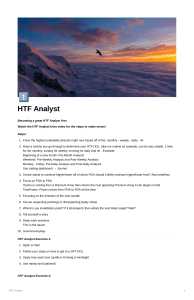

EU Killzone Trading Strategy: A Detailed Guide

advertisement

Trading EU Killzone Direction, establish where you think price is heading, and look for trades in that direction. - Do a top down analysis and build a story! Try to understand where price is heading, where is the pull on liquidity? Where might price do a liquidity grab to get momentum? Are we currently in a high probability area? Do we need to look for counter trend trades into HTF OB? Mark out the chart 1. Order Blocks & Imbalance, remember that the push has to break structure. 2. Important levels, structure breaks, highs, lows, DT or DB. 3. Premium / Discount, measure from swing high to low, both on 1D and 4H. - Can you foresee any of the patterns aligning with your zones of interest? There will not be setups everyday! Don’t force it, only take the high probability trades! EU Killzone, Frankfurt open +3 hours 1. Is there any manipulation? Look for a strong push into our areas of interest. 2. Look at the TDI for added confluence, Preferably on the 15M, but also on the 5m. 3. Conservative / Aggressive entry? Trades based on the LTF require more aggressive entries. a. Aggressive, either with a limit order at 50% of OB, or wait for the first 1M structure shift. Only use the aggressive entry if there is a clean type 1 setup in direction with the trend and with stacked confluences. Enter with half risk and then scale in with a conservative entry. b. Conservative, wait for the market structure shift on 3/5M, works better on HTF OB. If the trade is based on HTF, and you miss the first OB mitigation, enter at the next one. 4. Placing the trade, the entry a pip above OB and a SAFE SL - it’s more important to get into the trade rather than to maximize RR, that comes at a later stage! 5. Decide on how to manage the trade, full TP / partials / SL to BE, set alerts and close the charts. Type 1, Continuation This is the main pattern we want to focus on, it’s fractal and appears on all timeframes. If this is on the 15M, aggressive entry is probably the way to go since it might not retest. If on the 4H however, price will take longer to turn around and you can enter with a conservative entry. Type 2, reversal Market structure shift at a HTF OB, also fractal Type 3, retracement When Asian session is trending