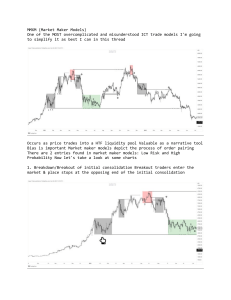

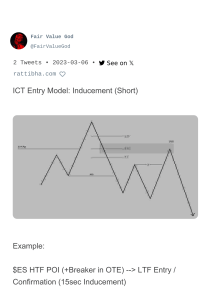

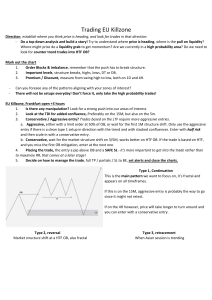

DOL DRAW ON LIQUIDITY Visual Guide by Hanson CREDITS AND REFERENCE ICT LOTUSXBT GALACTIC TRADING Proud Partner ELEMENTS STRUCTURE LIQUIDITY ORDERFLOW Before going through the guide, it is very important you have very good understanding of how these elements work DOL flow in three simple stages HTF LIQ DRAW LTF CONFIRMATION OBJECTIVE HTF LIQUDITIY DRAW 1. Buyside / Sell side Liquidity Raid 2. HTF Imbalance Identify Buyside or Sellside Liquidity or Imbalance on HTF, wait for price to reach to these levels and look for LTF entry models Buyside Raid Sellside Raid LIQ - PDH / PDL, PWH / PWL, EQH / EQL IMBALANCE Imbalance / FVG when price picks up momentum and moves fast an inefficiency is created leaving some orders not filled so the market revisits to rebalance itself at some point in time, thats when we position ourself In order to find imbalances, it should consists of 3 candles. For bearish scenario, it is where there is a gap between the lower wick of the first candle & the top wick of the third candle do not meet. LTF ENTRY MODEL LIQ GRAB + BOS + RTO Once we have Liq draw from HTF POI zoom into LTF, you want Qm pattern to form as confiramtion or else no trade. LIQ Grab FVG Liq grab with valid bos (body candle close) + Fvg or IDM, more confluence and higher probability. BOS / CH your entry will at OB, FVG or IDM with invalidation above local High/Low. Live Example towards the end Buyside Raid Invalidation LTF VIEW FVG Entry BOS TP/ Objective is next level of liquidity LIQUIDITY INTERNAL EXTERNAL LIQUIDITY LIQUIDITY OBJECTIVE Consolidation Liquidity Engineered HTF POI Price moves into HTF POI STAGES Liquidity Draw Reversal Zone SMR LTF ENTRY MODEL Excecution Objective Take Profit Price returns to consolidation DRAW ON LIQUIDITY Price is manipulated into BSL or SSL of the range, where the stop orders trigger. These orders provide liquidity for large positions to enter/exit without much slippage. SMART MONEY REVERSAL Once the Liquidity is Drawn, price forms a reversal pattern, we can identify the pattern using simple market structure shift, which allows us to enter the trade, and then price moves in the direction of the planned move. usually SMR occurs in two forms, eihter as Liq Raid or Swing failure My ideal entry is m5m5 or m5m1. INDUCEMENT Inducement is a trap left on purpose abvoe or below supply or demand by bigger entity to mitigate the ob or sweep liquidity later, The move is designed to take out early buyers/sellers and pattern traders. we can use this liq point to our advantage and capitalise it NO RAID NO TRADE TIME COMBINATION Daily -> M15 H4 -> M5 - M3 H1 -> M3 - M1 MODEL COMBINATION HTF FVG + LTF SMR HTF BSL / SSL + LTF SMR HTF BSL / SSL + HTF FVG + LTF SMR LTF ENTRY VARIATION LIQ GRAB LIQ GRAB IDM BOS LIQ Grab + BOS + IDM + RTO FVG BOS LIQ Grab + BOS + FVG + RTO Premium / Discount 1 Premium 0.5 Discount 0 Enter shorts in premium of price leg that broke market structure. Enter longs in discount of price leg that broke market structure. If Bias is Bullish look for SMR at discount region of the range If Bias is Bearish look for SMR at Premium region of the range FOLLOW THE HTF TREND DONT FIGHT IT When In Doubt Zoom Out Visual idea from Visualizevalue LIVE EXAMPLE HTF IMBALANCE Fill Time Frame - H4 Pair - $GU HTF Bias - Bearish IMBALANCE HTF IMBALANCE FILL (Liquidity draw) and Buyside Raid, now we go down to LTF (M5-M1) and look for reversal model for confirmation (SMR) to enter the trade. Always keep in mind of the HTF Bias LTF ENTRY MODEL Time Frame - M2 Invalidation H4 IMBALANCE Entry 1 LTF LIQ Grab FVG Entry 2 Inducement FVG BOS BOS LIQ GRAB + BOS + FVG + IDM + RTO ENTRY CONFIRMATION On Ltf now we have liq grab filling HTF FVG followed by break of structure with Fvg and IDM below fvg, good confluence to take the trade, if first entry was missed, now we have another fvg entry presented (Double Confirmation) look at the above chart for more information TRADE MANAGEMENT Time Frame - M3 H4 IMBALANCE 4R LIQ Grab IDM FVG 5R BOS Price Moves Into POI (BSL & H4 FVG) $$$ Liquidity Engineered SSL Objective HTF IMBALANCE LTF RAID IDM FVG BOS Line Chart for more clarity on LTF SMR Trade entered, now our objective is next LIQ pool, for above trade example, our objective is Sell side Liquidity, you can partial at internal liq, or full tp at ssl ABBREIVATION BSL - Buy Side Liquidity SSL - Sell Side Liquidity BOS - Break Of Structure CH - Change Of Character FVG - Fair Value Gap IDM - Inducement SMR - Smart Money Reversal HTF - Higher Time Frame LTF - Lower Time Frame PDH - Previous Day High PDL - Previous Day Low PWH - Previous Week High PWL - Previous Week Low RTO - Return To Origin FOR MORE CHART EXAMPLES SCAN SCAN THE ABOVE QR CODE Instructions: Open any QR scanner app Scan the Code It will redirect to my Notion site - where all my charts are stored END NOTE These concepts are not my own, i have credited and mentioned the reference, also the simplest concepts way are possible potrayed from in my understanding & what works for me, and not meant to mentor anyone DYOR before following it, this guide is published just to demonstrate how i trade the model. Not a Financial Advice. demo trade Thank you support Always before and going Backtest live appreciate and trading. all your