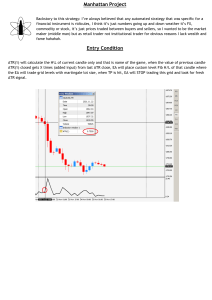

Trading Strategy: Liquidity, FVG, Order Blocks, Fib

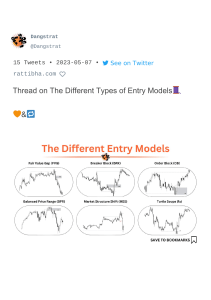

advertisement

1. 2. 3. 4. 5. Liquidity sweep break of structure FVG on all time frame Look for a clear Order block on all timeframe Plot Fib on all timeframe too, if FIB and FVG or OB aligns then wait for that trade exit levels 1. Top 2. Opposite fvg,ob I must identify the low, define it better to have better accuracy Remember to have a proper MSS, you must break the high/low of the previous opposite rally I want a solid candle indicating bullish/bearish pressure, not manananggal candle na sumilip lang yung ulo. Things that needs to be defined: 1. Inducement 2. Liquidity Grab 3. MSS (to distinguish MSS, from liquidity grab) 4. Latest swing low/high, to find MSS better Maybe use atr to know which trade to take, if the ATR is almost equal to your stop loss then don’t trade it. If its double then try taking it. Or maybe its okay to take it if its equal to your atr?