial Accounting text books available to students Bekoe, Asare, Donkor and Appiagyei, UGBS Slide 83 Introduction • Accounting information are recorded first in the prime books / books of original entry / journals. • They are then posted to the ledgers (subsidiary and general ledger) • The main books of accounting are: – Journals – Ledgers Bekoe, Asare, Donkor and Appiagyei, UGBS 84 Books of Original Entry/Journal • A book which records chronologically (i.e. in order of date) and in detail the various transactions of a trader or a business. • It is also known as Day Book because it contains the account of every day's transactions. Bekoe, Asare, Donkor and Appiagyei, UGBS 85 Characteristics of a Journal • It is the first successful step of recording and precedes the double entry system. A transaction is recorded first of all in the journal. • A transaction is recorded on the same day it takes place. • Transactions are recorded chronologically. Bekoe, Asare, Donkor and Appiagyei, UGBS 86 Advantages of a Journal • Each transaction is recorded as soon as it takes place. So possibility of any transaction being omitted from the books of account is minimized. • Since the transactions are kept and recorded in journal chronologically with narration, it can be easily ascertained when and why a transaction has taken place. • As a result ledger is kept tidy and brief. • Journal shows the complete story of a transaction in one entry. • Any mistake in ledger can be easily detected with the help of journal. Bekoe, Asare, Donkor and Appiagyei, UGBS 87 Types of Journals (Books of Original Entry) Sales day book – for credit sales Purchases day book – for credit purchases Returns inwards day book – for returns inwards Returns outwards day book – for returns outwards Cash book – for receipts and payments of cash and cheques General journal – for all other items and unusual transactions. Bekoe, Asare, Donkor and Appiagyei, UGBS 88 Source Documents for Transactions Sales (Credit & Cash) Invoices, Receipts Purchases (Credit & Cash) Invoice, Receipts Returns Debit note, Credit Note Bank Transactions Cheques, bank statements Bekoe, Asare, Donkor and Appiagyei, UGBS 89 Format of Sales/Purchases/Returns Journal Name of Journal Date Bekoe, Asare, Donkor and Appiagyei, UGBS Detail Ref 90 LF Amt Uses of General Journal • Opening Entries – When a businessman wants to open the book for a new year, it is necessary to journalize the various assets and liabilities before the new accounts are opened in the ledger. • Closing Entries – When the books are balanced at the close of the accounting period with a view to prepare final accounts it is necessary that balance of all the income and expenses accounts must be transferred to trading and profit and loss account. Bekoe, Asare, Donkor and Appiagyei, UGBS 91 Uses of General Journal • Rare Transactions Entries – In business it may happen sometimes that transactions are usually rare e.g. the purchase or sale of non-current assets, writing off bad debts. • Correction of Errors – When an error is detected in the books, the same is rectified through an entry in the journal proper • Adjusting Entries – Modification of the accounts at the end of an accounting period is called adjustments. Bekoe, Asare, Donkor and Appiagyei, UGBS 92 Uses of General Journal • Transactions with no special journal such as: – Distribution of goods as free sample. – Distribution of goods as charity. – Goods destroyed by fire. – Goods stolen by employees. – Exchange of one asset for another asset etc. Bekoe, Asare, Donkor and Appiagyei, UGBS 93 Format of General Journal General Journal Date Detail LF Name of the account to be debited Name of the account to be credited The narrative Bekoe, Asare, Donkor and Appiagyei, UGBS 94 Dr Cr Cash Book • A book of original entry in which transactions relating only to cash receipts and payments are recorded in detail. • When cash is received, it is entered on the debit or left hand side of the book. • When cash is paid out, it’s recorded on the credit or right hand side of the cash book. • The cash book, though cash journal it also represents the cash account of the ledger . Bekoe, Asare, Donkor and Appiagyei, UGBS 95 Cash Book • Single column cash book: – Records only cash receipts and payments. It has only one money column on each of the debit and credit sides of the cash book. • Two column cash book: – Consists of two separate columns on the debit side as well as credit side for recording cash and discount. – The discount column on the debit side of the cash book will record discounts allowed and that on the credit side discounts received. Bekoe, Asare, Donkor and Appiagyei, UGBS 96 Cash Book • Three column cash book: – One in which there are three columns on each side - debit and credit side. One is used to record cash transactions, the second is used to record bank transactions and third is used to record discount received and paid. – One main advantage of a three column cash book is that it is very helpful to businessmen, since it reveals the cash and bank deposits at a glance Bekoe, Asare, Donkor and Appiagyei, UGBS 97 Format of Cash Book Single Column Cash Book Date Detail LF Cash Date Detail LF Cash Two (Double) Column Cash Book Date Detail LF Bank Cash Date Detail LF Bank Cash Three (Treble) Column Cash Book Date Det. LF Bekoe, Asare, Donkor and Appiagyei, UGBS Disc Bank Cash Date 98 Det. LF Disc. Bank Cash Petty Cash Book • It is a book in which petty cash (the sum of money kept in hand) expenditures are recorded. • A petty cash book is generally maintained on a columnar basis - a separate column being allotted for each type of expenditure. Bekoe, Asare, Donkor and Appiagyei, UGBS 99 Petty Cash Book • Imprest system – Under this system a fixed sum of money is given to the petty cashier to cover the petty expenses for the month. – At the end of a month the petty cashier submits his statement of petty expenses to the chief cashier for reimbursement (of the same amount spent). – Thus, the imprest for the next month the same as it was at the beginning of the current month. Bekoe, Asare, Donkor and Appiagyei, UGBS 100 Petty Cash Book • Advantages of Imprest System – It acts as a healthy check on the petty cashier. – Petty cash book remains up to date. – It prevents unnecessary accumulation of cash in hand and – Thus the chances of defalcation of cash are minimized. Bekoe, Asare, Donkor and Appiagyei, UGBS 101 Format of Petty Cash Book Analysis of Expenses Receipt Date Details Bekoe, Asare, Donkor and Appiagyei, UGBS Ref Total Postage 102 Stationery T&T Fuel Sundry Books of Accounting for Businesses Bekoe, Asare, Donkor and Appiagyei, UGBS 103 End of Session Questions • Outline the books of original entry used in recording transactions • Identify four uses of the general journal • Explain the imprest system used in the petty cash book. Bekoe, Asare, Donkor and Appiagyei, UGBS Slide 104 UGBS 205 Fundamentals of Accounting Methods Session 5 – Recording transactions in the books of account (Part Two) College of Humanities Business School 2017/2018 Overview • After accounting data are recorded in the books of original entry, they are processed (classified and summarized) for the preparation of financial statements which is the output of the accounting information system. This session introduce students to the process of posting transactions to the various ledgers following the double entry and extraction from the trial balance. Godfred and Rita, UGBS Slide 106 Learning Objectives • At the end of this session, you should be able to – Identify and post transactions into their respective accounts in the ledgers – Identify and explain the types of ledger accounts – Balance and close off ledger accounts at any point in time – Extract and prepare an unadjusted trial balance Godfred and Rita, UGBS Slide 107 Reading List • Read Recommended Text – – Chapter 8 of Marfo-Yiadom, Asante & Tackie (2015) – Chapters 2, 5 and 6 of Wood & Sangster (2008) • Other Financial Accounting text books available to students Godfred and Rita, UGBS Slide 108 Ledgers • It is a book which contains a condensed and classified record of all the pecuniary transactions of the business generally brought, transferred or posted from the books of original entry. • Also called the king of all books of accounts because all entries from the journals must be posted to the various accounts in the ledger. Godfred and Rita, UGBS 109 Features of a Ledger • It has two identical sides - left hand side (debit side) and right hand side (credit side). • The difference of the total of the two sides represent balance on the ledger account. If the total of the two sides are equal there will be no balance. • Usually balance is drawn at the end of year and recorded on the deficit side to make the two sides equal. This balance is known as closing balance. • The closing balance of the current year will be the opening balance of the next year. Godfred and Rita, UGBS 110 Advantages of a Ledger • It is the ledger through which successful application of double entry system of bookkeeping is ensured. • Complete and reliable information is available in respect of each and every account. • It is possible to ascertain the amount of income and expenditure under each head and the overall result at the year end through trading and profit and loss account. • It is, therefore, possible to ascertain the value of different assets and liabilities and the true financial position at the year end through balance sheet. • The possibility of errors and defalcations is remote. Godfred and Rita, UGBS 111 Types of Ledgers A ledger contains details of assets, liabilities, capital, income and expenditure. Subsidiary ledgers Sales Ledger – for personal accounts of customers Purchases ledger – for personal accounts of suppliers Main ledger (General ledger) – for all other double entry accounts. Godfred and Rita, UGBS 112 An Account • It is an explanation, a record, a summary or a history of similar or particular transactions or events. • Is a standardized format that organizations use to accumulate the monetary effect of transactions on each financial statement item. • It is a tool for summarizing transaction effects for each account, determining balances, and drawing inferences about a companies activities. Godfred and Rita, UGBS 113 Types of Accounts Godfred and Rita, UGBS 114 Format of an Account Dr Date Name of Account Detail Godfred and Rita, UGBS Folio Amount Date 115 Cr Detail Folio Amount Posting Credit Sales Godfred and Rita, UGBS 116 Posting Credit Purchases Godfred and Rita, UGBS 117 Posting Returns Godfred and Rita, UGBS 118 Balancing-off Accounts • At the end of the period, the totals of the debit side of an account should be equal to the totals of the credit side (duality concept). • To balance off accounts means to put in a balancing figure (striking a balance) in an account. • The balancing figure should begin the next period as either an asset or a liability. Godfred and Rita, UGBS 119 How to Balance-off Accounts • Cast (sum up) both the debit and credit entries of the account and note them. • Whichever is larger becomes the totals of both sides of the account. • Determine the difference between the sums noted (this is the balancing figure). • Insert the balancing figure at the side with the smallest sum so that both sides are equal (this is the balance c/d or c/f ). Godfred and Rita, UGBS 120 How to Balance-off Accounts • Transfer the balancing figure to the opposite side of the account where balance c/d is, below the totals. (this is balance b/d or b/f). • The balance c/d should have the date of the last day of the period and the balance b/d should have the date of day beginning the period. • The side of the account where the balance b/d is determines the name of the account balance. Godfred and Rita, UGBS 121 Trial Balance • Trial balance is the list of all credit and debit balances on the various accounts at a particular point in time (usually shown in debit and credit columns). • The sum of the debit side of the and that of the credit side of the trial balance should agree. • It is used to test the accuracy of double entry book keeping. Godfred and Rita, UGBS 122 Trial Balance • It helps in identifying and detecting book keeping errors. – Whether each debit had a corresponding credit entry – Whether debit and credit entries have correctly been cast – Whether account balances have been correctly calculated and recorded • It is used to prepare financial statements as it links ledger accounts and financial statements. Godfred and Rita, UGBS 123 End of Session Questions • What are the advantages of having different journals in a business? • What is the difference between trade discount and cash discount? • Explain the difference between journals and ledgers. Godfred and Rita, UGBS 124 UGBS 205 Fundamentals of Accounting Methods Week 7– Control Accounts College of Humanities Business School 2017/2018 Overview • In a manual accounting system, there are bound to be errors in the recording and posting of transactions to the various ledgers. Controls are therefore set up to minimize errors in the accounting information systems. This session examines a type of accounting control used to check the arithmetical accuracy of the double entry records in the ledger. Godfred and Rita, UGBS Slide 126 Learning Objectives • At the end of this session, you should be able to – Explain Control Accounts – Understand the purpose of control accounts – Identify and prepare the Sales Ledger/Debtors Ledger Control Accounts and Purchases Ledger/Creditors Ledger Control Accounts Godfred and Rita, UGBS Slide 127 Reading List • Read Recommended Text – – Chapter 16 of Marfo-Yiadom, Asante & Tackie (2015) – Chapters 31 of Wood & Sangster (2008 • Other Financial Accounting text books available to students Godfred and Rita, UGBS Slide 128 Meaning of Control Accounts • Control account refers to an account that picks the summary of all transactions posted into the individual accounts in a given ledger. • An A/c in the general ledger to control individual A/Cs in a subsidiary Ledger • Used to check the accuracy of the entries in the individual accounts • Examples of control accounts could include:– The sales ledger control account, which summarizes the individual customer accounts – The purchases ledger control account, which summarizes the individual supplier accounts • It is built with the totals of all transactions that have individually been posted into the various accounts. Godfred and Rita, UGBS 129 Purposes/Functions of Control Accounts • Locate errors; – Control A/c balance must be the same as the totals of balances on individual A/c’s in relevant subsidiary ledger • Provide a summary of the total of debtors and creditors • Cross-check to avoid fraud • Facilitates quick decision making • Facilitates the preparation of trial balance and final accounts Godfred and Rita, UGBS 130 Kinds of Ledgers & Control Accounts • General Ledger • Subsidiary Ledgers; –Sales Ledger or Debtors Ledger –Purchase Ledger or Creditors Ledger Godfred and Rita, UGBS 131 Kinds of Ledgers & Control Accounts Control A/Cs: Receivables/Sales Ledger Control A/C – Used to keep track of all transactions with credit customers or debtors Payables/Purchases Ledger Control A/C – Used to keep track of all transactions with credit suppliers or creditors Godfred and Rita, UGBS 132 Sales Ledger Control Account Sales Ledger Control Account Balance b/d xxx Balance b/d Sales (credit) xxx Sales returns Cash/Bank refunds xxx Cash/Bank Bank (Dishon’d cheques) xxx Discounts allowed Interest on overdue bals xxx Balance set offs Bad debts recovered xxx Bad debts written off Bills receivables dishon’d xxx Bills receivables Balance c/d xx Balance c/d xxx Balance b/d xxx Balance b/d Godfred and Rita, UGBS 133 xx xxx xxx xxx xxx xxx xxx xxx xxx xx Sources of information for Debtors Control Account • • Item Opening debtors • • • Credit sales • • • Returns inwards Cash and cheques received • • • • Bad debts written off • • Discount allowed Closing debtors Godfred and Rita, UGBS • • 134 Source Debtors schedule or list from the previous period Totals on sales daybook or sales journal for the current period Returns inwards journal totals Cashbook total for receipts from debtors on the receipts side. General journal entries to that effect Cashbook debit side Debtors schedule or list from the end of the period Purchases Ledger Control Account Purchases Ledger Control Account Balance b/d xxx Balance b/d xxx Purchases returns xxx Purchases (credit) xxx Cash/Bank xxx Cash/cheque refunds xxx Discounts received xxx Interest on overdue bals. xxx Bills payables xxx Bills payables dishon’d. xxx Balance set offs xxx Balance c/d xxx Balance c/d xxx xxx xxx Balance b/d xxx Balance b/d xxx Godfred and Rita, UGBS 135 Sources of information for Creditors Control Account • Item • Opening creditors • Credit purchases • Returns outwards • Cash and cheques paid to creditors • Discount received • Closing creditors Godfred and Rita, UGBS • Source • creditors schedule or list from the previous period • Totals on Purchases daybook or purchases journal for the current period • Returns outwards journal totals • Cashbook total for payments to creditors on the payment/credit side. • Cashbook credit side • creditors schedule or list from the end of the period 136 UGBS 205 Fundamentals of Accounting Methods Week 8– Bank Reconciliation Statement College of Humanities Business School 2017/2018 Overview • This session seeks to discuss the information value of obtaining a reliable bank balance. Thus, students will go through the process of reconciling the bank balance in the cash book, which is unreliable, with the bank statement balance. Godfred and Rita, UGBS Slide 138 Learning Objectives • At the end of this session, you will be able to – To explain the need for Bank reconciliation statement – To explain the relevance of proper documentation for reconciliation purposes – To identify the causes of the differences between the balances on cash book and bank statements – To identify the main reasons why banks dishonour cheques – Reconcile cash book balances with bank statement balances Godfred and Rita, UGBS Slide 139 Reading List • Read Recommended Text – : - Chapter 11 of Marfo-Yiadom, Asante & Tackie (2015) - Chapters 30 of Wood & Sangster(2008) • Other Financial Accounting text books available to students Godfred and Rita, UGBS Slide 140 Introduction • Businesses keep records of both cash and cheque transaction in a cash book. • Nature of cash book – The debit side of the cash book is used for recording receipts – The credit side is used for recording payments Godfred and Rita, UGBS 141 Introduction • When amounts are paid into the business bank account, the bank also credits the business account and the cash book is debited. • Similarly, when cheques are drawn, the bank debits the business current account with the amount as soon as they are presented and honored and the cash book is credited. Godfred and Rita, UGBS 142 Introduction • What appears on the debit side of the cash book appears on the credit side of the current account in the bank’s books, and vice versa. • It follows therefore that all things being equal the two books should have the same balance. But rarely will the cash book balance agree with the balance shown on the bank statement. • Because of this possible discrepancy, there is the need to reconcile the two records (cash book and bank statement balance). Godfred and Rita, UGBS 143 Causes of differences/discrepancies • The causes of the differences between the two records are; – Informational differences • Differences arising from information available to bankers but not the entity – Timing Differences • Differences arising from the different times of recording by the entity’s cashier and the bankers Godfred and Rita, UGBS Slide 144 Causes of differences/discrepancies • Timing differences – Unpresented cheques – Cheques issued out by the entity but yet to be presented to the bankers or presented to the bankers but yet to clear – Uncredited cheques – Cheques received and deposited by the entity but yet to be credited by the bank – Bank errors; – wrong credits; errors by the bank that increases an entities balance – wrong debits; errors by the bank that decreases an entities balance Godfred and Rita, UGBS 145 Causes of differences • Informational differences – Standing order – Direct debit – Credit transfers – Bank charges – Dishonoured cheques etc… Godfred and Rita, UGBS 146 Reasons for dishonouring cheques • • • • • • • Stale cheques Insufficient funds Insufficient mandate Amount in words different from amount in figures Post dated cheques No signature of account holder Signature differs from bank specimen Godfred and Rita, UGBS 147 The need for a reconciliation statement • A BRS is a statement that is prepared to bring into agreement the difference between the cash book balance and the bank statement balance. • Who prepares this statement? Godfred and Rita, UGBS 148 The Reconciliation Process – Adjust the cash book with the informational difference: • Bring down the balance of the original cash book into the adjusted cash book • Enter on the credit side of the cash book all items not previously entered but appeared on the debits of the bank statement e.g. bank charges • Enter on the debit side of the cash book items that appeared on the credit side of the bank statement but not previously entered in the cash book Godfred and Rita, UGBS 149 The Reconciliation Process • Prepare the BRS using the timing differences: – Information entered in the cash book not yet recorded by the bank on the bank statement namely; unpresented cheques and uncredited cheques – Common errors by the bank (wrong debit and wrong credit) Godfred and Rita, UGBS 150 Format of BRS Bank Reconciliation Statement as at 30-09-2014 Gh¢ Gh¢ **** **** **** **** **** **** **** (****) **** Balance as per adjusted cash book Add Unpresented cheques wrong credit Less Uncredited cheques wrong debit Balance as per bank statement Godfred and Rita, UGBS 151 End of Session Questions • Is bank reconciliation necessary for businesses? Explain • What are the main causes of discrepancies between the cash book balance and the bank statement balance • Identify any four reasons for the dishonor of cheques by banks Godfred and Rita, UGBS Slide 152 UGBS 205 Fundamentals of Accounting Methods Week 9– Capital Expenditure and Revenue Expenditure College of Humanities Business School 2017/2018 Overview • This session presents the difference(s) between capital expenditure and revenue expenditure and make appropriate entries in the ledgers and financial statement. The difference between capital and revenue receipts is also highlighted Bekoe, Asare, Donkor and Appiagyei, UGBS Slide 154 Learning Objectives • At the end of the session, you should be able to – Explain the difference between capital receipts and revenue receipts – Explain the difference between capital expenditure and revenue expenditure – Determine the relevant financial statements for recording capital receipts, revenue receipts, capital expenditure and revenue expenditure Bekoe, Asare, Donkor and Appiagyei, UGBS Slide 155 Reading List • Read Recommended Text – -Chapter 12 of Marfo-Yiadom, Asante & Tackie (2015) -Chapters 24, 26 and 27 of Wood & Sangster (2008) - International Accounting Standards (IAS) 16: Property, plant and equipment • Other Financial Accounting text books available to students Bekoe, Asare, Donkor and Appiagyei, UGBS Slide 156 Capital Income/Receipts This refers to proceeds or monies received from; • The owner of a business as additional investments in the business • The sale of non-current assets • The acquisition of a loan for business operations Bekoe, Asare, Donkor and Appiagyei, UGBS 157 Revenue Income/Receipts This refers to receipt or income that is earned; • Normally in the course of business operations which may be from – the main operations of the organisation, or – from other sources – Examples can be sales, rent income and other commissions received. Bekoe, Asare, Donkor and Appiagyei, UGBS 158 Capital Expenditure • The expenditure is incurred to acquire, manufacture or improve assets for the purpose of earning income over time in an organisation. Bekoe, Asare, Donkor and Appiagyei, UGBS 159 Features of Capital Expenditure The expenditure is made To acquire assets referred to as non-current assets. To construct non-current assets, e.g. wages or salaries of workers to construct an organisation’s building. To put a new non-current assets in a usable position, e.g. legal charges on the purchase of land and building, cost on registering and acquiring a number plate for a new vehicle, transport expense on new machinery bought and any expense to put the new machinery in usable position. Bekoe, Asare, Donkor and Appiagyei, UGBS 160 Features of Capital Expenditure To increase the revenue earning capacity of an asset or business organisation. To acquire an asset, that gives benefits over many years in the business organisation, e.g. goodwill paid for in a purchased business organisation. For an asset, though revenue in nature, yet provide benefits for many years, e.g. extended or heavy advertising programme within a year, and preliminary or business formation expenses. To pay off any loan initially acquired for the operations of the business. Most of these assets acquired are referred to as noncurrent assets Bekoe, Asare, Donkor and Appiagyei, UGBS 161 Revenue Expenditure This is the expenditure which is incurred for the purpose of maintaining the noncurrent asset and the earning capacity of the business organisation. Bekoe, Asare, Donkor and Appiagyei, UGBS 162 Features of Revenue Expenditure The expenditure is incurred; normally in the course of the business operations constantly in the course of business operations and consumed totally in the period it is incurred. The full benefit of the expenditure is normally consumed totally in the period in which it is incurred. Bekoe, Asare, Donkor and Appiagyei, UGBS 163 Relevant Financial Statements • Capital income/receipt that is received as additional investments by the owner of the business is credited to the capital account. • Others in the form of income from the sale of noncurrent assets can be; – credited to the income statement where such amount is not material; – otherwise such amount is credited to capital surplus or reserve. Bekoe, Asare, Donkor and Appiagyei, UGBS 164 Relevant Financial Statements • Revenue Income is shown as income in the trading income statement for the year when they are earned. • The income which is received but not earned for that particular year is treated as a current liability in the statement of financial position. • On the other hand the income which is earned but not received is an asset and is shown in the statement of financial position as a current asset. Bekoe, Asare, Donkor and Appiagyei, UGBS 165 Relevant Financial Statements • Capital Expenditure is shown in the statement of financial position mainly as non-current asset. As and when a portion of such expenditure is used, it is treated as revenue expenditure, specifically depreciation and written off in the income statement. Bekoe, Asare, Donkor and Appiagyei, UGBS 166 Relevant Financial Statements • Revenue Expenditure is shown in the income statement as expense consumed in the year. • Such expenditure acquired or paid for but not consumed within the year is treated as prepayment or prepaid expense and shown in the statement of financial position as current asset. • On the other hand the expenditure consumed but not paid for is shown as accrued expense or expense payable and shown in the statement of financial position as current liability. Bekoe, Asare, Donkor and Appiagyei, UGBS 167 End of Session Questions • Distinguish between capital receipts and revenue receipts • Distinguish between capital expenditure and revenue expenditure Bekoe, Asare, Donkor and Appiagyei, UGBS Slide 168 UGBS 205 Fundamentals of Accounting Methods Week 10 – Depreciation of Tangible Non-Current Assets College of Humanities Business School 2017/2018 Overview • Non-current assets span more than one accounting year. It is thus important to spread the cost over the years for which an organization benefit from the use of the asset. This session introduces the student to the methods in accounting for the use of tangible non-current assets. Bekoe, Asare, Donkor and Appiagyei, UGBS Slide 170 Learning Objectives • At the end of this session, you should be able to – Determine the value of tangible non-current assets – Identify methods of depreciating tangible non-current assets – Learn how to calculate depreciation using the two most widely used methods – Learn to make entries for depreciation in books of accounts Bekoe, Asare, Donkor and Appiagyei, UGBS Slide 171 Reading List • Read Recommended Text – - Chapter 12 of Marfo-Yiadom, Asante & Tackie - Chapters 24, 26 and 27 of Wood & Sangster; - IAS 16: Property, plant and equipment • Other Financial Accounting text books available to students Bekoe, Asare, Donkor and Appiagyei, UGBS Slide 172 Accounting for Non-current Assets • Non-current asset – This is that asset acquired to be used in the organisation for a period more than (normally) one year. • Such expenditure is referred to as capital expenditure; that type of expenditure to acquire an asset of a permanent nature; in contrast to revenue expenditure; the expenditure to acquire asset that is consumed within one year, or that exists for only one year. Bekoe, Asare, Donkor and Appiagyei, UGBS 173 Accounting for Non-current Assets • Capital expenditure is made for such assets once a while, not very often; on the other hand, revenue expenditure items are acquired very often, at least year after year; for example annual rent, insurance or advertising expenses. Bekoe, Asare, Donkor and Appiagyei, UGBS 174 Value of non-current assets • Initial value of any non-current asset is the cost of the asset, which comprise of; – the purchase price of the asset – Carriage inwards on the asset – any additional/related expenditure incurred to put the asset in its usable state. Bekoe, Asare, Donkor and Appiagyei, UGBS 175 The Concept of Depreciation Depreciation Defined; It is the systematic allocation of the depreciable amount of an asset over its useful life (IAS 16). May be explained as the measure of wearing out, consumption or other reduction in the useful economic life of a non-current asset whether arising from use, efflux of time or obsolescence through technological or market changes. Bekoe, Asare, Donkor and Appiagyei, UGBS 176 Causes of Depreciation • • • • The level of usage The passage of time Technological obsolescence Market Obsolescence Any portion of non-current assets that is determined as having been used or consumed becomes expense. Bekoe, Asare, Donkor and Appiagyei, UGBS 177 Procedure to Determine & Charge Depreciation Determine cost of asset (purchase price/valuation) Determine estimated useful life Determine estimated residual value of asset Depreciation rate can be determined from these variables Bekoe, Asare, Donkor and Appiagyei, UGBS 178 Methods for Charging Depreciation Different methods are applied based on the type of asset and usage, or based on the different assumptions that are made: 2 Common Methods: Straight line method Reducing balance or diminishing balance method Other methods; Sum of years’ digits, revaluation method, machine hour method, depletion unit method Bekoe, Asare, Donkor and Appiagyei, UGBS 179 Straight line method • This method is based on the assumption that the asset is used equally over its useful life. • Under this method, the annual depreciation charge is an equal sum. It is calculated as: Depreciations Bekoe, Asare, Donkor and Appiagyei, UGBS = Cost – Residual value Estimated life 180 Illustration Cost of Motor Vehicle Estimated life Residual value Annual Depreciation Bekoe, Asare, Donkor and Appiagyei, UGBS = GH¢500,000 = 5yrs = GH¢50,000 = GH¢500,000 - GH¢50,000 5 = 450,000 5 = GH¢90,000 181 Reducing balance method • Reason – Greater benefit is to be obtained from the early years of using an asset – Appropriate to use the reducing balance method which charges more in the earlier years. – Helps even out the total amount charged as expense for the use of the asset each year. Bekoe, Asare, Donkor and Appiagyei, UGBS 182 Reducing balance method • Annual Depreciation = Net Book Value x Depreciation Rate • = (Cost – Accumulated Depreciation) x Depreciation Rate Example:Cost of Motor Vehicle = GH¢500,000 Depreciation rate is 20% p.a. Year Depreciation Year 1 20% * 500,000 = 100,000 Year 2 20% * (500,000-100,000) = 80,000 Year 3 20% * (500,000-180,000) = 64,000 Bekoe, Asare, Donkor and Appiagyei, UGBS 183 Accounting Entries Purchase of Non-current Asset by cash DR Asset A/c CR Cash/Bank With the cost of the asset When Depreciation is Charged for the year DR Depreciation Expense A/c CR Provision for Depreciation A/c (Accumulated Depreciation A/c) With the depreciation charge for the period Bekoe, Asare, Donkor and Appiagyei, UGBS 184 Accounting Entries At the end of the year; – Close off Depreciation Expense a/c to Income Statement – Balance on provision for depreciation a/c remains as closing balance (Bal. c/d); to determine the net book value (NBV) at year end; cost – provision for depreciation (accumulated depreciation) Bekoe, Asare, Donkor and Appiagyei, UGBS 185 Disposal of Non-current Assets Determine profit or loss on disposal Bekoe, Asare, Donkor and Appiagyei, UGBS 186 UGBS 205 Fundamentals of Accounting Methods Week 11– Adjustments for Financial Statements College of Humanities Business School 2017/2018 Overview • A business entity is required to adjust for the accruals, prepayments, bad and doubtful debts at the end of the accounting period. This session discusses these various end of year adjustments before the preparation of financial statements. Bekoe, Asare, Donkor and Appiagyei, UGBS Slide 188 Learning Objectives • At the end of this session, you should be able to – – – – Distinguish between bad and doubtful debts Learn how to provide for doubtful debts Pass entries to record bad and doubtful debts Make adjustments for prepaid and accrued expenses/revenue Bekoe, Asare, Donkor and Appiagyei, UGBS Slide 189 Reading List • Read Recommended Text – -Chapter 14 of Marfo-Yiadom, Asante & Tackie -Chapters 25 & 28 of Wood & Sangster; -IAS 18: Revenue • Other Financial Accounting text books available to students Bekoe, Asare, Donkor and Appiagyei, UGBS Slide 190 Concept of Trade Debt Valuation • Control account refers to an account that picks the summary of all Trade Debts that arise from the sale of goods or service on credit. • The reason for the valuation of trade debt is to avoid possible loss in the future from trade debts that resulted from past sale (Matching Concept) • Quality of trade debts is assessed through the ageing process (how long the debt has been in the books) Bekoe, Asare, Donkor and Appiagyei, UGBS 191 Concept of Trade Debt Valuation • As trade debts age and circumstances make it impossible to recover, it is prudent to write-off the debt (bad debts) • As trade debts increases, collection of some debts may become uncertain. As a result, it is prudent to provide for the possibility of a loss from the debt (provision for doubtful debts) Bekoe, Asare, Donkor and Appiagyei, UGBS Slide 192 Bad Debts These are debts that are not collectible hence it is considered as a loss to the organisation. Bookkeeping procedure: DR Bad Debt A/C xxx CR Trade Receivables A/C xxx At the end of the year, the bad debt a/c is closed to the income statement as: DR Income statement xxx CR Bad debt A/C xxx Bekoe, Asare, Donkor and Appiagyei, UGBS Slide 193 Doubtful Debts • These are debts whose collection cannot be certain. • This debt is not seen as a loss however some profit (provision) can be set aside against the probability that such debt may be a loss in the future. Bekoe, Asare, Donkor and Appiagyei, UGBS Slide 194 Types of Provision for Doubtful Debts • In providing for doubtful debts, the provision could be specific or general. • Specific provision: This is where a provision is made for a specific debt. E.g. Ama’s A/C • General provision: This is where provision can be made not for a specific debt but for the remaining total debt after deducting the specific debt. Bekoe, Asare, Donkor and Appiagyei, UGBS Slide 195 Calculating for the Provision • The rate is given and calculated on either: • The outstanding total receivables, or • On total credit sales Bekoe, Asare, Donkor and Appiagyei, UGBS Slide 196 Bookkeeping Procedure for Doubtful Debts Provision • Either for general or specific provision: DR Income Statement xxx CR Provision for Doubtful Debt xxx NB: for the first time a provision is being made in the books for doubtful debts Bekoe, Asare, Donkor and Appiagyei, UGBS Slide 197 Bookkeeping Procedure for Doubtful Debts Provision • When a provision has already been made in the previous accounting period; – Compare the current computed provision to the previous provision; – Where there is an increase in the provision (current higher than previous) • the amount of increase is charged to the income statement (i.e. DR Income statement) – Where there is a decrease in the provision (current lower than previous) • the amount of decrease is credited to the income statement (i.e. CR Income statement) as a gain Bekoe, Asare, Donkor and Appiagyei, UGBS Slide 198 Bookkeeping Procedure for Doubtful Debts Provision • In all cases the current provision for the year is used to reduce the value of trade receivables in the statement of financial position Bekoe, Asare, Donkor and Appiagyei, UGBS Slide 199 Recovery of Bad Debt • A debt that has been written off in the past can be recovered, when later the trade receivable takes the action to pay the debt. • The accounting treatment depends on whether the organisation intends to do business again with the trade receivable. Bekoe, Asare, Donkor and Appiagyei, UGBS Slide 200 Accounting Treatment of Bad debt Recovery If business relations is to be re-established, the account of the trade receivable is reopened DR Trade Receivables A/C CR Bad Debt Recovered A/C To reinstate the account xxx DR Bank/Cash A/C CR Trade Receivable A/C With money received xxx At the end of the period: DR Bad debt Recovered CR Income Statement With the recovered amount Bekoe, Asare, Donkor and Appiagyei, UGBS xxx xxx xxx xxx Slide 201 Accounting Treatment of Bad debt Recovery If business relations is not to be Re-established, the account of the trade receivable is not reinstated. DR Bank/Cash CR Bad Debt Recovered With the amount received At the end of the period: DR Bad Debt Recovered CR Income Statement With recovered amount Bekoe, Asare, Donkor and Appiagyei, UGBS xxx xxx xxx xxx Slide 202 Adjustments for Prepayments and Accruals Bekoe, Asare, Donkor and Appiagyei, UGBS Slide 203 Prepayments and Accruals • Expenses and revenues are not always paid or received on time. • Cash paid and received in a year should not be entered directly into the profit and loss account of that year. • Adjustment should be made. Bekoe, Asare, Donkor and Appiagyei, UGBS Slide 204 Prepayments and Accruals • Prepaid expenses – those to be used in the following period but have been paid for in advance. • Accrued expenses – those which have been used up in the current year, but have not yet been paid for. • Prepaid income – those to be earned in the following period but have been received in advance. • Accrued income – those which have been earned in the current period but have not yet been received. Bekoe, Asare, Donkor and Appiagyei, UGBS Slide 205 Expense Example • Two companies paying rent to a landlord in Accra. The rent is GHC3,000 a year. • Company A pays GHC 2,500 in the year • Company B pays GHC 3,100 in the year • How much rent should be charged to the income statement for the year in each company? Bekoe, Asare, Donkor and Appiagyei, UGBS Slide 21 Income Example • The company rents its building to two other entities at GHC 2,000 a year. • Company X pays GHC 1,700 in the year • Company Y pays GHC 2,500 in the year • How much is recognized in the income statement as rent income for the year? Bekoe, Asare, Donkor and Appiagyei, UGBS Slide 22 Expenses for the period = Cash paid – Accruals in last year + Accruals in this year + Prepayments in last year – Prepayment in this year Bekoe, Asare, Donkor and Appiagyei, UGBS Slide 23 Income for the period • = Receipt – Accruals in last year + Accruals in this year + Prepayments in last year – Prepayments in this year • Consider other adjustments • Goods drawings by the owner • Use of business assets by the owner • Owners’ private expense charged against the business expenses Bekoe, Asare, Donkor and Appiagyei, UGBS Slide 24 UGBS 205 Fundamentals of Accounting Methods Week 12 – PREPARATION OF FINANCIAL STATEMENTS College of Humanities Business School 2017/2018 Overview • Information in financial statements is the output of the accounting information system; recording transactions (inputs), classifying, summarizing and analyzing (processing), financial statement (output). This session introduce students to how the final output after recording and processing transactions will be presented to users of financial information. Bekoe, Asare, Donkor and Appiagyei, UGBS Slide 211 Learning Objectives • At the end of this session, you should be able to – Prepare a basic income statement of an entity – Prepare a basic statement of financial position of an entity Bekoe, Asare, Donkor and Appiagyei, UGBS Slide 212 Reading List • Read Recommended Text – -Chapter 15 of Marfo-Yiadom, Asante & Tackie -Part 2 and Chapters 9 & 39 of Wood & Sangster; -IAS 1: Presentation of Financial Statements; and -IAS 7: Statement of Cash Flows • Other Financial Accounting text books available to students Bekoe, Asare, Donkor and Appiagyei, UGBS Slide 213 The Income Statement • Do you recall the purpose of income statement? • Profit oriented businesses aim at making profits • The income statements provides information on the performance of businesses by determining the amounts of profit or loss made for a period • The income statement is made up of two sections; – Trading account – Profit and loss account Bekoe, Asare, Donkor and Appiagyei, UGBS Slide 214 Slide 6 The Income Statement • The trading account is prepared to derive gross profit/loss – Gross profit/loss = Net Sales – Direct Cost (Cost of Goods Sold) – Net Sales = Sales – Return inwards – Cost of goods sold = Opening stock + [Purchase + Carriage inwards – Returns outwards + other purchase costs] – Closing stock Bekoe, Asare, Donkor and Appiagyei, UGBS Slide 215 The Income Statement • The Profit and Loss Account is prepared to derive Net profit/loss – Net Profit/Loss = Gross Profit/loss – Indirect cost (Expenses) Bekoe, Asare, Donkor and Appiagyei, UGBS Slide 216 Typical Income Statement Bekoe, Asare, Donkor and Appiagyei, UGBS Slide 9 Slide 217 The Statement of Financial Position • Do you recall the purpose of the statement of financial position? • The statement of financial position is a list of balances according to whether they are assets, equity or liabilities (Accounting equation) • It shows the financial position of businesses at a specific point in time Bekoe, Asare, Donkor and Appiagyei, UGBS Slide 218 Typical Statement of Financial Position Bekoe, Asare, Donkor and Appiagyei, UGBS Slide 11 Slide 219 Typical Statement of Financial Position Bekoe, Asare, Donkor and Appiagyei, UGBS Slide 12 Slide 220